4 minutes reading time

For more than three decades, Australian investors have been able to access an investment option with the potential to deliver a higher rate of return than bonds without taking on a risk equivalent to investing in shares..

But the curtain is set to come down on this market in 2032. In this piece, we’ll look at what investors need to know and the options they will have when hybrids are no longer around.

Why is this move happening?

In short, APRA believes the Tier 1 market (comprised of bank hybrids) would not be able to operate as intended in a financial crisis. Instead, it wants banks to rely on more stable forms of capital like Tier 2 bonds and equity capital.

The world-first move1 was likely prompted by the March 2023 failure of Credit Suisse and APRA has decided to go ahead even though Australian hybrids are structured differently to the hybrids in Credit Suisse’s case2.

Will Australian banks be issuing any more hybrids?

The Betashares Investment Strategy and Research team believe it’s unlikely that the banks will be issuing any new hybrids. This is for several key reasons:

- Even once the upcoming hybrids roll off, the Big Four banks (in particular) should still meet their mandatory capital requirements,

- As roll-offs do occur, banks may issue more Tier 2 capital (not Tier 1 capital) to replace these hybrids,

- APRA has set a clear timeline for the new rules which all the banks can follow, and

- Given any plans to issue new hybrid securities would have to be run past APRA, and they’re proposing the phase out, these plans would be unlikely to get approval anyway.

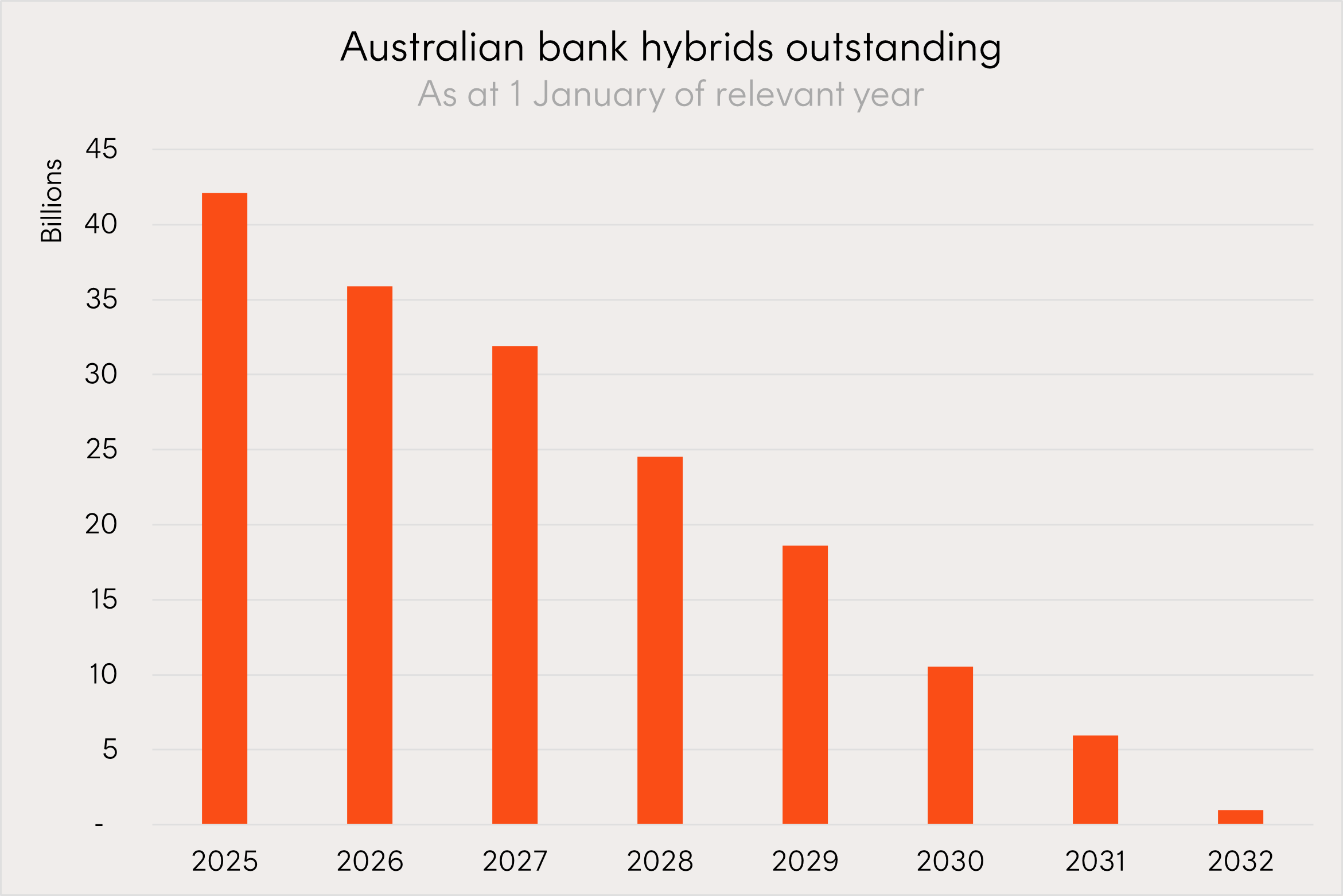

All this indicates that, in the next seven years, nearly $42 billion in investors’ capital will be returned.

Source: Betashares. As of March 2025.

What do these changes mean for your existing hybrid investments?

Investors could still consider either the BHYB Australian Major Bank Hybrids Index ETF or HBRD Australian Hybrids Active ETF as ways to maintain exposure to Australian bank hybrids between now and the end of the hybrid market’s life. Both funds pay monthly distributions and pass on the full benefits of any franking credits.

In the case of BHYB, the next first call date (meaning the first time the issuing bank can redeem the bond at a specific price on a specific day before the security’s maturity date) is not until June 2026. Approximately 50% of the portfolio is due to be called between 2029 and 2032.

Investors in HBRD receive exposure across the Australian bank hybrid, global bank hybrid, and corporate debt markets. AT1 capital (also called hybrids or capital notes) currently makes up 27% of the portfolio (as of 31 January 2025) while the global bank hybrid and corporate debt markets are not affected by APRA’s changes.

Beyond bank hybrids

Beyond these funds, Australian investors who have relied on hybrids in the past could turn their attention to traditional investment grade fixed income markets.

The most comparable exposures to Australian bank hybrids within the Betashares fixed income ETF suite include:

HCRD Interest Rate Hedged Australian Investment Grade Corporate Bond ETF offers investors exposure to income from high-quality Australian corporate bonds. It has a current yield to worst (the lowest possible yield an investor could receive if a bond is called early) of 5.34%3. It has achieved a total return of 9.28% over the past year and 9.85% p.a. since inception on 14 November 2022 (as at 31 January 2025).

BSUB Australian Major Bank Subordinated Debt ETF offers investors exposure to income from Tier 2 bank bonds. These securities are not affected by APRA’s proposed changes. BSUB’s current all-in yield (total yield including interest and fees) is 5.18%4 and has returned 5.88% since its inception on 6 May 2024 (as at 31 January 2025).

QPON Australian Bank Senior Floating Rate Bond ETF offers investors exposure to income from floating rate bonds issued by Australian banks. In the event of a crisis, senior floating rate bonds sit at the top of the order of repayment. QPON’s current all-in yield is 4.87%[5] p.a. It has returned 5.97% over the past year and 2.94% over the past 5 years (as at 31 January 2025).

All these ETFs pay monthly distributions to investors.

There are risks associated with investing in Betashares Funds including market risk, industry sector risk, currency risk and index tracking risk. Investment value can go down as well as up. An investment in a Betashares Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of each Betashares Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

References:

1. https://www.lexology.com/pro/content/apra-confirms-it-will-phase-out-at1-bonds-in-world-first ↑

2. https://www.afr.com/companies/financial-services/apra-will-wind-down-the-43b-bank-hybrid-market-angering-investors-20241209-p5kwuk ↑

3. As at 27 February 2025 ↑

4. As at 27 February 2025 ↑

5. As at 27 February 2025 ↑

2 comments on this

Thanks for the article – very useful information. It amazes me that APRA doesn’t like the idea of retail shareholders owning bank hybrids but has no problem with anyone who is at least 18 years of age opening a brokerage account and punting around with incredibly volatile small companies (e.g. mining companies) with miniscule market capitalisations. As you have mentioned, the Credit Suisse case is very different to the case of Australian bank hybrids and it appears that the Swiss case is just being used as flimsy excuse to curtail the distribution of billions in franking credits to hard working Australian investors. We will remember this on election day.

Does the portfolio makeup of HBRD mean that it will continue just without any Australian Hybrid exposure