5 minutes reading time

Five years ago, few people had heard of, let alone become experts on, artificial intelligence. Today, McKinsey research suggests 92% of companies1 plan to increase their AI investments.

And this year alone some of the world’s biggest firms, like Google, Meta and Microsoft, intend to spend more than US$300 billion2 in capital expenditures on AI-related projects.

With this ‘gold rush’ in spending comes opportunities for investors. In this article, we talk through two key tech trends making waves – and some of the ETFs providing exposure to the two themes.

Innovation hotspots

Technology is evolving at an unprecedented pace, with two major trends at the forefront:

- Cybersecurity: As digital adoption grows, so do the risks of cyberattacks. This year cybercrime costs are expected to soar to US$10.5 trillion annually, making robust digital security essential3. The urgency to protect sensitive data and critical systems is driving consistent investment in this sector.

- Artificial intelligence (AI): Once the domain of sci-fi, AI now drives everything from personalised recommendations to autonomous vehicles. At its core are semiconductors, the building blocks that enable AI to learn and evolve. As demand for smarter systems grows, AI is set to reshape the global economy.

These trends are not only reshaping industries but also offering investors an opportunity to gain exposure to innovative companies with the potential to define the future.

Spotlight on cybersecurity

With so many interconnected devices in business and at home, cybersecurity isn’t just a line item on IT budgets – it’s a necessity for corporations, governments and individuals alike.

This is where HACK Global Cybersecurity ETF comes into focus. HACK offers investors exposure to a portfolio of leading global cybersecurity companies, including innovators like Palo Alto Networks, CrowdStrike and Fortinet*. These firms are at the forefront of protecting critical infrastructure, sensitive data and digital systems from ever-evolving threats.

Data from Cybersecurity Ventures suggests the cost of global cybercrime could top US$10.5 trillion this year alone4. 10 years ago, that cost was just US$3 trillion. Investment from corporates in cybersecurity tools, according to the same research houses, is estimated to top US$1.75 trillion in the five years to 20255 (actual outcomes may vary materially from forecasts). In other words, corporate cybersecurity spending – and therefore demand for these services – is likely to grow further.

Whether it’s securing cloud platforms, combating ransomware or safeguarding connected devices, the companies within HACK are addressing challenges that impact every industry.

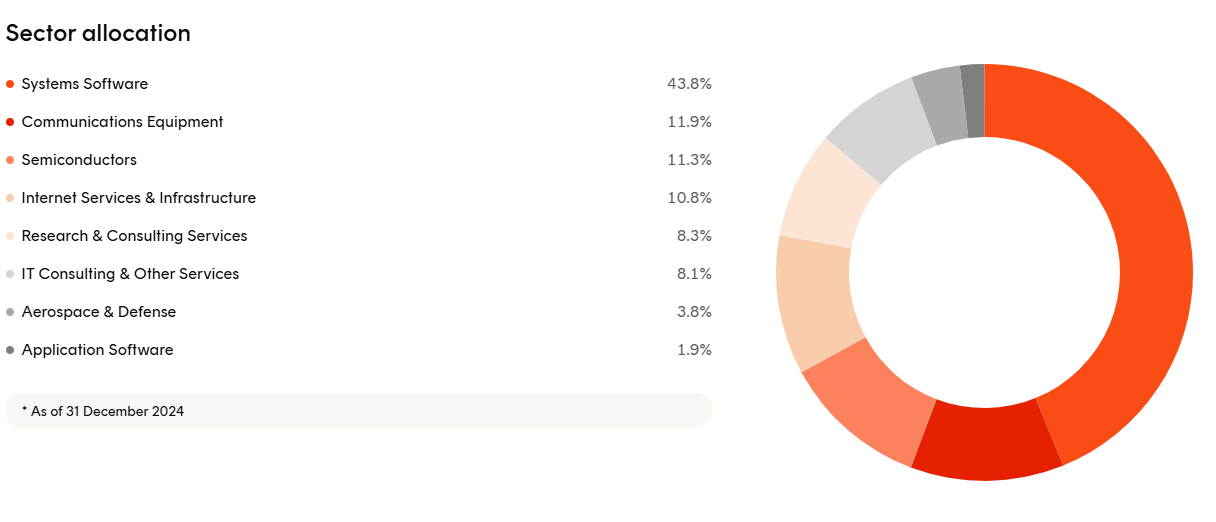

HACK – sector allocations as at 31 December 2024

Source: Betashares

Source: Betashares

HACK recently achieved the milestone of reaching $1 billion in assets under management, a testament to cyber security being a key theme within the wider technology sector.

AI: Transforming the world, one algorithm at a time

AI has transitioned from a niche concept to a significant contributor of global innovation, becoming a growth and productivity driver across a range of industries. Whether it’s powering chatbots, enabling self-driving cars or advancing medical diagnostics, AI is reshaping how we work, live and interact. At its core are semiconductors, the building blocks of AI, enabling the processing and learning capabilities that drive smarter systems.

As demand for AI accelerates, that’s creating opportunities for investors to tap into its growth. From established tech giants to emerging disruptors, the AI ecosystem offers a range of investment opportunities.

Betashares ETFs to consider:

- RBTZ Global Robotics and Artificial Intelligence ETF : RBTZ offers exposure to the global robotics and AI theme, investing in the companies driving advancements in robotics and AI. It does this by aiming to track the Nasdaq Consumer Technology Association Cybersecurity Index (before fees and expenses). And, although NVIDIA* is the largest individual holding, RBTZ also features access to other industries such as healthcare (Intuitive Surgical*) and engineering (ABB*).

- NDQ Nasdaq 100 ETF : NDQ aims to tracks the performance of the Nasdaq 100 Index (before fees and expenses), providing investors exposure to 100 of the largest non-financial companies listed on the Nasdaq market. This includes global tech leaders like Nvidia, Apple, Microsoft and Amazon*, offering broad access to the US technology ecosystem and its innovators. For investors concerned about currency risk, HNDQ Nasdaq 100 Currency Hedged ETF offers a currency-hedged version of the fund that seeks to minimise the effect of currency fluctuations on returns.

The next steps in tech investment

As technology continues to evolve, investors have an opportunity to gain exposure to the innovations shaping the future.

ETFs provide diversified exposure to high-growth sectors like cybersecurity and AI, offering a way to access the tech trends with the potential to drive long-term market growth. Instead of relying on investments in individual companies you gain exposure to entire ecosystems of innovation.

Whether your goal is to diversify or capture growth in emerging sectors tech ETFs can play a valuable role in building a forward-looking portfolio.

*In relation to the companies referred to above, there is no guarantee these stocks will remain in the relevant Fund’s portfolio or be profitable investments.

Investing involves risk. The value of an investment and income distributions can go down as well as up. An investment in a Betashares Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of each Betashares Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

Any Betashares Fund that seeks to track the performance of a particular financial index is not sponsored, endorsed, issued, sold or promoted by the index provider. No index provider makes any representations in relation to the Betashares Funds or bears any liability in relation to the Betashares Funds.

References:

1. McKinsey, 2025, Superagency in the workplace: Empowering people to unlock AI’s full potential at work: https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/superagency-in-the-workplace-empowering-people-to-unlock-ais-full-potential-at-work?cid=other-eml-alt-mip-mck&hlkid=1a1ce9b2946e42178e707c7c48ad035e&hctky=16027347&hdpid=64ad201f-5a6f-4e18-8503-3afd51f9ac86

2. CNBC, 2025, Tech Megacaps to Spend More than $300 billion in 2025 to Win in AI: https://www.cnbc.com/2025/02/08/tech-megacaps-to-spend-more-than-300-billion-in-2025-to-win-in-ai.html

3. The Hacker News, 2024: Unmasking the True Cost of Cyberattacks: Beyond Ransom and Recovery

4. Cybersecurity Ventures, 2024: Top 10 Cybersecurity Predictions and Statistics For 2024

5. Cybersecurity Ventures, 2021: Global Cybersecurity Spending To Exceed $1.75 Trillion From 2021-2025