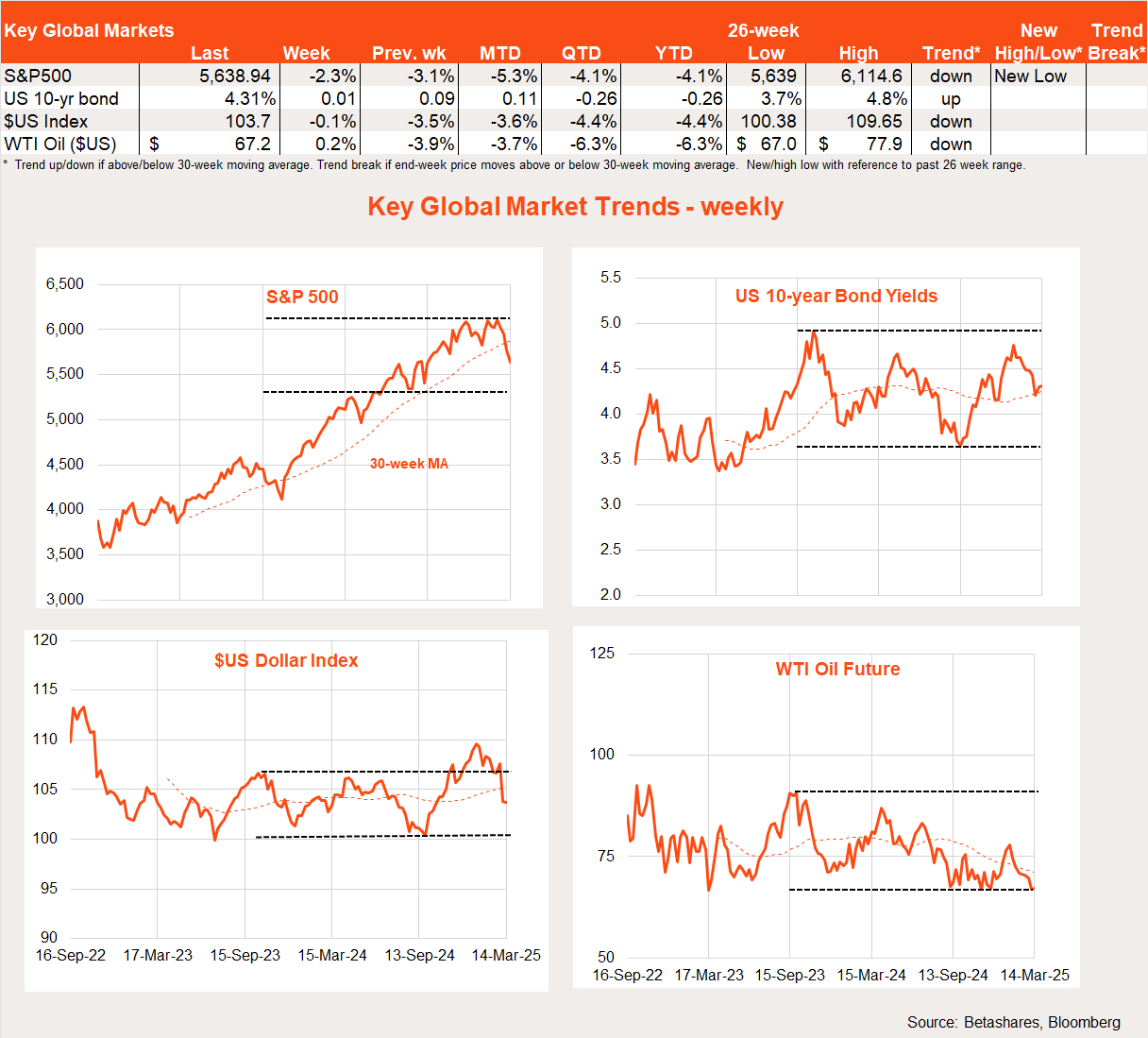

To reiterate the opening line from the past two weeks, “global equities retreated further last week due to ongoing US tariff concerns.” Markets rebounded on Friday, largely as a result of a quieter day from President Trump.

6 minutes reading time

The week ahead will likely continue to be dominated by tariff news. What will Trump announce next?

Otherwise, the key news will be the US Federal Reserve’s latest interest rate decision on Thursday morning. The decision will also include updated economic forecasts and the Fed’s ‘dot plot’, which highlights where the Fed’s monetary policy board expects interest rate policy to go in the medium-term. Economists expect US rates to remain on hold.

Market interest will focus how the Fed views the escalating trade tensions – it is more of a risk to growth, inflation or both? At present, the Fed’s dot plot has two rate cuts pencilled in for this year. Fed Chair Jerome Powell has also signalled that the Fed might change the way it reports its forecasts on rates and the economy this week.

On the data front, US February retail sales will be in focus because last month’s 0.9% decline was a shock to markets. Markets partly put this down to seasonal quirks and extreme weather. At the moment, economists anticipate a 0.6% rebound. However, a weak result might see market talk of recession escalate further.

In China, we get the monthly data dump today. This will cover updates on industrial production, business investment and retail sales.

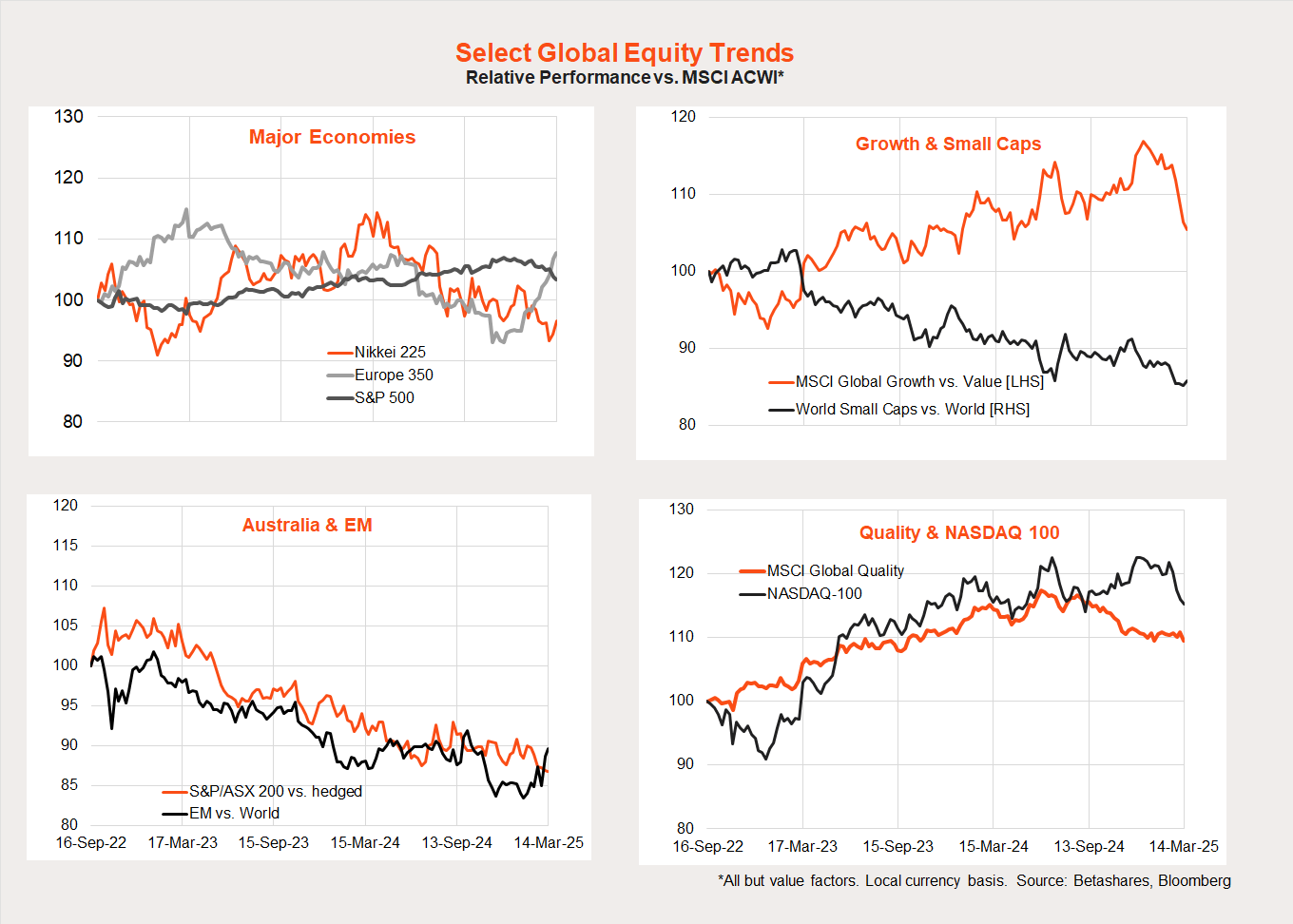

Non-US stocks handily outperformed US stocks again last week, with Europe and emerging markets again holding up better. Last week, Japanese stocks joined the fray.

This has continued the pullback in the relative performance of the NASDAQ 100 and global growth over value. Australia, alas, has not yet benefited from the rotation away from the US.

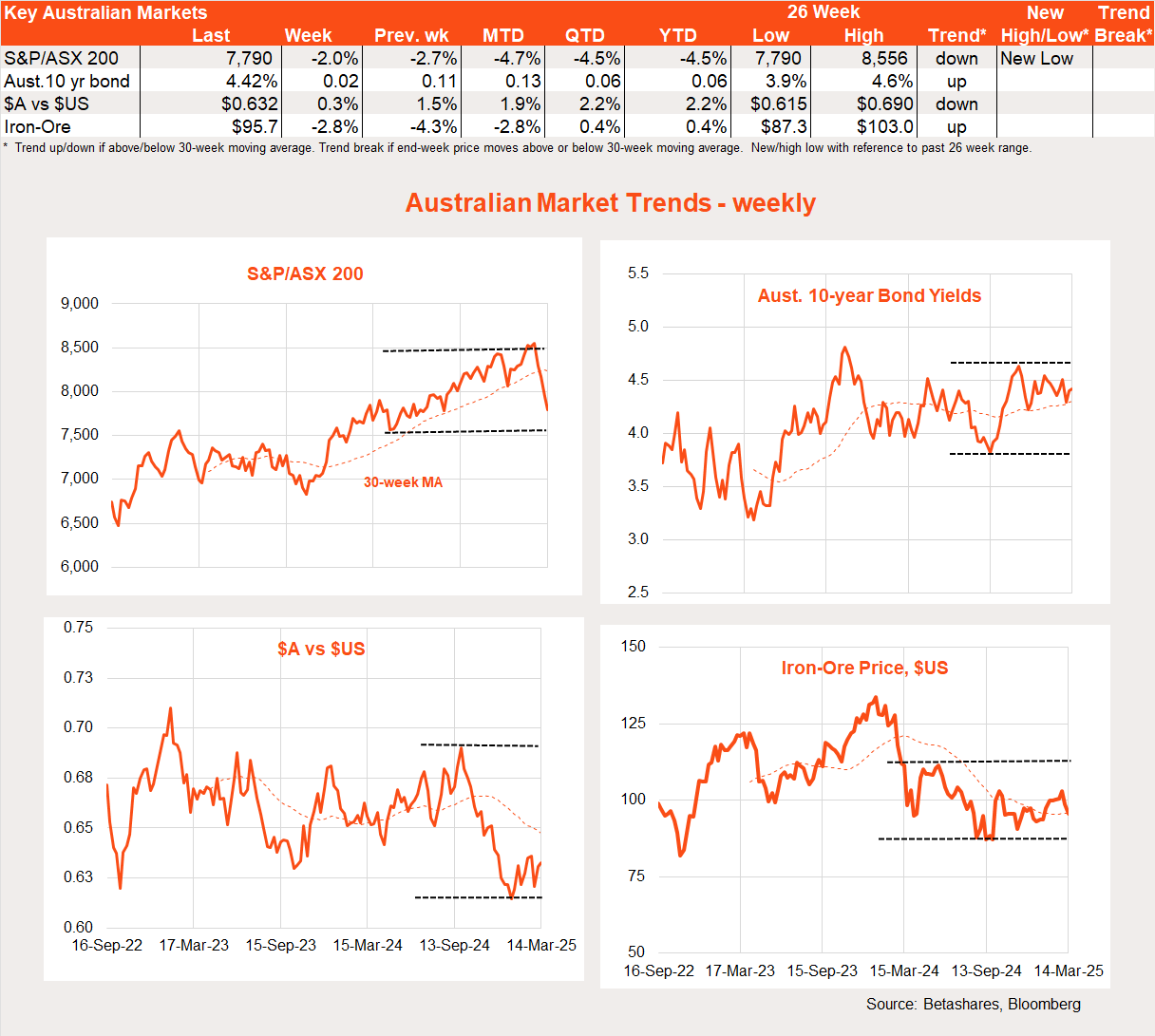

Local stocks slumped further last week. However, they have bounced this morning following Friday’s US stock market gains. Iron ore prices fell further, after China announced plans to reign in steel production.

The major local highlights last week were business and consumer confidence. The Westpac measure of consumer confidence bounced, thanks to the recent interest rate cut. In contrast, the NAB measure of business conditions held steady, implying corporate Australia is a little more worried about the global trade outlook.

The key news this week will be Thursday’s labour market report. A further solid employment gain of 30k is expected, meaning the unemployment rate will stay steady at 4.1%.

Have a great week!