All will be fine

5 minutes reading time

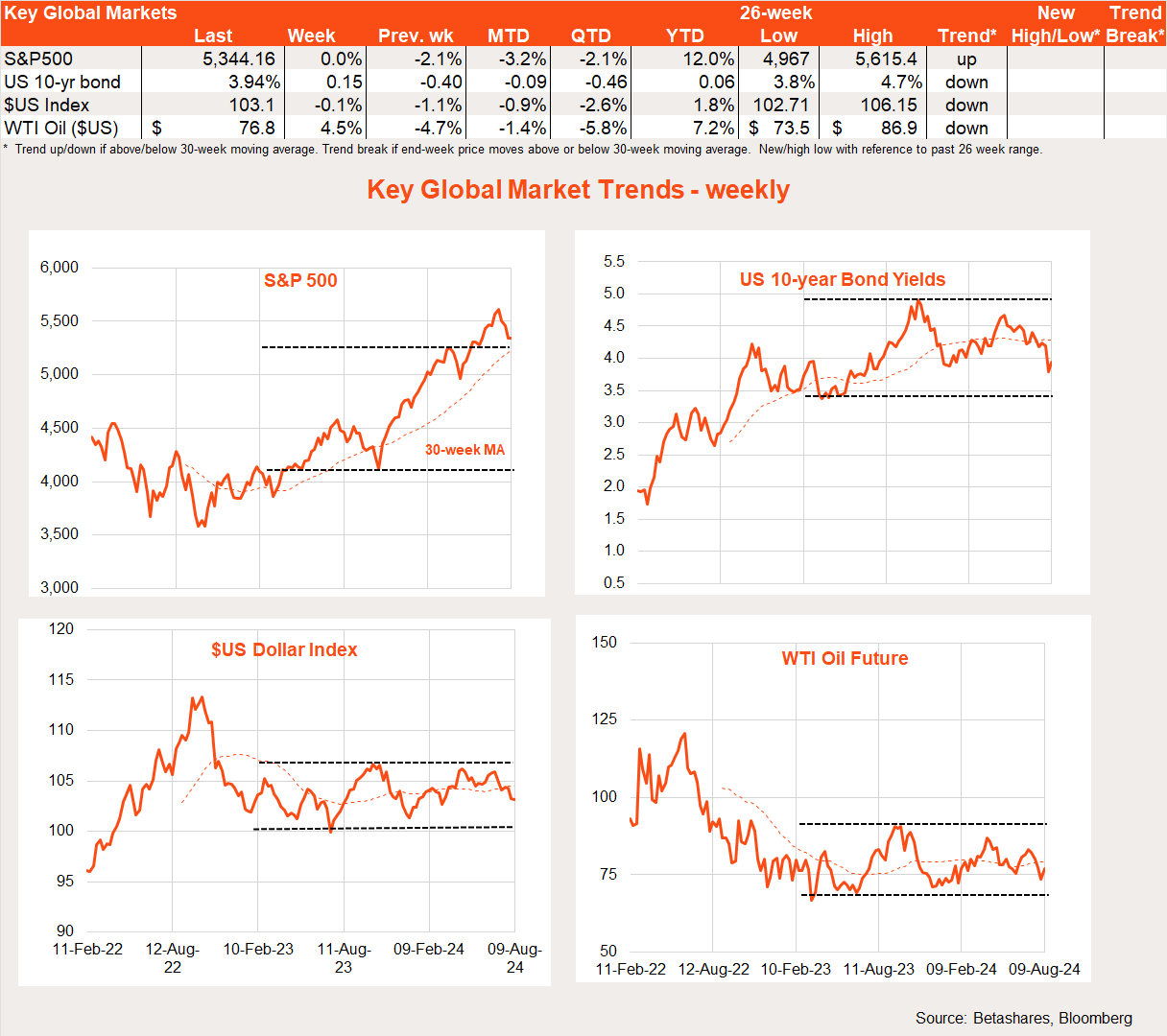

Global markets

Global stocks rebounded over the course of last week after the volatility of the previous Friday and Monday – helped by reassuringly firm US economic data. Overall, this resulted in a flat week for global and US stocks, with a modest rebound in bond yields.

As I outlined in a short video update last week, a weak US payrolls report and a surprise Bank of Japan interest rate hike were a ‘1-2 punch’ that hit markets over Friday August 2 and Monday August 5.

While the US payrolls report was soft, I don’t think fear of recession was the major driver of market weakness. Instead, it seems the increase in US rate cut expectations that followed – along with higher Japanese rates the previous day – was likely the more important driver, as the narrowing in US-Japan interest rate differentials pushed up the Yen further and triggered an unwinding of the popular ‘yen carry trade’, where investors borrowed yen at near-zero interest rates to buy all manner of other assets, including US Treasuries and tech companies. Indeed, the US equity market’s peak back in mid-July has coincided with the start of yen strength versus the US dollar.

Against this backdrop, two events last week helped stabilise markets – at least for now. For starters, although it still likely planned to raise rates further – given inflation was back to the 2% levels it desired – Bank of Japan officials suggested it would proceed carefully and avoid hikes in periods of market instability. How the BOJ manages this balancing act remains to be seen.

Secondly, perhaps the best real-time indicator of the health of the US labour market – weekly jobless claims – eased back last week after rising the previous week. This helped soothe concerns about a sudden lurch into recession.

Global week ahead

Inflation returns to centre stage this week, with the US July CPI report due on Wednesday (US time). Markets are expecting and have now grown accustomed to benign reports, with a 0.2% monthly gain in the core CPI anticipated – which would further ease annual core inflation from 3.3% to 3.2%.

Given recession concerns, retail sales and weekly jobless claims – also due this week – take on added importance. July sales are expected to bounce back 0.4% after a flat June result, while weekly jobless claims are expected to tick up slightly to 235k from 233k. In today’s fragile environment, bad news (i.e. weak economic reports) are likely to be bad news for equity markets, even if this results in heightened US rate cut expectations.

A range of Fed speakers is out and about this week, and likely to confirm a September rate cut is on the table – but perhaps push back against talk of a large 0.5% cut.

On Thursday, we get China’s monthly data dump covering news on retail sales, industrial production and business investment. That data is likely to confirm the economy is chugging along – at a pace acceptable to the Government, albeit perhaps not to the global investment community which is still hankering for more fiscal stimulus.

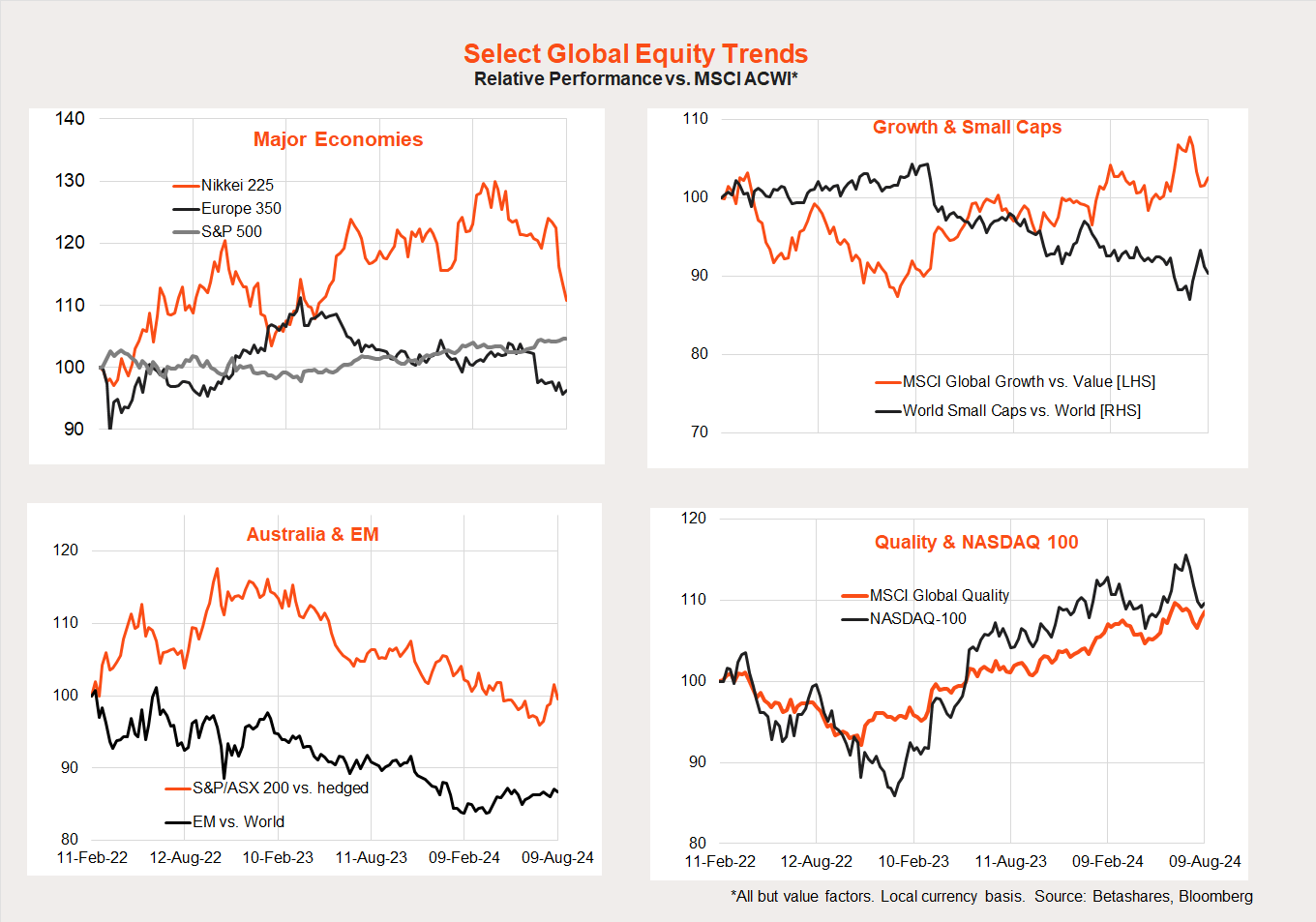

Market trends

The unwinding of Japanese equity outperformance continued last week, though there was a rebound in the relative performance of large cap technology/growth stocks as markets stabilised.

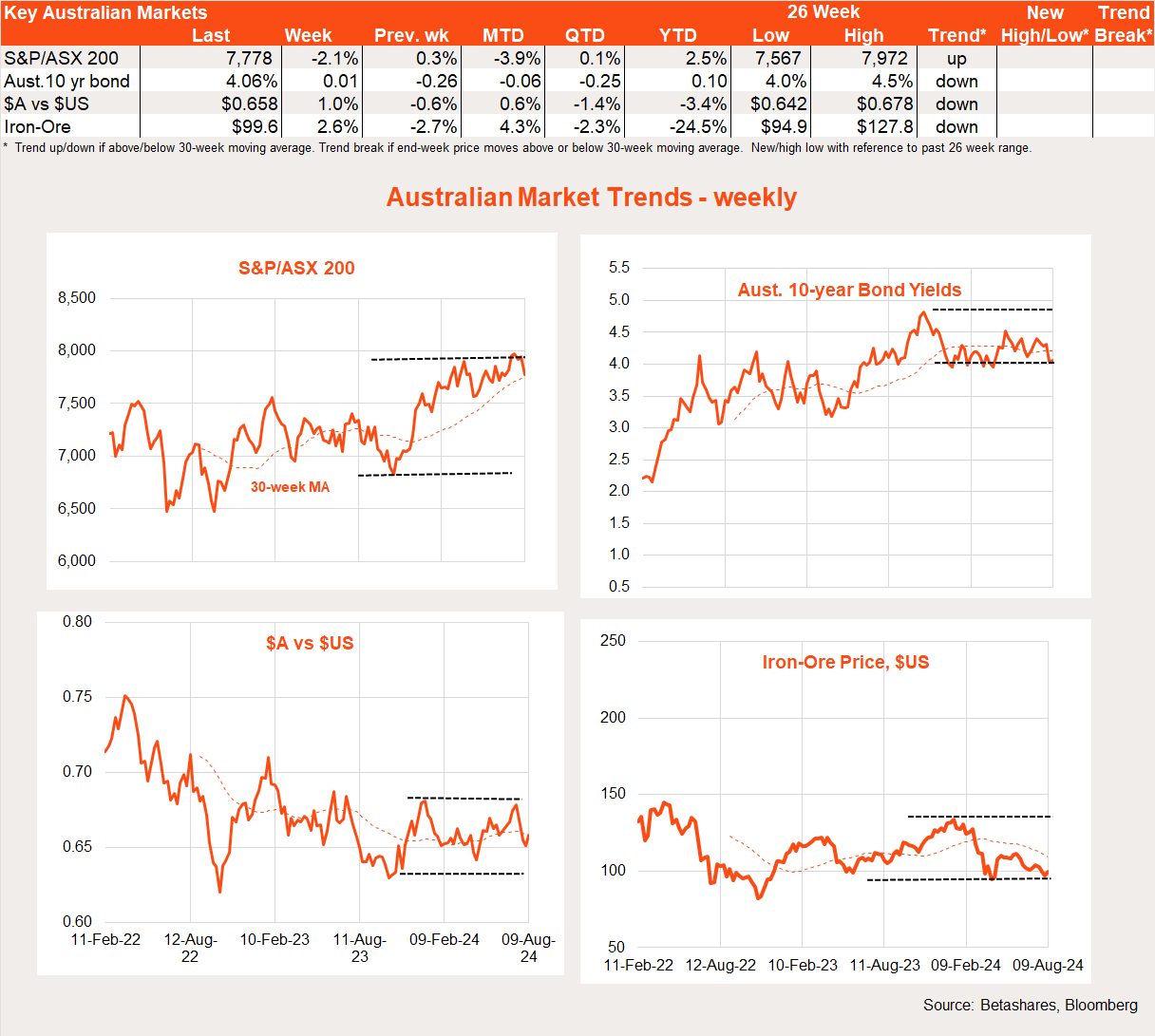

Australian market

Local stocks ended down last week, but should benefit this morning from the further rebound in US stocks last Friday.

The local highlight (or lowlight) last week was the ‘hawkish hold’ by the Reserve Bank of Australia. Although, as expected, the lower than feared June quarter CPI result allowed the RBA to hold rates steady last week, Governor Bullock was at pains to remind us inflation remains too high – and a rate cut this year at this stage seems unlikely.

Indeed, if inflation fails to fall further anytime soon, further rate hikes could be possible. Despite all the talk of a weak economy and cost-of-living hardship, the RBA still believes the fundamental driver of persistent inflation is a high level of demand relative to available supply.

All up, continued RBA hawkishness has now led me to push out the timing of the first expected rate cut – from November or December, to February 2025 at the earliest.

Why? Given the volatility of monthly CPI reports, the RBA will likely want to see convincing signs of easing inflation in at least two quarterly CPI reports – the second of which (for the December quarter) won’t be released until January next year.

We’ll learn more about RBA thinking when the Governor appears before a Parliamentary Committee on Friday, with Deputy Governor Hauser also giving a speech at lunchtime today.

In terms of economic data, we get updates on business and consumer confidence from the NAB and Westpac surveys tomorrow, along with the Q2 Wage Price Index. Business sentiment has eased of late to be modestly below long-run average levels – although capacity utilisation has remained relatively high and wage/cost pressures still firm. Consumer sentiment has been despondent, while the WPI measure of wage growth has eased gradually though is also still firm.

Most importantly, the July labour force report is out on Thursday, with a modest 20k gain in employment expected which would keep the unemployment rate steady at 4.1%.

All up, this week’s economic data is likely to remain mixed to soft – but not weak enough to allow the RBA to shift its focus from lingering concern with still uncomfortably high inflation.

1 comment on this

Enjoying these updates as a trader and Betashares Direct customer. Thanks David.