Take & Give

5 minutes reading time

- Global shares

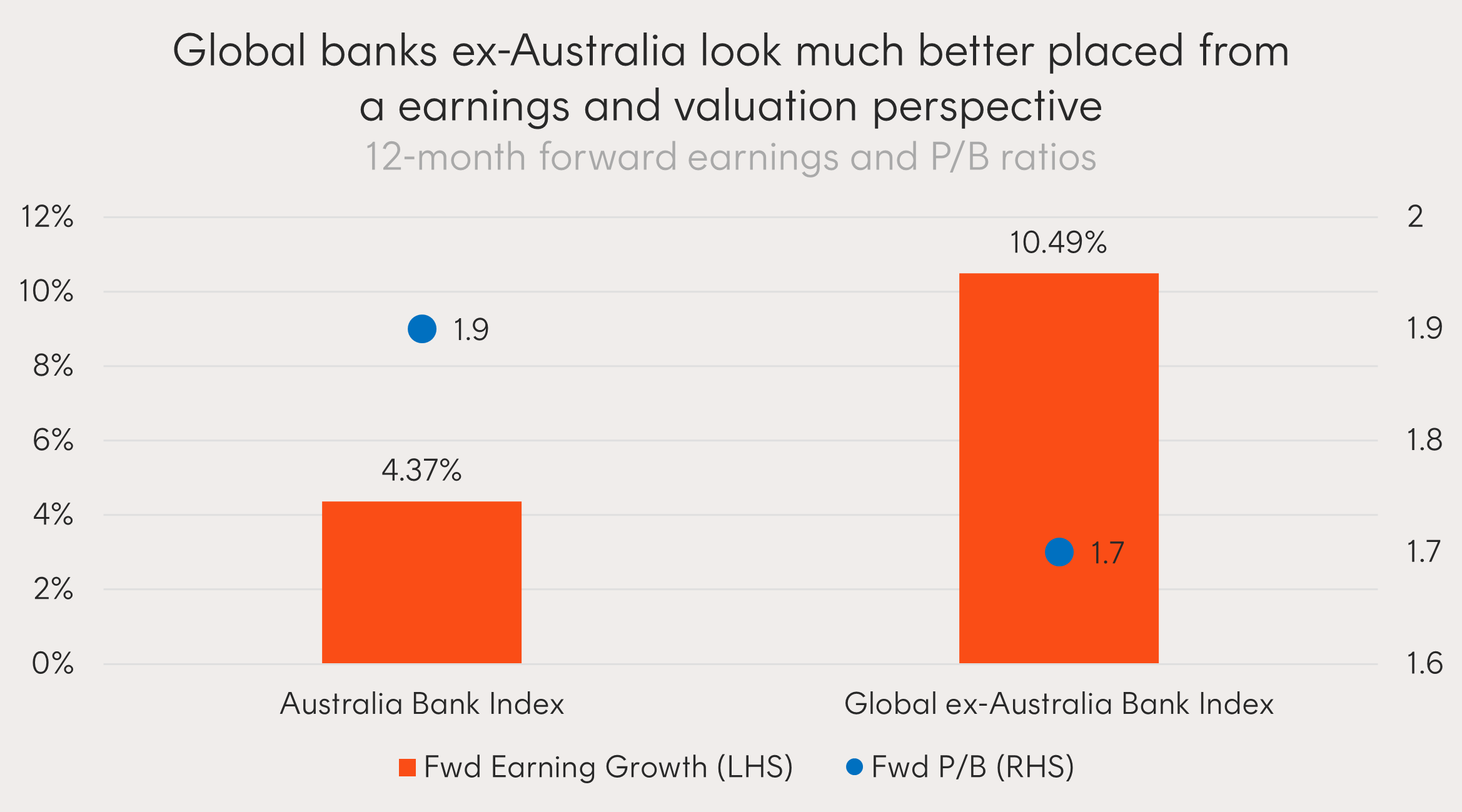

Given the stellar run of Australia’s banking sector, it may surprise some to learn that global banks have been outperforming. Over the past 12-months, an Australian and a global ex-Australia bank Index have returned 35% and 49% respectively.1

From a valuation and forward earnings standpoint, global banks look better positioned to continue their run.

Source: Bloomberg. As at 24 January 2025. Earnings estimates are Bloomberg consensus estimates. Actual results may differ from estimates. Australia Bank Index is the MVIS Australia Banks Index. Global ex-Australia Bank Index is the Nasdaq Global ex-Australia Banks Hedged AUD Index. You cannot invest directly in an index.

Global Bank profits surging

The US banking sector has been a clear winner from the last two corporate earnings reporting seasons. In Q3 every US large cap bank reported a high-quality earnings beat driven by a resurgence in capital market fees. At the time management teams pointed to this just being the beginning with strong pipelines building attributed to the macro environment normalising and financial sponsors gaining confidence in the next phase of the cycle.

Fast forward to last week (January 24th) and of the 17 Financial firms that have reported in the Q4 2024 earnings season, every single one has surprised to the upside.

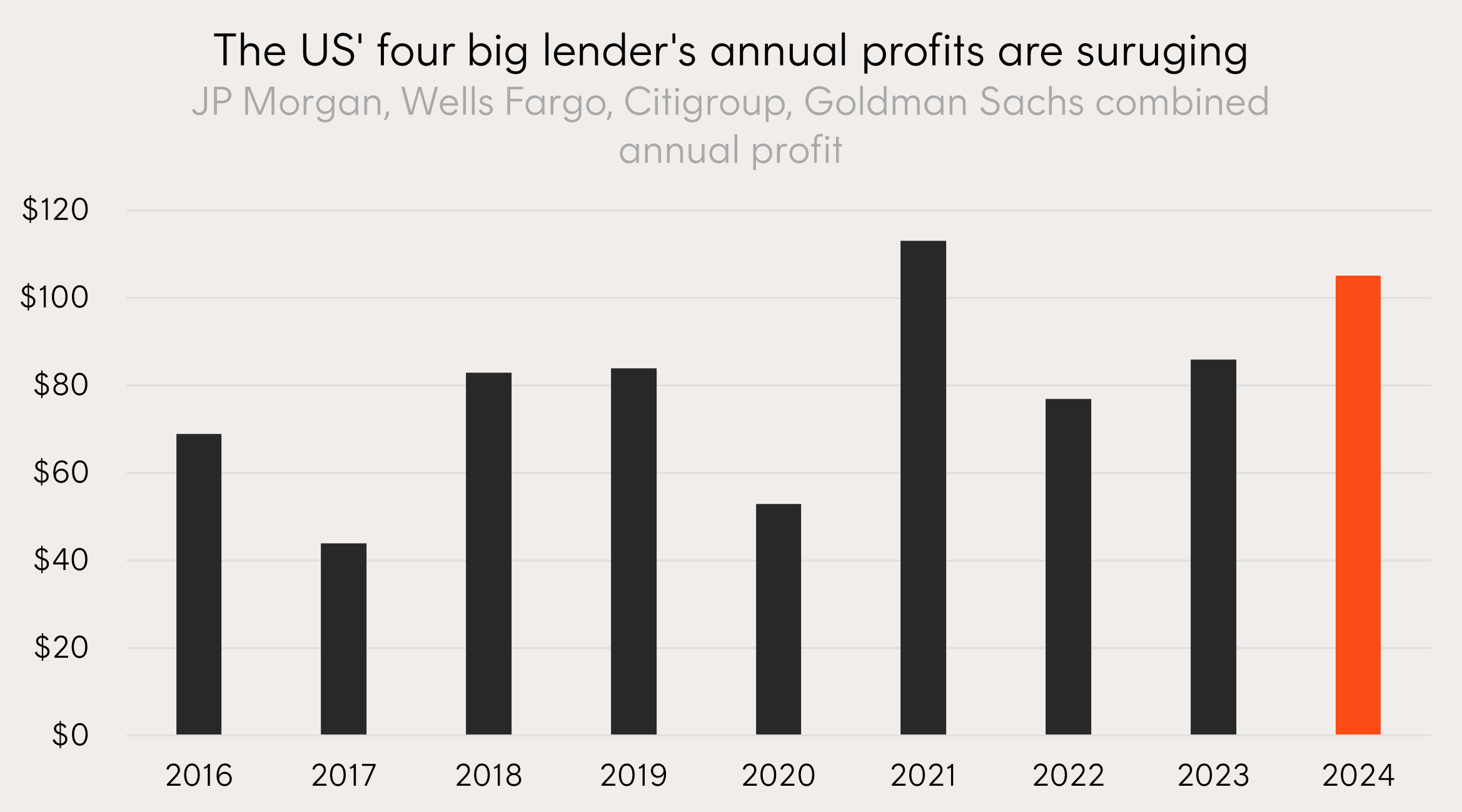

The big four US lenders (Citi, JP Morgan, Wells Fargo, and Goldman Sachs) collectively reported their second most profitable year ever in 2024 surpassing a combined US$100b. JP Morgan became the first bank in US history to record over US$50b in annual profit while three of Citi’s five largest segments recorded record revenue (wealth, US personal banking and services).

Source: Company filings. As at 16 January 2025.

Record profits for 2024 were attributed in part to interest rate moves benefiting trading and lending revenue. However, the more exciting element for investors should be capital market and investment banking fees jumping, the latter seeing an aggregate 32% increase from 2023. With banking volumes relative to GDP for M&A activity and debt and equity capital markets in the US coming off three-decade lows, there is optimism for a long runway of growth ahead.

This has been an experience shared globally. The Royal Bank of Canada saw its stock surge last year as trading and investment banking revenues rebounded. Meanwhile in Singapore a bank stock rally supported by higher profitability expectations recently drove the whole market near record highs.

The biggest Trump beneficiary?

US banks could be some of the biggest winners under the incoming Trump administration.

There are expectations for Trump’s new administration to take bolder deregulatory action than in his first term. The Basel III Endgame will be revisited and likely quashed under Trump, which is expected to free up billions in capital that would otherwise be mandated for capital requirements.

Republican regulators have also flagged a roll-back of recent M&A review provisions, making deals easier to complete. JPMorgan CEO, Jamie Dimon, told CEOs at a global summit that bankers were “dancing in the street” following Trump’s victory with expectations for the changes to be a big catalyst for bank profits heading into 2025.

Finally, aside from regulations, the heightened market volatility that may come from a Trump led administration could also help the big bank’s trading business which can more easily profit in a volatile environment.

Considering the already strong earnings results these banks are experiencing have been achieved before any of these expected deregulations have come into effect is a promising sign for future profits.

BNKS Global Banks Currency Hedged ETF provides Australian investors with exposure to the world’s largest banks outside of Australia, including Bank of America, JP Morgan, Citibank, Royal Bank of Canada, and HSBC with ~50% of the portfolio in North American banks.

BNKS can be used in portfolios to take a tactical tilt to global banks which have been crowded out of broader indices by mega-cap technology stocks in recent years.

You can find more information on BNKS fund page here.

There are risks associated with an investment in BNKS, including market risk, international investment risk, banking sector risk and concentration risk. Investment value can go up and down. An investment in the Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

1. Source: Bloomberg. As at 23 January 2025. Australia Bank Index is the MVIS Australia Banks Index Global ex-Australia Bank Index is the Nasdaq Global ex-Australia Banks Hedged AUD Index. You cannot invest directly in an index. Past performance is not an indicator of future performance. ↑