Liberation Day

5 minutes reading time

Global markets

Global equities ended the week stronger despite a higher-than-expected US inflation report and also thanks to a delay in planned US tariffs and hopes around proposed Russia-Ukraine peace talks.

The underlying resilience of global equities was on display last week as markets shrugged off a higher-than-expected US inflation report.

The US core consumer price index (CPI) rose 0.4% in January – a touch more than the 0.3% expected. This pushed up annual core inflation to 3.3% from 3.1%.

That said, there’s a suspicion the result could have been affected by seasonal distortion. In recent years, more businesses seem to push through their annual price increases in January than the seasonal adjustment process allows for.

Moreover, some of the strength in hotel and car prices could be related to shortages caused by the LA fires. The LA fires are also thought responsible for the weakness in January retail sales reported on Friday.

As regards inflation, certain items in both the CPI and producer price (PPI) reports last week (such as health care, insurance and airline rates) also suggested a fairly benign result for the Fed’s preferred inflation measure, the private consumption expenditure deflator or PCED, when it is released later this month. If the core PCED rose by only 0.3% in January, it would pull down the annual rate from 2.8% to 2.6%, which would be the first decline in several months.

President Trump’s market impact last week was mixed. His announcement of 25% across the board tariff increases on steel and aluminium imports was met with market alarm, though we are still waiting to see the extent of any exemptions (including Australia!). But his announcement that reciprocal tariffs would be delayed until April – following a careful study of trade restrictions imposed by other countries – was met with some market relief. More positive were reports that the US and Russia were planning to discuss a peace deal – though hopefully with Ukraine also!

Last but not least, during Congressional testimony Fed chair Powell reiterated the Fed was in no hurry to cut interest rates again – although still saw the next likely move as down not up.

Global week ahead

There’s little of major note this week, with a smattering of US activity data, minutes for the recent FOMC meeting, and a bunch of Fed speakers. Given we know the US economy is firm and the Fed is biding its time, these events are unlikely to be significant market movers – what matters at present is the inflation outlook and Trump.

Outside of the US, the Reserve Bank of New Zealand is widely expected to cut rates a further 0.5% on Wednesday to 3.75%, due to falling inflation and its weak economy.

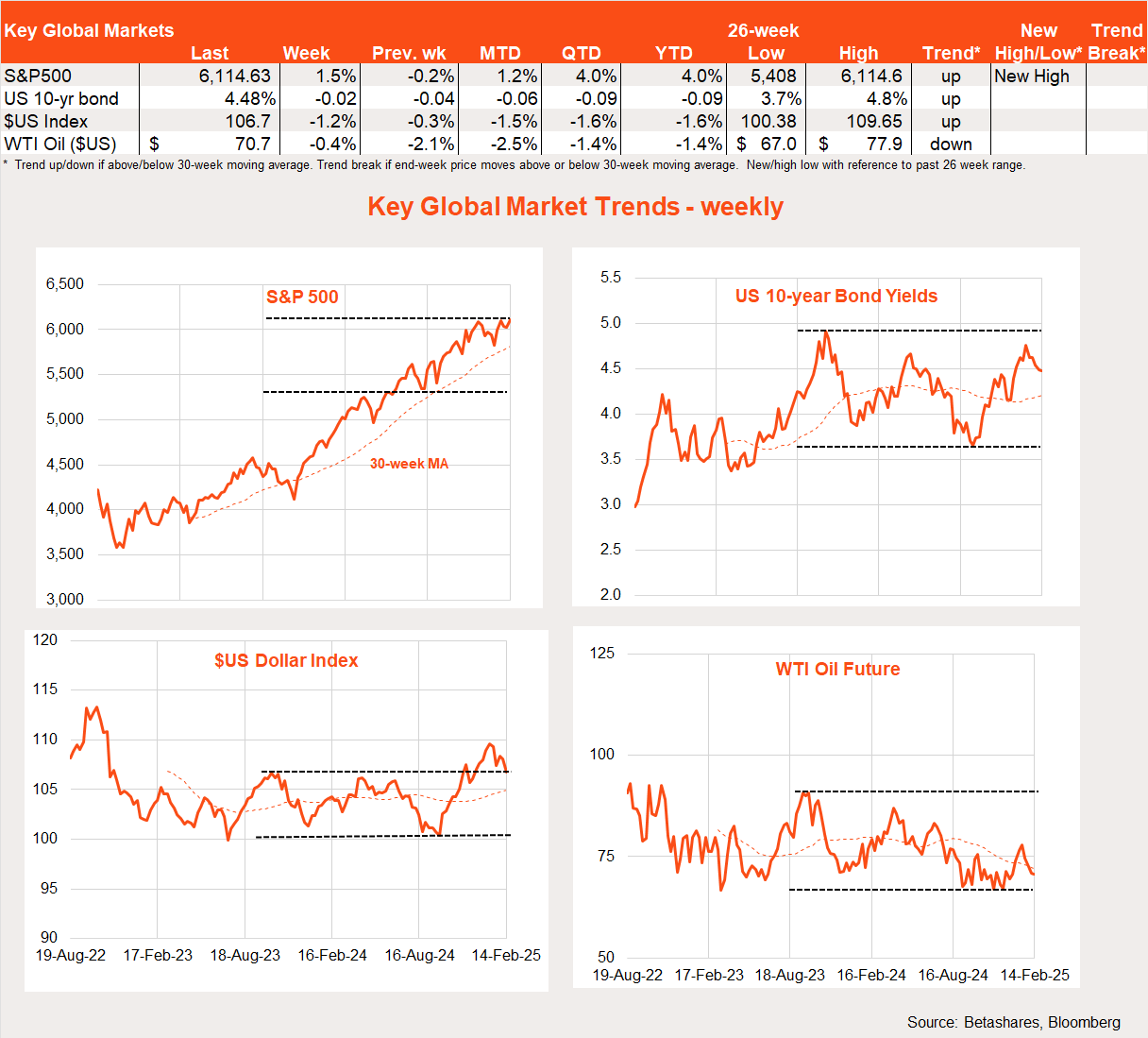

Global market trends

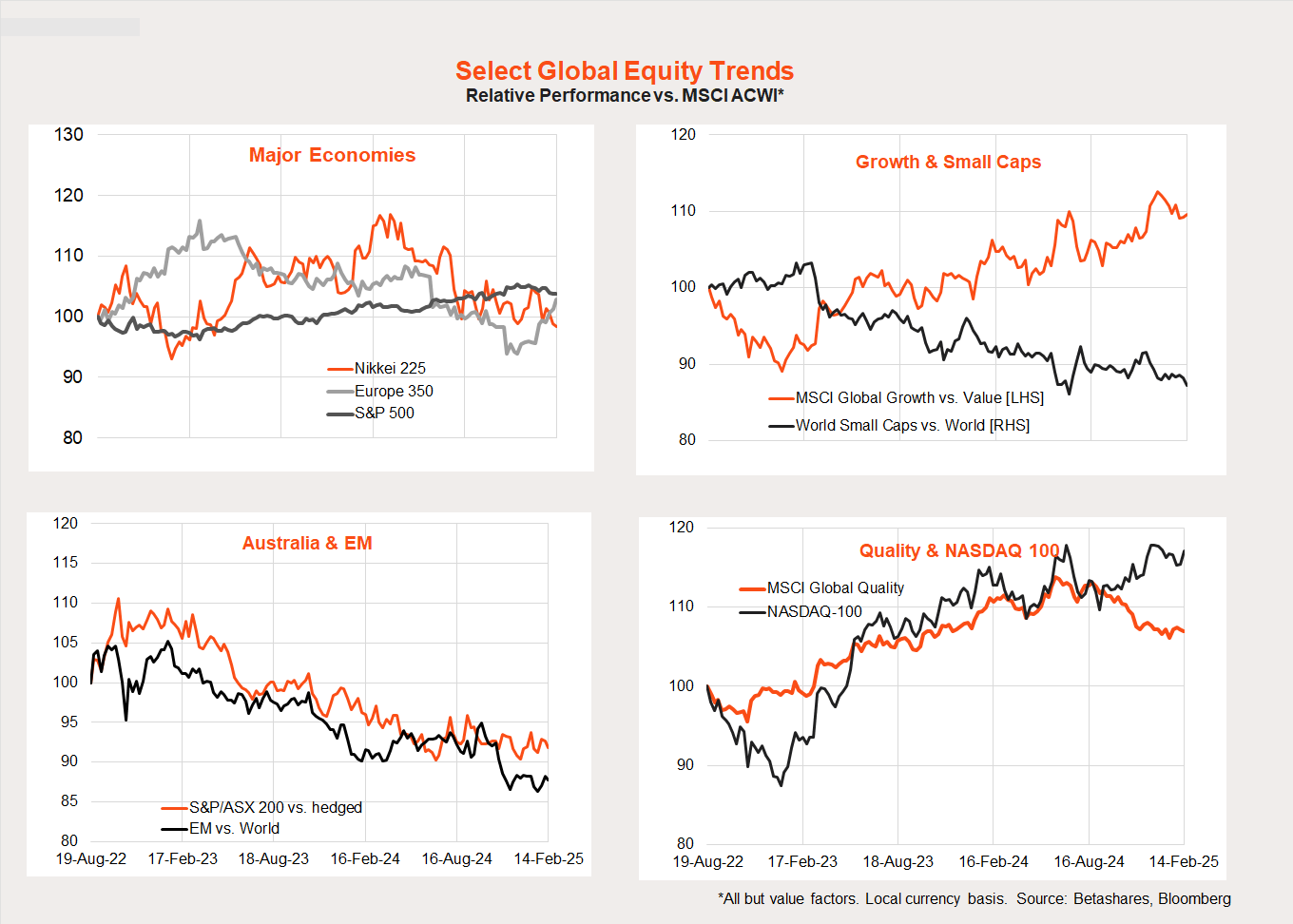

European stocks had another good week, continuing their trend of outperformance so far this year. That said, the NASDAQ 100 was also up a solid 2.9%.

In terms of global trends, so far this year we’ve seen a pullback in the relative performance of the NASDAQ 100 and global growth over value, replaced by a lift in Europe’s relative performance. There are tentative signs that the underperformance of global quality assets through last year appears to be bottoming out.

Australian market

Local stocks pushed higher last week, helped by firmer global markets and mounting excitement around a likely RBA rate cut this week.

Last week, local economic data confirmed the economy remained sluggish and in likely need of a rate cut to spark animal spirits. Despite talk of rate cuts, both the Westpac measure of consumer confidence and the NAB measure of business conditions remained fairly subdued.

Turning to the week ahead, the major highlight will be the RBA’s rates decision tomorrow afternoon. To my mind, the case for a rate cut this month has been clear ever since release of the Q4 CPI report. Underlying inflation has come down quicker than the RBA expected and the economy deserves to be rewarded for its good behaviour with a rate cut ASAP.

To not cut rates this week would effectively renege on a promise to deliver interest rate relief once there was sufficient progress on lowering inflation. It would break the hearts of millions of Australians and undermine the RBA’s still-tarnished public reputation. In fact, I’d like to see the RBA cut rates by 0.35% to 4.0%, so we can finally get the cash rate cut back to cleaner 0.25% level increments. The RBA could follow up this generous rate cut by playing down the prospect of another cut anytime soon (i.e. deliver a ‘hawkish cut’).

Supporting the case for a rate cut should be another fairly benign wage price index report on Wednesday, with annual growth expected to slow to 3.2% from 3.5%. That would further suggest unemployment need not rise to 4.5% to keep inflation contained as the RBA has long suggested – but rather could stay as low as the current 4% rate. We’ll also get another, likely firm, January employment report on Thursday underpinned by solid population growth. However, the unemployment rate is expected to tick up to 4.1%.

Have a great week!

1 comment on this

Great stuff as always, thanks David.