Betashares Australian ETF Review: August 2025

9 minutes reading time

- Equity income

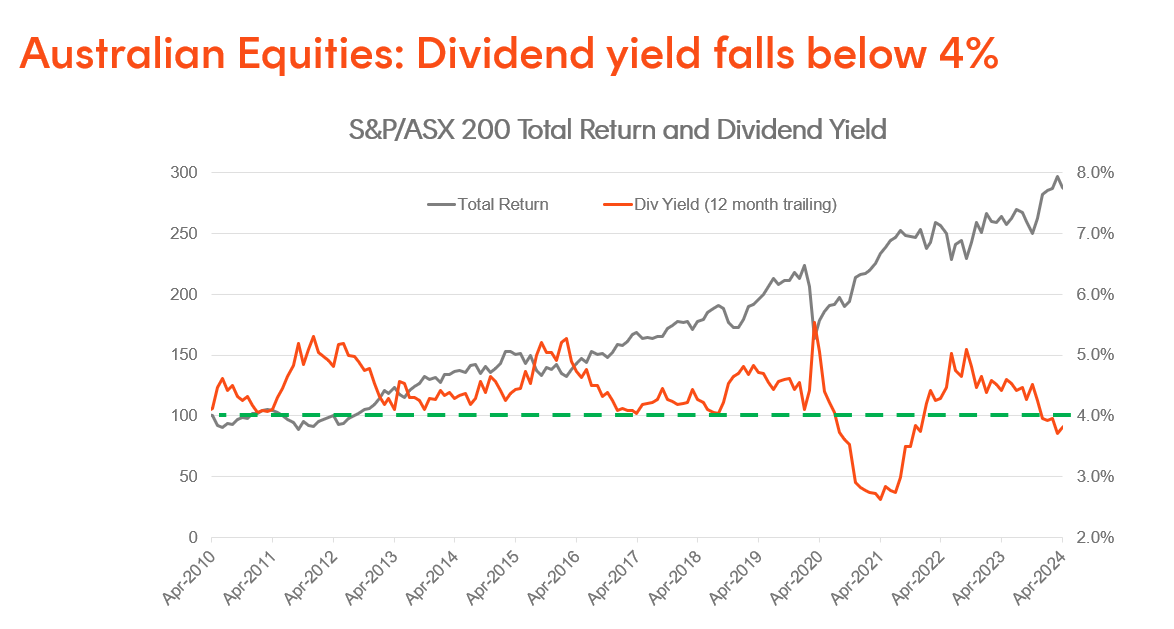

Australian shares have long been a staple for income investors, thanks to their historically high dividend yields, which typically range between 4-5.50% before franking. However, there has been a recent shift in the landscape.

While market downturns like the COVID-19 decline caused a temporary dip in dividends as companies were forced to conserve payouts, they have historically rebounded quickly.

Recently, however, we’ve seen an unusual occurrence: the Australian market’s base yield has steadily trended lower and dipped to below 4%.

Source: Bloomberg. As at 1 May 2024. Chart excludes franking credits. You cannot directly invest in an index. Past performance is not an indicator of future performance.

The top 200 Aussie companies paid out $33.9 billion in dividends during the February 2024 reporting season, down from $34.8 billion a year earlier1. Rising business costs and debt are taking a bite out of those payouts. Yet share prices are rallying on the prospect of cooling inflation and improved economic growth.

While rising share prices are good news, they can make achieving income targets a challenge if dividend growth from the market isn’t keeping pace.

In this blog, we explore four ETFs currently yielding above 5% to consider as a supplement to core Australian equity and fixed income exposures2.

1. QOZ FTSE RAFI Australia 200 ETF

12-month distribution yield: 5% or 6.5% when accounting for franking credits

- Top holdings: BHP Group, Commonwealth Bank of Australia, Westpac (as at 17 May 2024)

QOZ employs ‘fundamental indexing’, a strategy designed to screen for and own stocks based on their merits rather than market capitalisation.

Instead of size, QOZ screens ASX companies using these metrics – sales, cash flow, dividends, and book value, then ranks and invests in companies accordingly.

By prioritising fundamentals, QOZ has provided attractive income and total returns over time:

- The fund’s base yield with franking credits adds up to 6.5%, compared to 5% for the market-weighted ASX 2003.This is because Fundamental indexing by its nature can build a portfolio of companies with healthier balance sheets which have a greater capacity to pay dividends while avoiding those who are reducing or not making payouts.

- QOZ’s index has delivered an average additional return of 1.86% per annum over the ASX 200 since May 1992 until the end of 2023, based on Betashares and Bloomberg data4. This underscores the compounding benefits of a strategy based on fundamentals.

2. YMAX Australian Top 20 Equities Yield Maximiser Complex ETF

12-month distribution yield: 8% or 9.8% when accounting for franking credits (as at 17 May 2024)

- Top holdings: CSL, National Australia Bank, Goodman Group (as at 17 May 2024)

YMAX is an investment option for those seeking quarterly distributions and reduced portfolio volatility. This fund invests in the 20 largest blue-chip shares listed on the ASX and employs a ‘covered call’ strategy to boost income.

Betashares’ range of Yield Maximiser funds use a covered call strategy to offer additional income over and above dividends generated by the portfolio. This approach takes a two-pronged strategy: earning dividends from the underlying stocks and generating income from writing call options on those shares.

It’s first important to take a moment to understand how this strategy works by watching the following video:

A covered call strategy performs well in a neutral or gradually rising market, allowing call options to generate income without stocks being called away too often, as has been seen in recent months. Equity prices are being supported by expectations of a global soft landing and the likelihood of a rate cut in the US, however, a pause at home now looks more likely.

Risks of covered call ETFs

Covered call ETFs blend dividends with profits from option writing, therefore seeking to offer higher yields compared to Australian equity ETFs. However, it’s essential to note that there are risks.

While it can boost income, it may also limit capital growth due to cost of options premiums offsetting gains in the underlying portfolio. On the flip side, during market downturns, options profits can help cushion losses.

Investors should carefully understand covered call products and seek professional advice before investing in them.

3. HCRD Interest Rate Hedged Australian Investment Grade Corporate Bond ETF

Interest/All-in-yield: 5.98% (as at 17 May 2024)

- Top holdings: Vicinity Centres Trust, Sydney Airport Finance, Westconnex (as at 17 May 2024)

HCRD invests in a fixed income sector known as corporate bonds, also commonly referred to as ‘corporate debt’ and ‘credit’.

Credit offers a higher yield than government bonds because they are considered higher risk than investing in debt securities issued by the Australian government.

While they are higher risk, the bonds held by HCRD are ‘investment grade’ – meaning they are issued by entities that ratings companies including Standard & Poor’s and Moody’s have deemed as reliable borrowers.

HCRD holds a diversified portfolio of 50 investment grade corporate bonds, featuring essential businesses like Coles, Woolworths, Sydney Airport, and WestConnex, as well as debt issued in Australian dollars by global brands including McDonald’s and Verizon.

The fund selects securities based on their expected returns, rather than how big the bond issuer is. The strategy also uses tools to reduce the volatility typically associated with fixed-rate bonds when interest rates change.

Since November 2022, HCRD has experienced lower volatility than both the S&P/ASX 200 Index and its unhedged counterpart, CRED Australian Investment Grade Corporate Bond ETF .

Source: Bloomberg. Australian Fixed Rate Corporate Bonds (CRED) represents Betashares Investment Grade Corporate Bond ETF (ASX: CRED) total return. Australian Fixed Rate Corporate Bonds Hedged (HCRD) represents Betashares Interest Rate Hedged Australian Investment Grade Corporate Bond ETF (ASX: HCRD). As at 31 December 2023. Starting date chosen as inception of HCRD on 14 November 2022. Past performance is not an indicator of future performance.

Relative to other types of fixed income and as at 20 May 2024, HCRD presents an attractive estimated yield to maturity of 5.68%, compared to 4.2% for the Australian 10-year government bond rate5 and average bank savings account yield of 3.44%6.

Furthermore, Australian credit offers compelling relative value compared to global corporate bonds due to our relatively higher yield. This gap could narrow based on our base case for a global soft landing, which would support bond prices.

4. BSUB Australian Major Bank Subordinated Debt ETF

- Interest/All-in-yield: 5.68% (as at 17 May 2024)

- Top holdings: Commonwealth Bank of Australia, ANZ, National Australia Bank, Westpac (as at 17 May 2024)

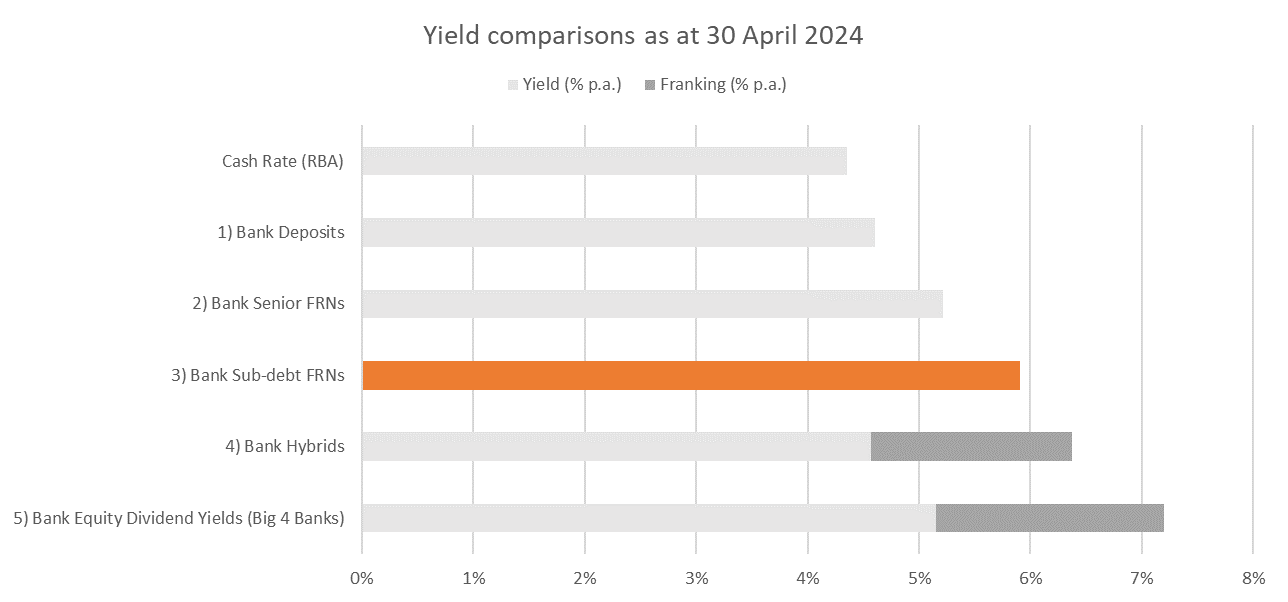

BSUB provides a new alternative to an income favourite: bank dividends.

The Big Four banks, serving a vast number of customers, require substantial capital to fund loans for business ventures and home purchases.

Many of us are familiar with how banks gather funding through customer deposits and issuing listed securities, including hybrids and shares. However, a lesser-known category, subordinated debt floating rate notes (FRNs), is gaining attention among investors.

These notes are termed ‘subordinated’ because they ranks below senior FRNs or traditional bonds in the capital structure. Subordination and callability are features of Tier 2 securities that introduce a higher risk level than that of senior bonds. Further, a key feature of the regulatory requirements for subordinated FRNs, being Tier 2 regulatory capital instruments, is that they absorb losses at the point of non-viability of the issuer. Below, we provide a comparison of yields and seniority across a bank’s capital structure.

Source: Bloomberg, Betashares, RBA. Past Performance is not indicative of future performance. Yield will vary and may be lower at time of investment. Bonds and hybrids have relatively higher risk compared to cash deposits. Yield does not take into account fund fees and costs. Yield will vary and may be lower at time of investment.

We covered subordinate debt extensively in this article to mark the launch of ASX: BSUB. The case for considering this asset arises from the recent aggressive rate-hiking cycle, which has repositioned fixed income as an attractive source of income.

Subordinated debt, in particular, continues to offer very attractive returns, delivering around 1.8% above cash deposits and 0.9% above senior bank FRNs (as of 30th April 2024). With cash yields currently near 6%, major bank subordinated FRNs now match or even surpass the fully franked yields of their ordinary shares but with significantly less volatility.

Conclusion

Australian shares will remain a core component of most income portfolios. However, falling yields in the broader Australian market have coincided with the emergence of new and attractive opportunities, particularly in light of the recent aggressive rate cycle.

Strategies such as fundamental indexing, covered calls, credit securities, and subordinated bank debt can help investors enhance the income of their existing portfolios while offering the prospect of better risk-adjusted returns.

As always, it’s crucial for investors to thoroughly understand these concepts and products before investing. Consider seeking financial advice to ensure they align with your goals.

There are risks associated with an investment in the Funds mentioned in this blog, which may include for example (fund specific) market risk, security specific risk, credit risk and use of options risk An investment in the Funds should only be considered as part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of each Fund, please see the relevant Product Disclosure Statement and Target Market Determination, both available on the Betashares website (www.betashares.com.au).

1. CommSec February 2024 reporting season wrap ↑

2. All yield information is as at 17 May 2024. Please refer to the relevant product page for further performance information. Past performance is not an indicator of future performance. ↑

3. Source: Betashares, Bloomberg. As at 30 April 2024. QOZ’s yield is calculated by summing the prior 12-month per unit distributions divided by the closing NAV per unit at the end of the relevant period. Yield will vary and may be lower at time of investment. Franking level is the total franking level over the last 12 months. Past performance is not indicative of future performance. ↑

4. QOZ commenced operation on 10 July 2013, data prior to this date is based on back tested results. ↑

5. Trading Economics Australian 10-year government bond yield ↑

3 comments on this

Interesting ideas to ponder over, particularly around covered calls.

Interesting read. Strangley beatshares haven’t fallen anywhere near the massive drop in dividends paid. Each couple of months they seem to drop, wasn’t that long back that a $15 harvest share was paying over .10c, now $13 share lucky to pay .07c dividend.

I’ve owned YMAX for years and I love it. Great addition to any portfolio, good work and 2 thumbs up from me.