8 minutes reading time

Trading volumes in Betashares’ three Bear equity Funds have increased dramatically as investors seek to protect themselves against – or profit from – falls in the U.S. or Australian sharemarkets.

A number of individuals have contacted us with questions around price movements in these funds, and how they relate to movements in the underlying market.

In the light of this, we thought it worth recapping how these funds work in detail, and what investors in the funds can expect. In particular, it’s essential to understand:

- the connection between the Bear Funds and index futures prices, and

- the impact of rebalancing on returns from these Funds.

What Bear equity funds does Betashares offer?

Betashares offers three Bear, or Short, equity funds (‘Bear Funds’):

Each fund targets a return that is negatively correlated to the return of either the Australian or the U.S. sharemarket:

- BEAR targets an unleveraged return that is negatively correlated to the Australian sharemarket on a given day – specifically a relationship of between -90% and -110% on a given day.

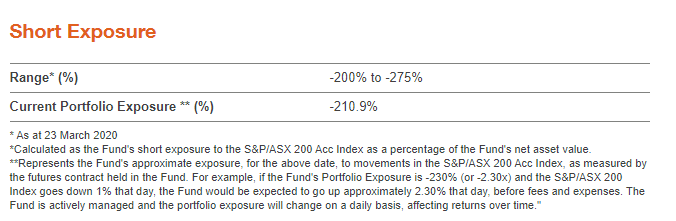

- BBOZ and BBUS seek to generate magnified returns that are negatively correlated to the Australian and U.S. sharemarket respectively – specifically a relationship of between -200% and -275% on a given day.

How are prices of the Bear Funds determined?

The Bear Funds achieve their short exposure by selling share index futures contracts – not by short selling the shares in the index. This means that they would still be able to operate if the government brings in a ban against short-selling shares, as discussed in last week’s post.

The Australian Bear Funds sell futures over Australia’s benchmark S&P/ASX 200 Index (known as SPI 200 futures), while BBUS sells S&P 500 Index futures. As a result, the market prices of the Funds on the ASX reflect futures prices – not the price level of the sharemarket index.

Typically, equity index futures prices and the relevant sharemarket index move in parallel, and so in the hours when the sharemarket is open, price movements in the Bear Funds will reflect movements in the physical sharemarket.

However, trading hours for the sharemarket and the futures market are different. Futures markets operate around the clock even when sharemarkets are closed. When the sharemarket is closed, futures prices continue to move – and at volatile times such as those we are experiencing now, these moves can be significant. Futures price movements translate into movements in the prices of the Bear Funds – particularly BBUS, as the U.S. sharemarket operates in a different timezone to ASX trading hours.

Let’s look at a recent example.

On Wednesday 18 March in the U.S. (overnight Wednesday Australian time), the S&P 500 fell by 131 points, or around 5%. Holders of BBUS without a proper understanding of the way in which the funds have been constructed may have been surprised that on the morning of Thursday 19 March, BBUS opened almost unchanged from its closing price the previous day on the ASX.

Given a 5% fall in the U.S. sharemarket, how did BBUS not open up 10% or more?

The key to understanding this is the connection between the price of BBUS and S&P 500 futures.

The chart below shows the price of S&P 500 futures through Wednesday 18 March and Thursday 19 March up until midday Australian time.

The red lines on the chart show the movement in S&P 500 futures from the close of U.S. sharemarket trading on 17 March to the close of U.S. sharemarket trading on 18 March. Like the S&P 500, futures fell over this 24-hour period around 5%.

The green lines show the (minimal) change in the S&P 500 futures price from close of ASX trade on Wednesday 18 March to ASX open on Thursday 19 March. Remember that it is these futures prices that determined the price of BBUS at ASX close on Wednesday, and ASX open on Thursday.

Click image to view a larger version. Source: Bloomberg. Past performance is not an indicator of future performance.

What is important for holders of BBUS (who obviously invest during ASX trading hours, not U.S. trading hours) is what happened in the futures market while the U.S. sharemarket was not open for trading, in particular:

- U.S. futures continued to trade after the U.S. sharemarket closed, and by the close of trade on the ASX on 18 March, had fallen substantially, to around 2420. The closing price of BBUS on 18 March reflected that futures price (not the closing value of the S&P 500 on 17 March).

- In the three hours between the U.S. sharemarket closing on 18 March, and the ASX opening for trading on 19 March, S&P 500 futures rose, to around 2420. The opening price of BBUS on 19 March reflected that futures price (not the closing value of the S&P 500 on 18 March).

This example illustrates the importance of understanding that it is price movements in the futures markets that affect the pricing of the Bear Funds. This is particularly the case for BBUS, given its use of S&P 500 futures.

It’s worth noting that futures market movements may equally work in favour of investors in BBUS. For example, on Friday 13 March U.S. time, with the ASX closed, the S&P 500 had a huge increase, up more than 9% – an outcome that would typically be very damaging for holders of Short Funds! However, when trading started on Monday morning in Australia, BBUS opened up from its close on Friday – again due to movements in S&P 500 futures prices over the weekend while the U.S. sharemarket was closed.

In summary, over the long term, futures markets will be highly correlated with the underlying equities market. In the short term they will typically be highly correlated – but in very volatile times such as these, there can be unpredictable moves when the futures market continues to trade after the sharemarket has closed.

The discussion on futures applies also to the Australian Bear Funds (BEAR and BBOZ), however because there is not the timezone issue, there is far less scope for futures market movements outside sharemarket trading hours to have an impact.

How does rebalancing affect my Bear Fund?

As stated above, each Fund aims for a specified gearing/portfolio exposure range on a day-to-day basis. However, it should not be expected that the return over a longer period will necessarily fall within the target range.

One of the reasons for this is the rebalancing that occurs from time to time to maintain gearing within the target range.

Portfolio exposure, or the gearing ratio, changes on a daily basis as the market moves. As markets fall, your initial capital increases in value which means the portfolio exposure declines. As markets rise, your initial capital decreases in value which means the portfolio exposure increases.

If the portfolio exposure moves outside the target range, the Fund will be rebalanced to bring it back within the target range. It’s important to understand the impact this can have on returns for periods longer than one day. Note that the approximate gearing ratio of the fund is published on our website daily and is located in the “Key Facts” section of the fund page. An example of this is shown below:

Again, it’s easiest to illustrate this with an example. Assume the following:

- The S&P/ASX 200 is at 5,000 points. For the sake of simplicity, we’ll assume ASX SPI 200 futures are also at 5,000 points.

- You hold BBOZ, currently with a NAV of $15.00

- The portfolio exposure of BBOZ is -237.5%.

On Day 1:

- the market falls to 4500 (a fall of 10%)

- BBOZ rises by 23.75% (= -10% x -237.5%) to $18.56

- BBOZ’s portfolio exposure moves outside the target range, and the Fund is rebalanced to a ratio of -237.5%.

On Day 2:

- the market rises to 4725 (a rise of 5%)

- BBOZ falls by 11.9% (= 5% x -237.5%) to $16.36.

Over the two days:

- the market has fallen 5.5%

- BBOZ has risen by 9.1%.

While on each day, the Fund has moved -237.5% of the move in the market, over the two-day period, the move in BBOZ’s NAV has been around -165% of the move in the market.

It’s important to note that this ‘rebalancing’ effect is particularly marked during periods of high volatility, such as the period we are currently experiencing. For example, since inception of BBOZ (April 2015) until the middle of February 2020, BBOZ was rebalanced approximately 3-4 times a year. By comparison, since the middle of February to date, BBOZ has been rebalanced approximately every 2-3 days.

Key takeout: The Bear Funds target a return in a particular range over a one-day period, and should not be relied upon to generate exactly that return over a period of longer than one day. For this reason, investors should not expect the applicable Bear Fund to have the same return or hit a certain price at a specific Index level.

Summary

The Betashares Bear Funds are designed to provide returns that are negatively correlated with the Australian or U.S. sharemarket, and so may be used to help protect against, or profit from, sharemarket declines. It is important for investors in a Bear Fund to understand its features, including how it is priced, and that it targets a return over a one-day period only. Additionally, Betashares strongly recommends investors review the relevant PDS and consider the risks associated with an investment in the relevant Bear Fund. These include the risk of negatively correlated returns, market risk, futures risk and gearing risk (in the case of BBOZ/BBUS). Investors should also check the Betashares website for details of the Fund’s historical performance, as well as the current portfolio exposure, to ensure that the Fund continues to meet their investment objectives.

The Bear Funds’ strategy of seeking returns that are negatively correlated to market returns are the opposite of most managed funds. Also, gearing magnifies gains and losses and may not be a suitable strategy for all investors. Investors in geared strategies should be willing to accept higher levels of investment volatility and potentially large moves (both up and down) in the value of their investment. Geared investments involve significantly higher risk than non-geared investments. Investors should seek professional financial advice before investing, and monitor their investment actively. An investment in any of the Bear Funds should only be considered as a component of an investor’s overall portfolio.