Jump in unemployment opens door for November RBA rate cut

9 minutes reading time

Building wealth through long-term investing is a well-established strategy. However, are you inadvertently hindering your own progress?

Many investors begin confidently, selecting core ETFs and embracing a buy-and-hold approach. However, emotional triggers can arise – a negative news headline, a friend’s panicked advice. These external influences can lead to impulsive decisions like market timing or chasing fads, potentially derailing your long-term goals.

In this article, we’ll examine the data to help you understand why leaving a high-quality portfolio alone to work its magic is a tried-and-tested approach to long term wealth creation.

The “snowball effect” in investing

“Rule No. 1: Never lose money. Rule No. 2: Never forget Rule No. 1.” – Warren Buffett

Legendary investor Warren Buffett dispenses countless pearls of wisdom. But a lesser-known principle from his autobiography reinforces the true secret to building wealth – compounding – in a unique way.

Buffett himself likens it to a snowball effect1. Imagine a snowball rolling downhill, gathering momentum and size with every revolution. Compounding operates in the same way. You earn returns not only on your initial investment, but also on any growth in your initial investment that accumulates over time.

Take for example Coca-Cola, a core portfolio holding that Buffett’s Berkshire Hathaway accumulated a US$1.3 billion stake in from 1988 to 1994. By the end of 2023 those shares were worth nearly US$25 billion2 – a staggering increase fueled by the snowball effect from compounding.

But it wasn’t just growth in the share price – that snowball effect is further amplified by reinvested dividends. In 1994, Berkshire received $75 million in dividends from Coca-Cola. By 2023, that annual payout had ballooned to $736 million.

The rewards of patient investing

The value of staying in the market can take many years to become evident, but successful long-term investors understand that it takes time for compounding to work. Often, a long time.

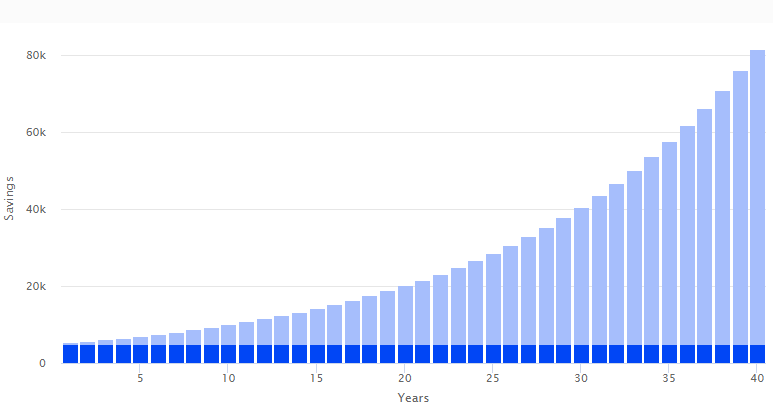

To visualise the tremendous difference early investment and compounding can make to your future wealth, consider the following chart illustrating the hypothetical value of an initial $5,000 investment over 40 years at a 7% return:

Source: Moneysmart.gov.au; assumes a 7% growth rate compounded monthly on a $5,000 initial deposit with no further contributions. For illustrative purposes only.

Notice the shape of the compound returns graph: it takes a while for the benefits of compounding to fully take effect. But once they do, the snowball effect kicks in. Consider the value of the initial investment at different intervals:

| Investment period | Value of investment |

| 5 Years | $7,088 |

| 10 Years | $10,048 |

| 15 Years | $14,245 |

| 20 Years | $20,194 |

| 30 Years | $40,582 |

| 40 Years | $81,557 |

The first 10 years of compounding yielded $5,048. But in the last 10 years of the investment period, it grew to $81,557!

Now let’s take this data and put it into perspective against the age you begin investing. If you invested the $5,000 using the same assumptions at:

- At age 25: You end up with $81,557 by the time you hit 65 (40 years)

- At age 35: You end up with $40,582 by the time you hit 65 (30 years)

Due to the power of compounding, the investor who invested $5,000 at age 25 and simply left it to grow was $40,975 ahead of their counterpart who started a decade later by the time they both turned 65. What a difference that last 10 years made. This speaks to not only the benefits of compounding, but also highlights the importance of starting investing early.

The benefits of reinvesting distributions

As the above example illustrates, an important consideration for building wealth through the power of compounding is reinvesting returns so they are added to the principal.

When you buy and hold an ETF, its unit price has the potential to appreciate over time based on the performance of the underlying index or assets being tracked.

But capital growth isn’t always the whole story when it comes to returns: you may also receive distributions, which can be paid out as cash or reinvested under a Distribution Reinvestment Plan (DRP) if offered by that individual ETF.

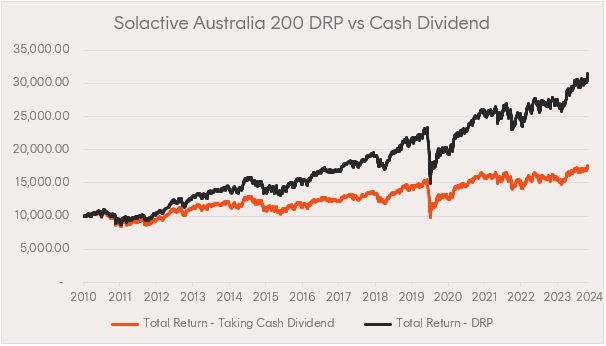

Reinvesting distributions can significantly enhance the compounding effect. The example below demonstrates the difference in returns an investor would have achieved by purchasing units in the A200 Australia 200 ETF comparing the outcomes of receiving cash distributions versus participating in the Distribution Reinvestment Plan (DRP).

Source: Bloomberg. Hypothetical example provided for illustrative purposes only. Past performance is not indicative of future performance of any index or ETF. Not a recommendation to make any investment or adopt any investment strategy. Inception date of A200 is 7 May 2018. Graph shows the performance of the Solactive Australia 200 Index, adjusted for A200’s management fees and costs. You cannot invest directly in an index.

The lesson? To make the most out of compounding, consider a strategy that includes reinvesting distributions if appropriate for your circumstances.

How investors can hurt their own progress

While the power of compounding is undeniable, even experienced investors can unknowingly disrupt its magic. The allure of market timing or the urge to tinker with a well-defined strategy can be particularly tempting during periods of volatility.

The reality of investing is that nobody knows for sure which way the market is headed tomorrow, and attempting to predict highs and lows can dramatically hinder the growth of your portfolio long-term.

| S&P/ASX 200 | S&P/ASX 200 (minus top 5 days) | S&P/ASX 200 (minus top 20 days) | |

| 1 Year (%) | 12.21% | 12.21% | 12.21% |

| 3 Years (%, p.a.) | 5.96% | 1.66% | -4.28% |

| 5 Years (%, p.a.) | 8.51% | 5.84% | 2.09% |

| 10 Years (%, p.a.) | 8.79% | 7.44% | 5.52% |

| 20 Years (%, p.a.) | 9.31% | 8.04% | 4.52% |

| 30 Years (%, p.a.) | 9.80% | 8.73% | 6.36% |

Source: Bloomberg, Betashares. As at 30 June 2024. Past performance is not an indicator of future performance. Top five and top 20 days since over the last 30 years have been removed from the respective data sets. None of these days occurred in the past year so one year returns are unaffected.

Since major rallies tend to occur precisely during or shortly after market crashes, pulling out your investment in a bid to stop the bleeding can work against you. Consider this table illustrating the value of an ASX 200 portfolio that is left to grow, compared to one missing the top five market rally days and another missing the top 20 days:

Over a 1 year or 3 year timeline, there’s no discernible impact. But on a longer investment time horizon, missing those days can sometimes halve the value of your investment. In the absence of a crystal ball—which nobody has—it’s best to stay the course with the routine rebalancing exercise to keep your portfolio’s asset allocation and risk profile in check.

ETFs: A powerful compounding tool

ETFs are powerful vehicles for harnessing the power of compounding without the need to research individual stocks.

For example, buying just one share of the NDQ Nasdaq 100 ETF provides exposure to the top 100 US non-financial companies including Apple, Microsoft and NVIDIA, and as different companies enter or fall out of the index, the fund is adjusted to reflect the changes.

This diversification reduces the risk and volatility associated with individual shares and can lead to more stable, long-term growth—and greater peace of mind.

Another significant advantage of building ETFs into your long-term strategy is their typically lower fees compared to other investment options like actively managed funds. Since individual trading fees may not seem particularly large, it’s easy to overlook their long-term impact over an investing lifetime. Lower fees mean more of your money remains invested over time—and we’ve seen how powerful compounding is when money stays invested.

Many ETFs including A200 and NDQ offer a DRP, making it easier to reinvest earnings automatically.

Compounding matters more as life expectancies rise

In our example above, we compared a $5,000 investment made at 25 and 35, illustrating the major gains to be realised by starting early. But what if you’re beyond those ages, and you’re worried you haven’t invested enough to meet your financial goals?

As beneficial as an early start is, the next best time to invest more and refine your strategy to maximise the effect of compounding is today.

Australians are living longer, with the average age at death today being around 80 for men and 85 for women3. Young and working-age people today will likely live—and work—even longer. This means that even mid-career people may have decades of work ahead of them before drawing on their investments, giving them plenty of time to mature.

In addition to starting as early as you can, making a habit of investing consistently is another great way to make the most of compounding. The easiest way to do this is to automate it, requiring no extra action from you.

Not everyone has the cash resources to invest $10,000 at the start of every year, but a fortnightly automatic $385 investment into ETFs via a zero-brokerage* platform like Betashares Direct has the same effect while being more manageable for budgeting.

Finally, choosing investments with favourable compounding characteristics can further enhance your returns. Look for investment vehicles with low fees, solid growth potential and a DRP option.

* Refer to the PDS for information on interest retained by Betashares on cash balances.

Sticking to the plan

This big “secret” to investing success isn’t a secret at all, and you don’t have to be a finance expert to benefit from it: over the long term, staying invested enables you to benefit from the power of compounding and amplify your wealth.

While average annual results may usually be positive, periods of intense volatility are an unavoidable reality of share markets. Sticking to your plan and avoiding emotional decisions is essential to avoid buying and selling at the wrong time.

Finally, utilising investment vehicles like ETFs, which offer low costs and an automatic distribution reinvestment mechanism, can be an effective strategy for setting yourself up for success.

The bottom line? Your future self will thank you if you invest soundly and simply stick to the plan.

Disclaimer

Investing involves risk. The value of an investment and income distributions can go down as well as up. An investment in a Betashares Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of each Betashares Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

Sources:

1. Why Warren Buffett loves compound interest ↑

2. Warren Buffett is now earning a nearly 60% yield on Coca-Cola ↑

2 comments on this

Good to know. Exactly why I’m encouraging my children to start investing in their 20s and let compounding do its magic.

Great advice!