It was a bumpy ride for bitcoin and the broader crypto market as breakthroughs from China’s DeepSeek, the Fed’s interest rate announcement and Trump’s tariffs caused volatility across crypto and equity markets over the past week.

Bitcoin barely clung to US$100,000 as bitcoin and Ethereum were down 4.48% and 6.82% respectively over the seven days to 2 February. Bitcoin’s market capitalisation is ~US$1.9 trillion. The global crypto market cap is at ~US$3.4 trillion, while bitcoin’s market dominance sat at 58.5%.

|

Price |

High |

Low |

Change from previous week |

| BTC (in US$) |

$100,257 |

$106,109 |

$97,906 |

-4.48% |

| ETH (in US$) |

$3,113 |

$3,400 |

$3,024 |

-6.82% |

| |

|

|

|

|

Source: CoinMarketCap. As at 2 February 2025. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

Trump’s Digital Asset Executive Order

On 23 January, President Trump signed an Executive Order (EO), titled Strengthening American Leadership in Digital Financial Technology. The EO focuses on promoting US leadership in digital assets and financial technology, and the importance of the digital asset industry in innovation and economic development. In addition to these new changes, the Trump’s Digital Assets EO revokes both the Biden Administration’s Digital Assets EO and the previous Treasury Department’s Framework for International Engagement on Digital Assets.

Key policies include:

- ensuring access to open public blockchain networks for lawful purposes

- promoting the US dollar’s sovereignty through lawful dollar-based stablecoins

- ensuring fair access to banking services

- providing regulatory clarity with technology-neutral regulations

- protecting against the risks of central bank digital currencies (CBDCs) by prohibiting their establishment and use in the US.

The EO also prohibits any actions to establish, issue or promote CBDCs within the US or abroad, except where required by law. It mandates the immediate termination of any ongoing plans or initiatives related to the creation of a CBDC within the US, and no further actions may be taken to develop or implement such plans1.

Fed Chair urges crypto regulation

In a press conference following a meeting of the Federal Open Market Committee (FOMC) on 29 January, Fed Reserve Chair, Jerome Powell, called for stronger regulations around crypto currency and indicated that the US central bank and Congress have been actively working on the issue.

Powell also addressed “debanking” practices, stating that when dealing with legal crypto firms, banks should not be forced to sever ties due to excessive risk aversion. He added that financial institutions are welcome to serve crypto customers provided they manage the risks.

“Banks are perfectly able to serve crypto customers, as long as they understand and can manage the risks, and it’s safe and sound,” Powell said, adding, “The threshold has been a little higher for banks engaging in crypto activities, and that’s because they’re so new2.”

CRYP company spotlight

MicroStrategy raises $563 million for more bitcoin

There was strong demand for the preferred stock offering from MicroStrategy looking to raise capital for more bitcoin. The company was looking to raise US$250 million but ended up with over US$563 million after expenses, selling 7.3 million shares of perpetual preferred stock at $80 each and a dividend yield of 10% from the initially expected 8%.

As at 26 January, MicroStrategy held over 471,000 bitcoin acquired at an aggregate purchase price of US$30.4 billion. The company’s stock returned more than 607% over the 12 months to 31 January 2025. Executive Chairman Michael Saylor has a predicted a base case price of US$13 million per bitcoin by 20453.

MicroStrategy is currently held in the Betashares Crypto Innovators ETF (ASX: CRYP)4. CRYP provides exposure to global companies at the forefront of the crypto economy.

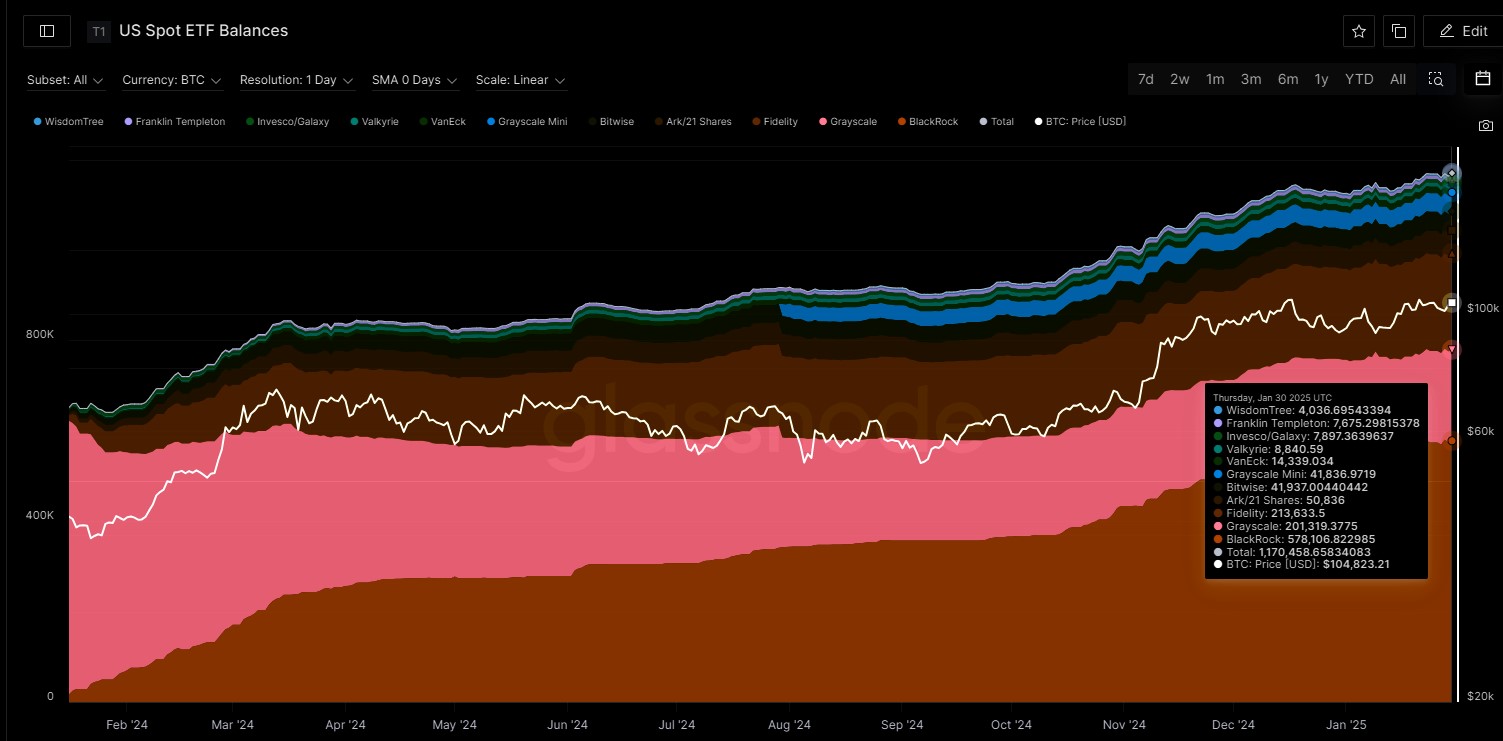

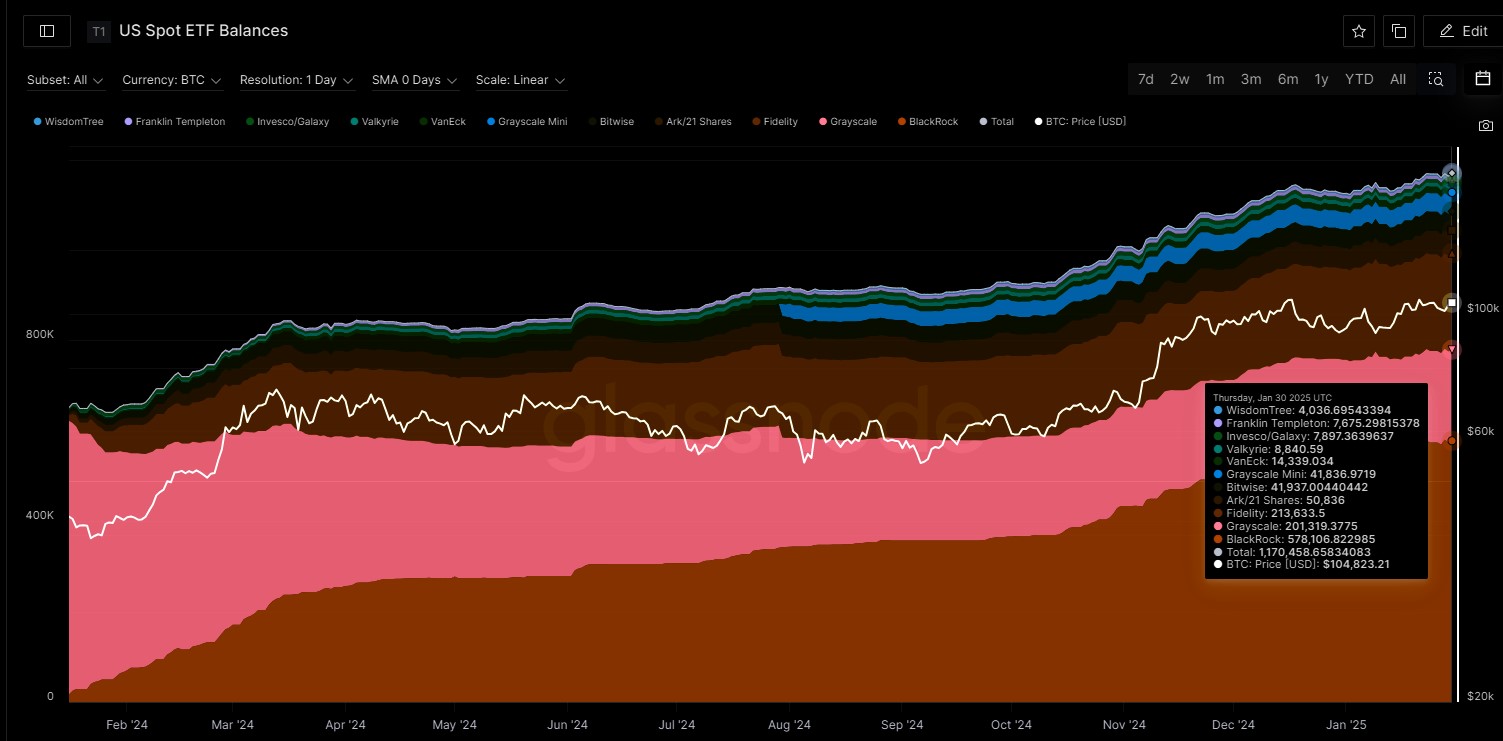

Bitcoin (BTC): US spot ETF balances

This metric offers the most recent balances of the leading bitcoin ETFs traded in the US, typically reflecting holdings at the end of the previous trading day (T+1).

According to data from Glassnode, as at 30 January, spot bitcoin ETFs continue to see increased inflows, led by BlackRock and Fidelity.

Source: Glassnode. Past performance is not indicative of future performance.

Most altcoins were in the red over the past week, but the Litecoin (LTC) price was especially active, heading higher before ending the week lower. There was a lot of speculation that LTC will be the next crypto to receive spot ETF approval.

While other cryptocurrencies such as SOL and XRP are still awaiting regulatory approval, the US SEC has already provided feedback on the S-1 registration for a potential LTC ETF filed by Canary Capital. Two ETF experts from Bloomberg have noted that the engagement looks to be positive.

On 15 January, Nasdaq officially filed to list the spot LTC ETF applications. This means the SEC’s formal review process has begun, and the SEC has 45 days from that date to issue an initial response and up to 240 days to deliver a final decision.

A decision may be made by March 2025, with final rulings expected by September 2025. Canary Capital, Grayscale, and CoinShares have all submitted applications for a spot LTC ETF5.

References:

1. https://www.whitehouse.gov/fact-sheets/2025/01/fact-sheet-executive-order-to-establish-united-states-leadership-in-digital-financial-technology/

2. https://cryptopotato.com/fed-chair-calls-for-crypto-regulation-warns-banks-against-excess-risk-aversion/

3. https://news.bitcoin.com/microstrategy-locks-in-new-funding-to-fuel-bitcoin-buying-spree/

4. As at 4 February 2025. No assurance is given that this company will remain in the portfolio or will be a profitable investment.

5. https://www.ccn.com/news/litecoin-ltc-spot-etf-fund-launch-date/

Off the Chain is published every second Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.