10 steps to successful investing in 2025 and beyond

5 minutes reading time

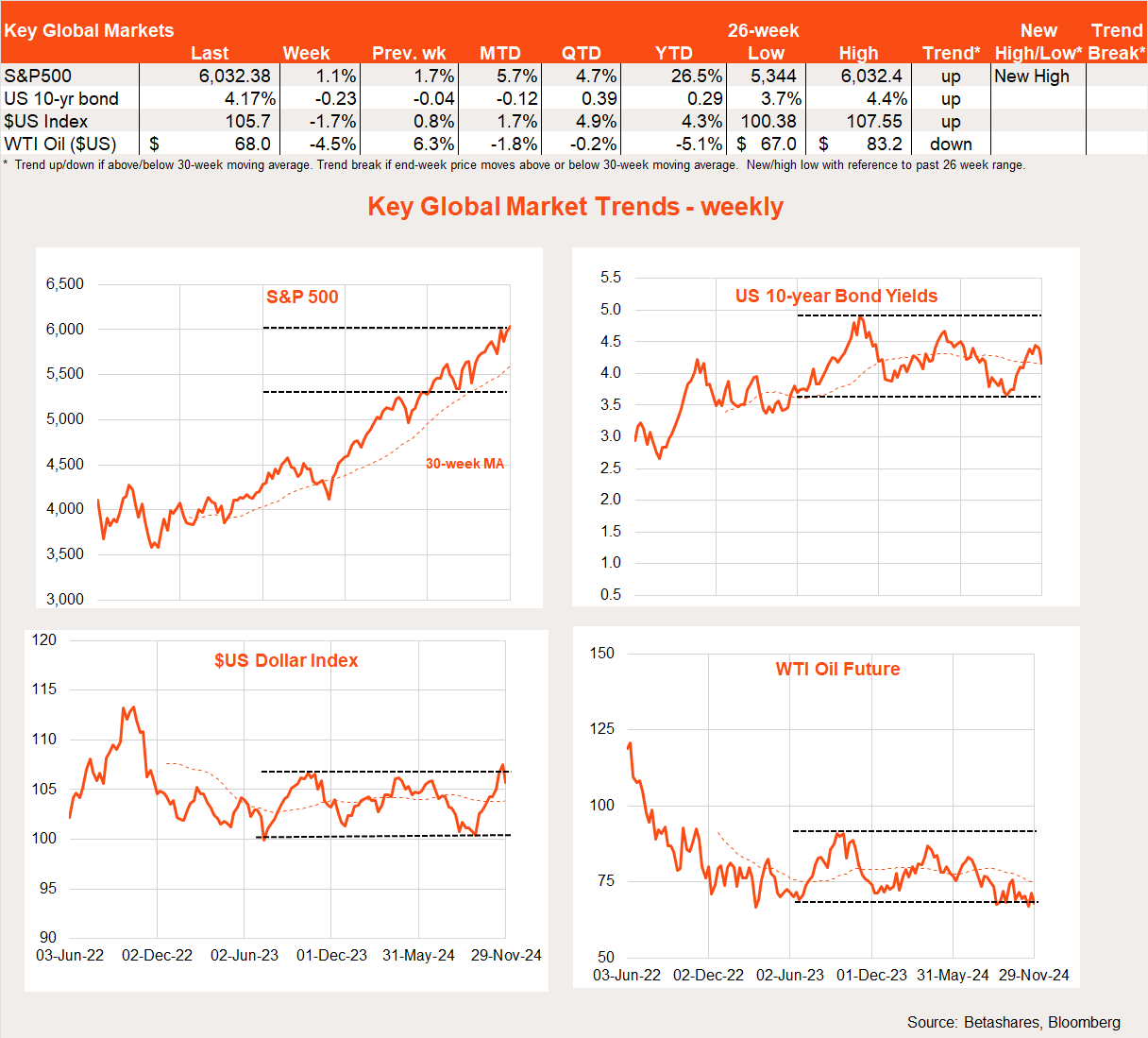

Global markets

Global equities continued their rebound last week, supported by market confidence in Trump’s choice for the new US Treasury Secretary. Easing Middle East tensions and encouraging Fed minutes were also market positives.

There was little in the way of major global economic data again last week. Instead, a positive market reaction to the choice of hedge fund billionaire Scott Bessent as Trump’s Treasury Secretary at the start of the week helped set the market tone. As I alluded to last week, although supportive of tariffs, Bessent’s Wall Street background and comments that Trump “does not want to cause inflation” gave investors some relief. Not only did equities rise, but there was also a decent decline in bond yields.

Also notable last week, Trump’s announcement that he would levy a 25% tariff on Canada and Mexico – and a 10% tariff on China – was, perhaps surprisingly, well absorbed by the market. One suspects the market is already somewhat prepared for and inoculated against the various Trump outbursts we’re likely to get in coming months (and years!). So far at least, Trump’s threats are being treated as opening bargaining chips in a likely heated series of global negotiations to “get a fair deal for America” in various areas.

In other news, minutes to the recent Fed meeting highlighted most voting members remain confident that inflation will continue to ease – allowing them to support the labour market from weakening further by gradually lowering rates toward a more neutral setting. According to the markets, this leaves a rate cut at this month’s Fed meeting still a warm (66%) chance.

Last but not least in global news, was the ceasefire deal struck between Israel and Hezbollah, which helped to ease oil prices. Reports suggest the upcoming December 5 OPEC meeting will see its production cuts rolled forward, given the market appears well supplied heading into 2025.

Global week ahead

The major global highlight this week will be Friday’s November US payrolls report, although it’s likely to be heavily distorted by the bounce back in employment following hurricane and strike-related disruptions. Indeed, the market expects a 200k employment bounce back after a meagre 12k gain in October, with the unemployment rate edging up to 4.2% from 4.1%.

Fed chair Powell also speaks on Thursday, with markets naturally focused on what he hints at with regards to a rate cut this month.

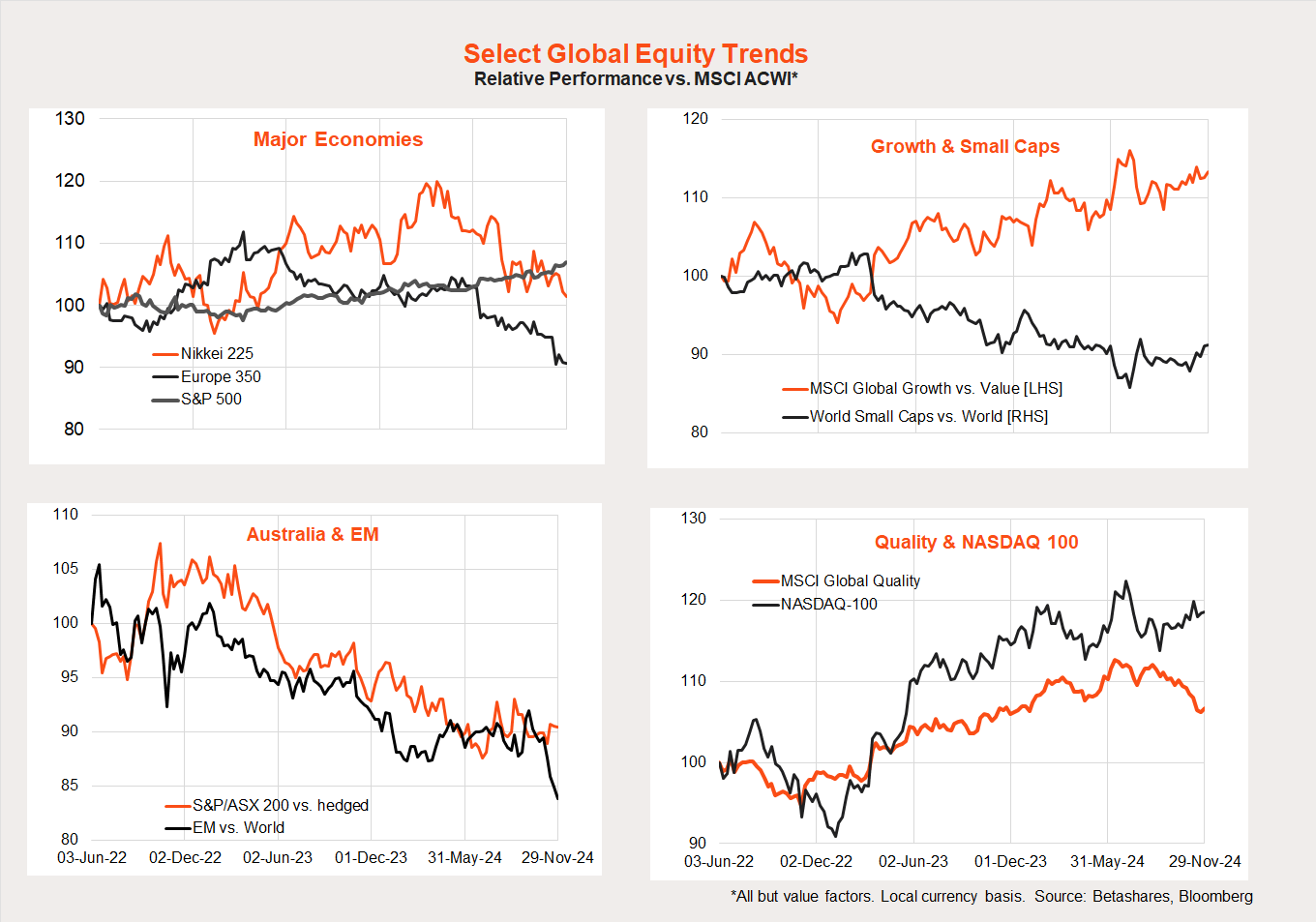

Market trends

The one clear global equity trend to emerge from the Trump victory has been a strengthening of US equity outperformance – compared to Japan, Europe and emerging markets. Australia’s relative performance has been choppy and in a sideways trend in recent months.

There are also tentative signs of a bounce in small cap performance, though this has not stopped continued relatively good performance from global growth and the Nasdaq 100.

Global quality has underperformed somewhat of late, which from a sector perspective seems to reflect its underweight exposure to the outperforming financial sector, and overweight exposure to the underperforming health care sector.

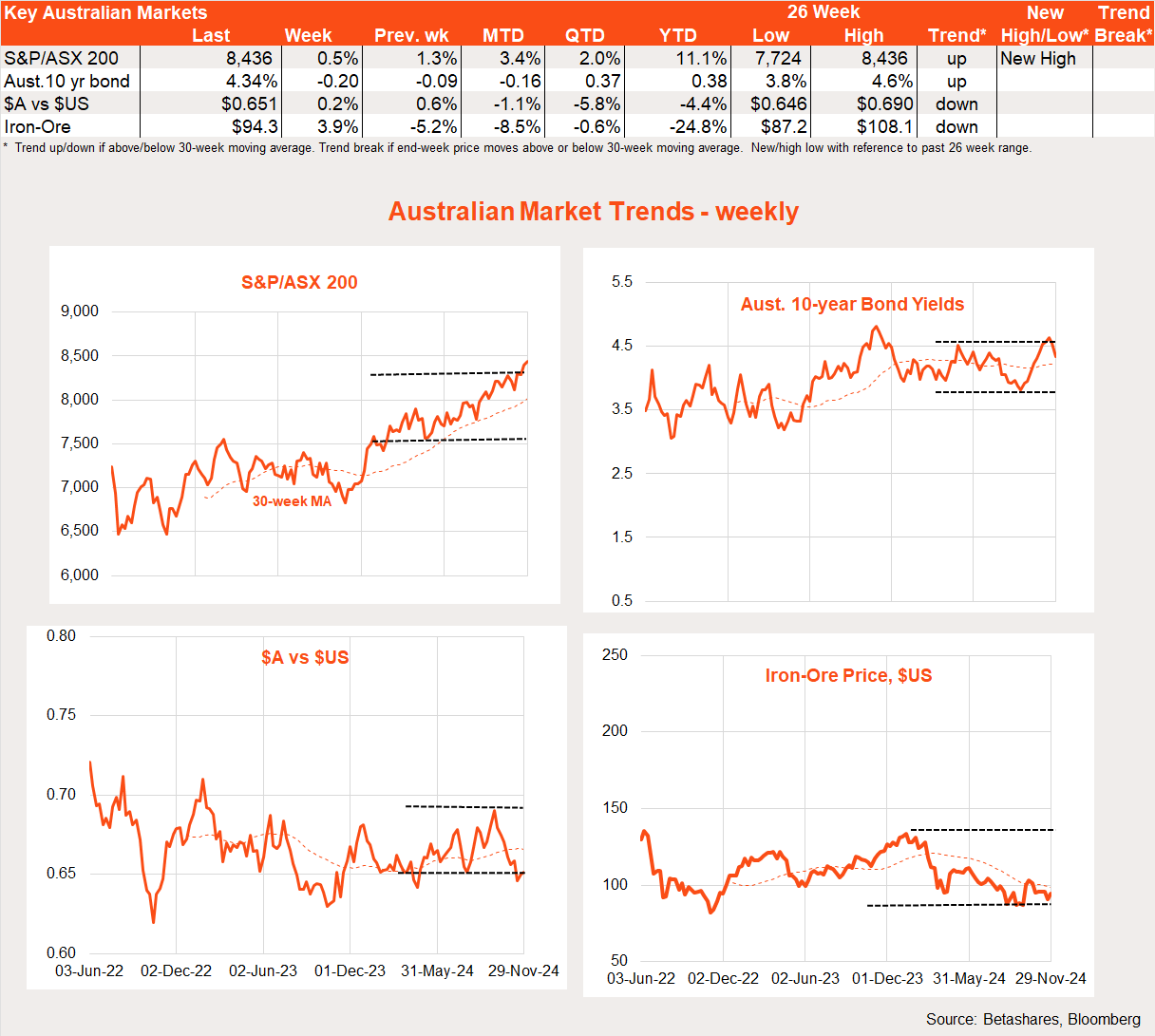

Australian market

Local stocks inched ahead last week, supported by the decline in bond yields and ongoing global market confidence. The $A continued to recover a little of its losses since Trump’s election, helped by a rebound in iron-ore prices on growing hopes for more Chinese stimulus in the face of US trade threats.

The main local news last week was the October monthly CPI report, which disappointingly revealed a lift in annual trimmed mean inflation from 3.2% to 3.5%. This measure of underlying inflation can be volatile and it sadly zigged up rather than down last week – which reduces the odds of a nice downside surprise in the quarterly CPI report in late January.

Also arguing against a rate cut any time soon, local construction and business investment reports for Q3 were a bit better than expected last week, which should support a slight acceleration in GDP growth on Wednesday.

The main drivers of construction/business investment remain public infrastructure and private non-residential construction (data centres and energy generation). Although it lifted in Q3, poor affordability and intense competition for tradies continues to constrain residential construction despite a backlog of work to be done.

Although trade and inventory data today and tomorrow will firm up market estimates, at this stage the market expects a pedestrian 0.5% gain in Q3 GDP on Wednesday – up from the meagre Q2 gain of 0.2%. This would lift annual growth to 1.1% from 1.0%.

Although on face value this is very weak below-trend economic growth, the RBA would argue the overall level of activity is still above potential and poor productivity suggests potential growth at present is lower than we’ve seen historically. Despite weak measured GDP growth, employment growth remains firm, the unemployment rate low and underlying inflation still frustratingly sticky – meaning the RBA can’t and won’t provide any interest rate relief this side of Christmas, or even Easter 2025.

Have a great week!