3 minutes reading time

Reading time: 3 minutes

Eating. It’s one thing we all do on a daily basis. But while we accept that food is an enjoyable staple of life, we typically give little thought to the investment opportunities that agriculture offers.

Do you spread margarine on your toast, splash a little soy sauce on your rice, or eat tofu? All of these contain soy, which of course comes from soybeans. Do you enjoy yoghurt, the occasional chocolate bar, soft drink or beer? They generally contain sugar. Your favourite breakfast cereals, pasta, and bread typically contain wheat, while corn is used for chewing gum, snacks, peanut butter and even industrial products like soaps, paints, and cosmetic powders. Corn can even be used to make fuel for your car.

Common sense tells us there will always be a demand for these agricultural goods, but few of us consider them as an asset class to invest in.

Why invest in agriculture?

There are several reasons to consider investing in agriculture:

- Diversification- the agricultural sector has historically had a relatively low correlation to other major asset classes. This means that when investments such as shares and property are struggling, agriculture may enjoy a period of solid returns. The combination of agriculture with other asset classes can help reduce overall portfolio volatility.

- Global population growth – as populations grow, so too does the demand for feed, fuel and food. Agricultural commodities (soy, sugar, wheat, corn) can be used to feed livestock and humans, as well as being an energy source, covering all these bases.

- Bio-fuel use – with a growing global emphasis on renewable energy, agricultural resources are in demand for the production of bio-fuels.

- Growth of emerging markets – urbanisation and increased wealth in emerging markets are increasing the demand for dairy products and meat, in turn leading to a rise in the demand for livestock feed.

- Supply constraints – there is a shortage of arable land in the world, limiting the ability to increase the yield of crops. Limited supply and an ever-increasing demand provides structural support for the prices of agricultural products.

How can you invest in agriculture?

Investing directly in agricultural commodities is somewhat impractical. Very few people have the space or inclination to store bags of wheat, soybean, corn and sugar!

The BetaShares Agriculture ETF – Currency Hedged (synthetic) (ASX: QAG) offers more convenient access to this sector. It provides exposure to the performance of a basket of agricultural commodities, with a currency hedge against movements in the AUD/USD exchange rate. Exposure is achieved via agricultural commodity futures. The fund, which can be traded on the ASX like shares, provides investors with an opportunity to further diversify their portfolios without having to invest directly into commodities or futures markets.

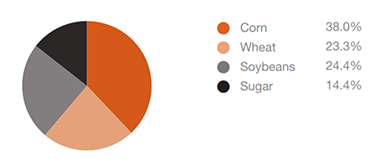

As of 30 April 2019, QAG’s commodities exposure was:

Asset Allocation

The index which QAG aims to track is based on the price of futures contracts. Investing in commodity futures is not the same as investing in the “spot price” of a given commodity. As such, QAG does not aim to, and should not be expected to, provide the same return as the performance of the spot price of the underlying commodities. The performance of ETFs that are linked to commodity futures may be different to the spot price for the commodity itself.