Fed meeting recap: hawkish quarter point rate cut

6 minutes reading time

This information is for the use of financial advisers and other wholesale clients only. It must not be distributed to retail clients.

Having previously laid out the case for a quality investing approach in Australia, we wanted to examine the performance of Betashares AQLT Australian Quality ETF over the financial year just ended.

As a refresher, in seeking a core portfolio of Australian companies with high exposure to the quality factor, AQLT holds a blend of the largest companies on the ASX along with the highest quality mid and smaller cap companies all weighted by their quality attributes.

It is important to remember that past performance is not indicative of future performance.

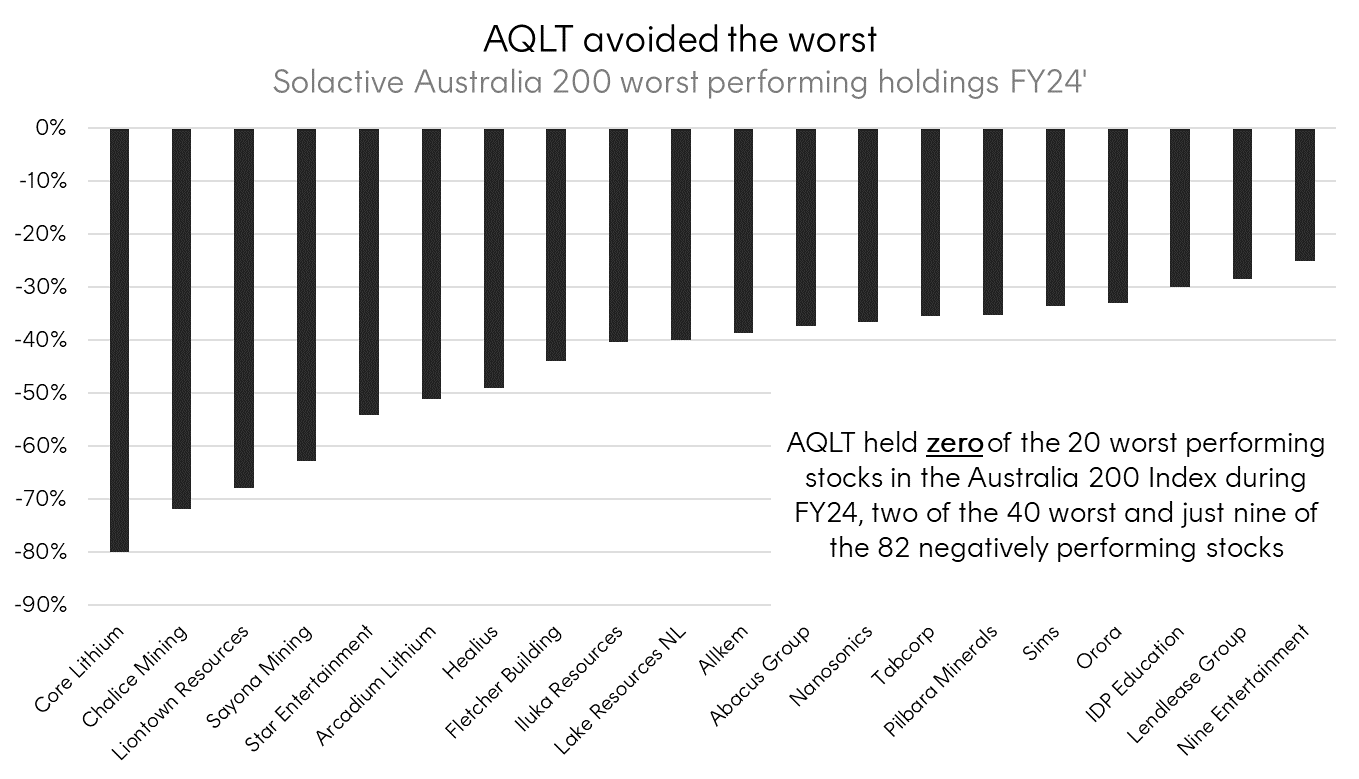

Avoiding the worst

The measure of a good ‘quality’ fund often starts with the companies it avoids holding.

By screening for high return on equity, low levels of leverage, and the stability of earnings over a sustained period, ‘quality’ funds typically avoid selecting companies with poor fundamentals that may have a higher probability of providing very negative returns.

In the financial year ending 30 June 2024 (FY 24), 82 companies in the Solactive Australia 200 Index (Australia 200) experienced negative performance. Of these, AQLT held:

- Zero of the 20 worst,

- Just two of the 40 worst, and

- only nine of the 82 negative performers in total.

Importantly, of the nine negatively performing stocks held by AQLT four were from the cohort of large cap companies that AQLT automatically selects and then reweights based on their quality attributes rather than size. AQLT’s index does this with the aim of avoiding the shortcomings of unconstrained Australian quality funds that can deviate too significantly from benchmark Australian indices like the S&P/ASX 200.

This left just five negative performers in the Australia 200 that AQLT’s quality screens selected for FY 24.

Source: Bloomberg, Betashares. Performance based on attribution data of Solactive Australia 200 Index from 1 July 2023 to 28 June 2024 and includes stocks held within the Solactive Australia 200 Index during the 12-month period. Past performance is not an indicator of future performance.

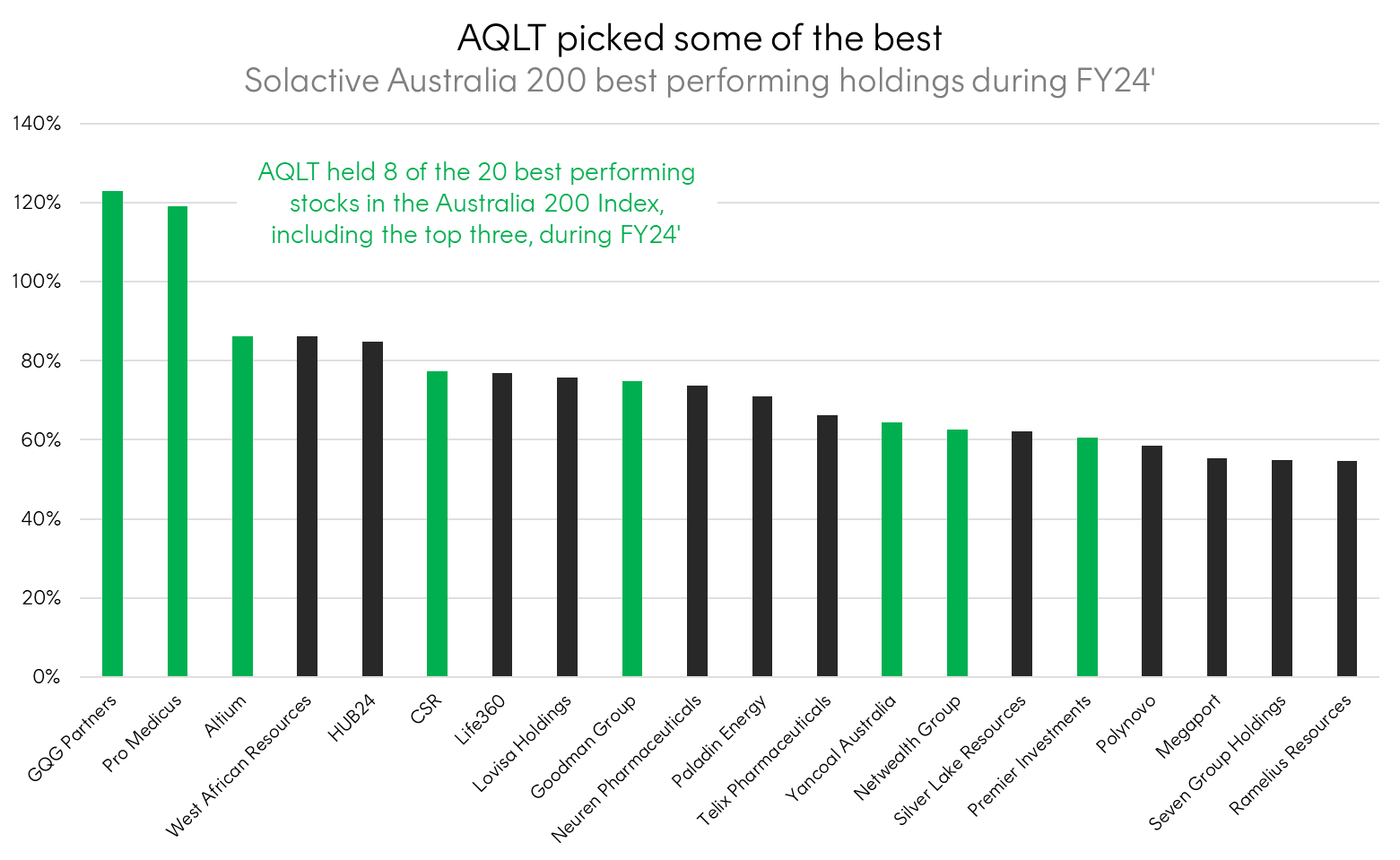

Picking the best

Quality screens won’t necessarily always pick the top performers. Sometimes the top performing stocks are associated with speculative price gains, or unexpected gains and windfalls not already factored into earnings.

Notwithstanding this, ‘quality’ funds seek to hold the performers that have had strong fundamentals underlying their growth.

Within the Australia 200 last financial year, a lot of the top performers were indeed backed by strong fundamentals.

In FY 24, AQLT held eight of the top 20 performers in the Australia 200 – including the three biggest ‘winners’ in GQG Partners, Pro Medicus and Altium1 (Altium was acquired by Renesas Electronics Corp in July ’24 and is no longer in AQLT’s portfolio as a result).

Pro Medicus and Altium scored well across all three quality metrics, whilst GQG’s very strong return on equity (4th best in the entire universe) and low levels of leverage were its largest contributors.

More than 75% of AQLT’s portfolio, 31 out of 40 holdings, were positive performers in the Australia 200 during the FY just ended.

Source: Bloomberg, Betashares. Performance based on attribution data of Solactive Australia 200 Index from 1 July 2023 to 28 June 2024 and includes stocks held within the Solactive Australia 200 Index during the 12-month period. Altium ceased to be in AQLT’s portfolio in July 2024 after being acquired by Renesas Electronics Corp. There is no guarantee these stocks will remain in AQLT’s portfolio or be profitable investments. Past performance is not an indicator of future performance.

Worth their weight

An important feature of AQLT’s methodology is allocating a higher weight to companies with higher quality scores. Unlike traditional market capitalisation weighted indices, that rank companies by their size, this approach upweights the exposure to high quality companies and the quality factor in AQLT’s portfolio.

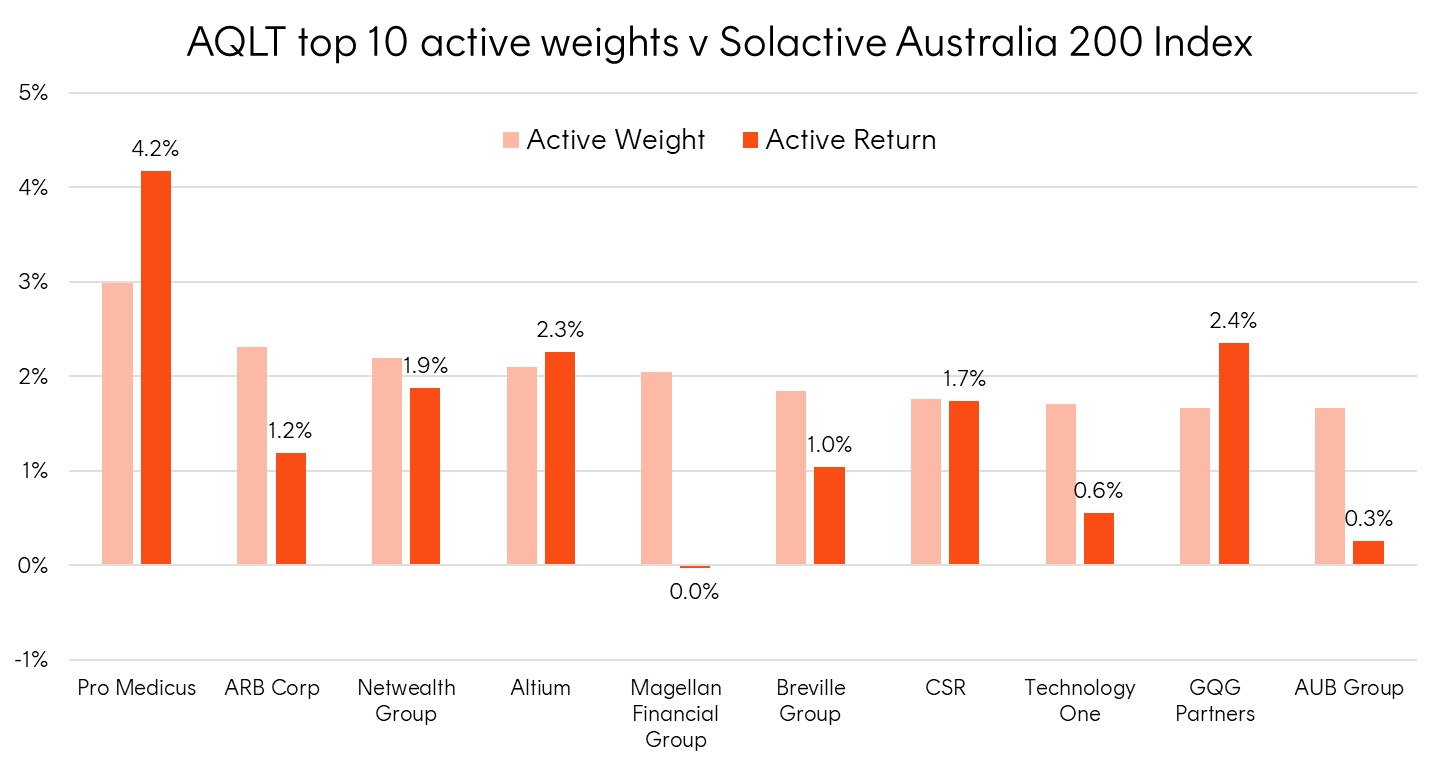

Of AQLT’s top 10 active weights, excluding the 12 large caps automatically selected, AQLT generated positive active return from nine of them – totaling 15.4% of outperformance over the Australia 200.

Within AQLT’s top 10 active weights were also Pro Medicus, Altium, and GQG Partners – the three highest performers on the Australia 200 during FY 24.

Most notably Pro Medicus, the Australia 200’s second best performer, was also the top ranked company based on AQLT’s quality composite scoring system during the 2023 rebalance process. Altium was 9th and GQG Partners was 23rd.

Source: Bloomberg, Betashares. Performance based on attribution data of Solactive Australia 200 Index from 1 July 2023 to 28 June 2024 and includes stocks held within the Solactive Australia 200 Index during the 12-month period. Altium ceased to be in AQLT’s portfolio in July 2024 after being acquired by Renesas Electronics Corp. There is no guarantee these stocks will remain in AQLT’s portfolio or be profitable investments. Past performance is not an indicator of future performance.

The 12 large cap companies that were automatically selected in AQLT’s portfolio and reweighted based on their quality attributes contributed to negative active return for AQLT.

AQLT’s methodology suffered from Australian bank outperformance as quality screens underweighted the ‘Big 4’. Notably, AQLT overweighted Macquarie due to its higher return on equity which led to outperformance.

Nevertheless, with a total net of fees excess return over the Australia 200 of 10% in FY 24, AQLT’s selection of high-quality companies more than offset the negative contribution from the large caps.

AQLT can be used in a diversified portfolio as a core Australian equities allocation. Alongside existing low-cost passive Australian ETFs, AQLT can improve portfolio diversification and fundamentals. AQLT may also be suitable as a replacement for higher cost active managers.

For any more detailed analysis about AQLT’s FY 24 attribution or methodology, please contact us.

There are risks associated with an investment in AQLT, including market risk and non-traditional index methodology risk. Investment value can go up and down. An investment in the Fund should only be made after considering your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

Reference:

1. There is no guarantee these stocks will remain in AQLT’s portfolio or be profitable investments. Altium ceased to be in AQLT’s portfolio in July 2024 after being acquired by Renesas Electronics Corp. ↑