Bitcoin ETFs: What are they and how do they work?

6 minutes reading time

Bitcoin and the broader crypto market ended the week slightly higher. Bitcoin traded at over US$24,000 for the first time since August 2022, after the Fed raised the benchmark federal funds rate by only 25 basis points to 4.75%. Bitcoin’s performance last month was the best January on record since 2013, up almost 40%.

As at 5 February 2023, bitcoin was trading at US$23,405. Ethereum outperformed bitcoin over the week, rising 4.61% vs bitcoin’s 0.84% gain. Bitcoin’s market capitalisation is hovering around US$450 billion, with the total crypto market above US$1.09 trillion. Bitcoin’s market dominance is sitting at 41.5%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $23,404 | $24,167 | $22,657 | 0.84% |

| ETH (in US$) | $1,668 | $1,690 | $1,546 | 4.61% |

Source: CoinMarketCap. As at 5 February 2023. Past performance is not indicative of future performance.Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

The Blackrock iShares Core S&P 500 ETF (CSPX) can now be traded as a token. Backed Finance, a DeFi platform, created a tokenised version of the ETF, and tokens can now be traded on UniSwap, a decentralised exchange (DEX). The token uses the Ethereum network. One of the benefits of tokenising is transparency, as tokens can be tracked and traced on the network’s blockchain. In addition, users can self-custody and do not need to be verified by a broker to purchase the tokens, unless they redeem for the underlying asset, which requires a Know Your Customer (KYC) identity verification.

“Crypto markets run 24/7, settlement can take less than five minutes, and asset transfers are seamless,” said Adam Levi, co-founder of Backed. “Backed is committed to realising these benefits securely and transparently, and Chainlink Proof of Reserve is a core tool that will help provide our clients with unmatched transparency.”1

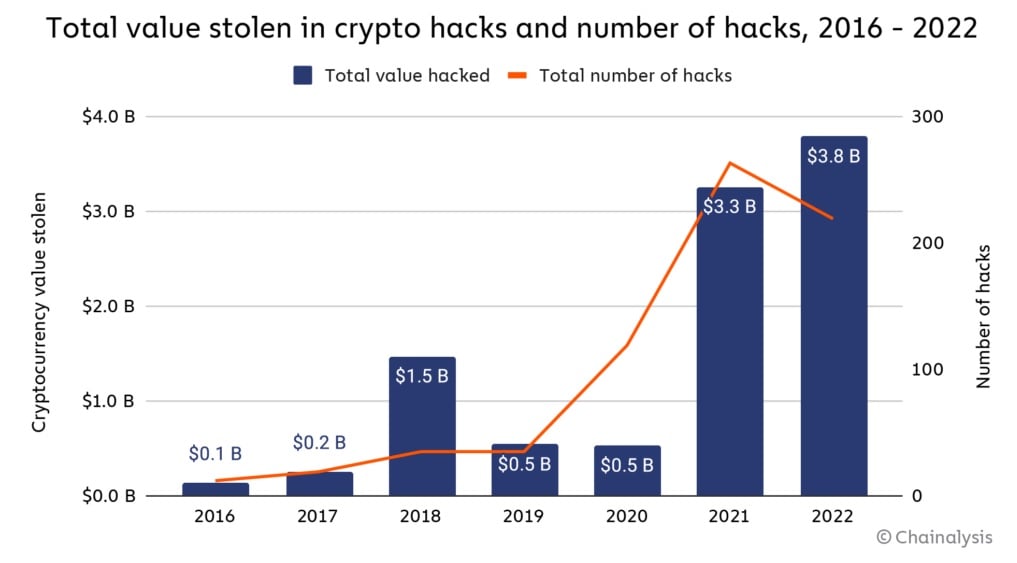

$3.8B stolen by hackers in 2022

2022 set a new record high for crypto hacking, according to blockchain analytics firm Chainalysis. Approximately US$3.8 billion was stolen from cryptocurrency businesses. The majority of that, 82.1% of all crypto stolen, was from decentralised finance (DeFi) protocol hacks. The firm’s data revealed hacking activity increased in March and peaked in October, when over $775.7 million was stolen in 32 separate attacks making it the “biggest single month ever for cryptocurrency hacking”. The analytics firm also stated that hackers with links to North Korea have been the most prolific, stealing an estimated $1.7 billion of crypto over several hacks.2

Coinbase has emerged successful in a lawsuit filed by a group of clients who claimed that the exchange facilitated the sale of unregistered securities and failed to register as a broker-dealer. The class action lawsuit has been dismissed.

In October 2021, the plaintiffs requested damages resulting from the sale or soliciting of 79 digital assets by Coinbase. Because the platform is not registered with the SEC, the plaintiffs claimed that the sale represented “illegal contracts”.

The judge in the case, US District judge Paul Engelmayer, said the terms of Coinbase’s agreement “flatly contradict” allegations in the lawsuit as Coinbase had no direct role in the transactions. In his ruling, Judge Engelmayer wrote “[t]hese activities of an exchange are of a piece with the marketing efforts, materials and services that courts … have held insufficient” to qualify defendants as sellers.3

On-chain metrics

Source: Glassnode. Past performance is not indicative of future performance.

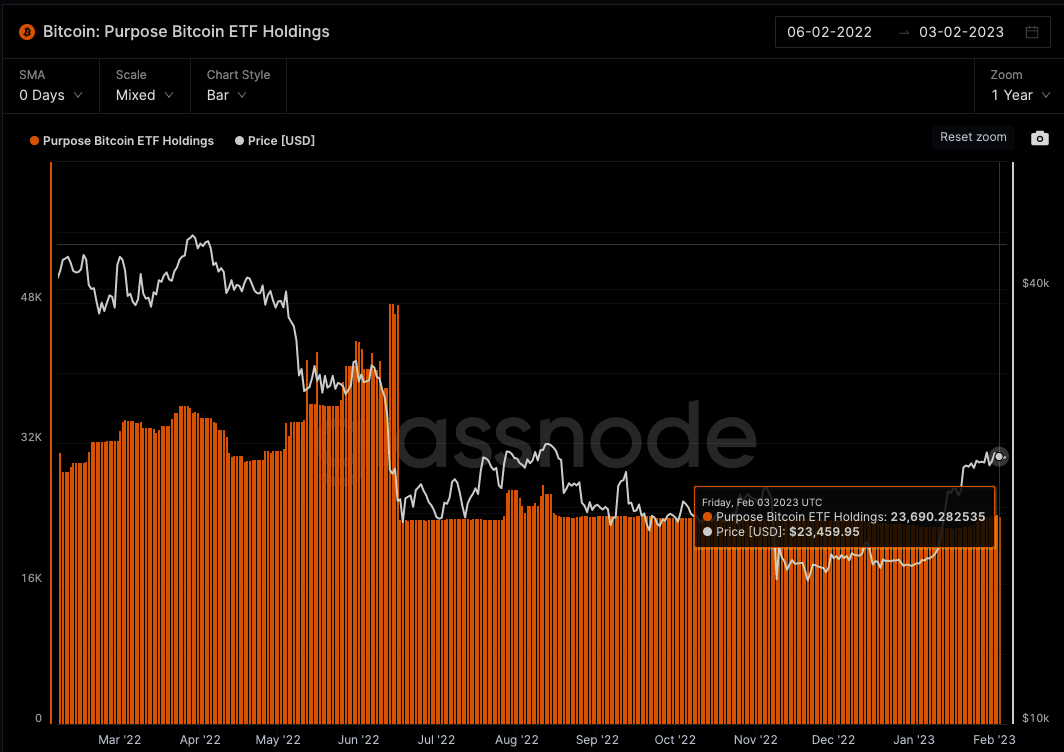

Bitcoin (BTC): Purpose Bitcoin ETF Holdings

This metric shows the total holdings of the Purpose Bitcoin ETF. The Purpose Bitcoin ETF is currently the largest spot bitcoin ETF in the world.

According to data from Glassnode, the Purpose Bitcoin ETF added just over 969 BTC last month, showing subdued demand through the January rally.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

In altcoin news, Fantom (FTM) was up over 35% over the seven days to 4 February, making it the best-performing Top 40 cryptocurrency over that period. While the broader crypto market has had a strong January, helping drive the price of FTM higher is an ambitious roadmap announcement for 2023. Fantom has indicated that it will narrow its focus to the decentralised application (dApp) ecosystem.4

According to the Fantom website, Fantom is a highly scalable blockchain platform for DeFi, crypto dApps, and enterprise applications.5

|

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets. Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio. |

1. https://www.trustnodes.com/2023/02/03/blackrock-etf-tokenized-on-uniswap

2. https://blog.chainalysis.com/reports/2022-biggest-year-ever-for-crypto-hacking/

3. https://www.reuters.com/technology/coinbase-wins-dismissal-lawsuit-claiming-it-sold-unregistered-securities-2023-02-01/

4. https://cryptonews.com/news/fantom-price-prediction-as-bullish-roadmap-revealed-by-andre-cronje-can-ftm-reach-10.htm

5. https://fantom.foundation/

Past performance is not indicative of future performance.

Off the Chain is published every Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.