Is your portfolio really diversified?

6 minutes reading time

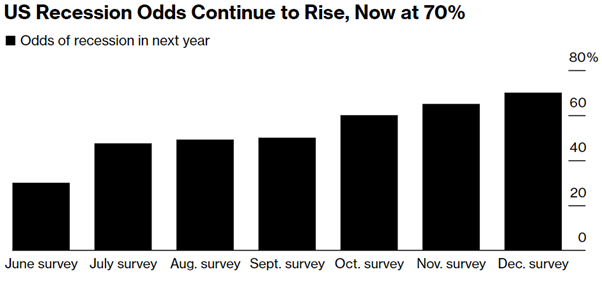

After a year that most investors would probably rather forget in 2022, conditions appear challenging again as we enter 2023. Inflation remains high throughout most of the developed world, central banks continue to turn the screws on interest rates, and the spectre of a US-led global recession looms large over markets. A survey of economists by Bloomberg is now suggesting a 70% chance of a recession in 20231.

Source: Bloomberg.

While Betashares Chief Economist, David Bassanese, puts the chance lower than this at 50%, risks appear skewed to the downside.

In conditions like these, a focus on defence, patience, and quality can pay off for investors.

With this in mind, here are six ETF investment ideas to consider in 2023.

Defence

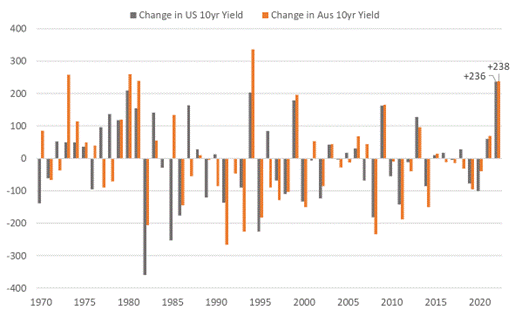

When it comes to playing defence in a diversified portfolio, government bonds have traditionally played a key role. Long term government bonds suffered last year as interest rates and yields increased to fight inflation.

Calendar year movements in benchmark 10-year yields (in basis points)

Source: Bloomberg, Betashares.

As at the time of writing though, market pricing suggests that most of the global monetary tightening is behind us. Inflation is also priced in to fall sharply over the next 12 months. If markets are correct about this, and the much-touted US recession does occur, this could create favourable conditions for a rally in bonds.

High-quality, long term government bonds are well placed for this scenario. Long term government bonds (i.e. those with a long modified duration) are highly sensitive to changes in interest rates, meaning that even small changes in rates can create relatively large moves in the price of the bonds.

1. Betashares U.S. Treasury Bond 20+ Year ETF – Currency Hedged (ASX code: GGOV) offers the longest duration exposure of any Betashares fixed income product. It invests in high quality, long-dated US Treasury bonds. The addition of currency hedging also means that investors are generally not exposed to fluctuations in the AUD/USD exchange rate. As at 31 January 2023, GGOV’s yield to maturity is 3.6 %

2. Betashares Australian Government Bond ETF (ASX code: AGVT) offers exposure to a portfolio of high-quality bonds issued predominantly by Australian state and federal governments. While the duration is not as long, the credit quality and potential for attractive yield make it a useful defensive exposure for those with a preference for investing locally. As at 31 January 2023 AGVT’s yield to maturity is 3.94%

Patience

For those who are uncertain about the future direction of interest rates, there is another option – get ‘paid to wait’.

3. Betashares Australian High Interest Cash ETF (ASX code: AAA) invests only in deposit accounts held with selected banks in Australia.

While many banks advertise attractive rates on deposit accounts or term deposits, these often come with attached conditions that could include not making withdrawals, depositing a minimum amount each month, or reversion to a lower rate after a limited time. AAA is simple and convenient, can be bought and sold like any share on the ASX, with the variable interest rate on the fund’s deposit accounts (currently 3.2%p.a. ) being available to all unitholders.

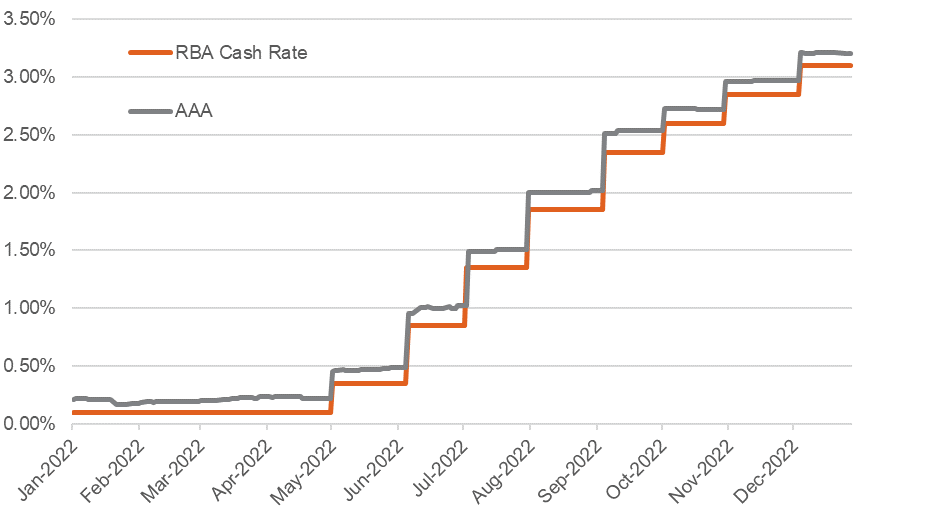

AAA has historically also reflected increases in the RBA cash rate quickly, as is shown in the chart below. And with monthly distributions, investors won’t have to wait long to get their hands on that income.

Interest rate for AAA compared to RBA cash rate during 2022 rate increases

Source: Betashares, RBA. AAA interest rate has been annualised and adjusted for fund fees and expenses.

Quality

While the case for investing in equities during a possible US-led global recession may not be immediately obvious, for those with a long-term investment timeframe, periods of heightened volatility can offer opportunities to buy assets at a discount. However, it’s important to have confidence that the underlying businesses have the resilience to survive any economic hardship unscathed.

As such, many investors look for companies that offer relatively resilient earnings tied to non-discretionary revenues.

4. Betashares Global Healthcare ETF – Currency Hedged (ASX code: DRUG) offers exposure to the largest global healthcare companies, hedged into Australian dollars. The largest global healthcare companies are mostly pharmaceutical companies. These are often considered “defensive” by nature of having inelastic demand for their products and can typically pass on rising costs on to consumers. Eight of the top 10 holdings in DRUG are major pharmaceuticals companies.

Despite the defensive nature of their earnings, healthcare companies also offer the potential for growth. Data from the OECD shows healthcare expenditure growth of 5% and 6% in 2020 and 2021 respectively, across the 20 OECD countries.

For investors who want to maintain some exposure to equities, but are still looking for companies better poised to survive any health scares the economy may face, DRUG might be just what the doctor ordered. Of course, any sector-specific investment exposure should form part of a broader, diversified portfolio. Since its inception in August 2016 to 31 December 2022, DRUG has returned 8.98% p.a.

For more direct exposure to quality, Betashares offers two ETFs that provide exposure to a range of high-quality companies across various industries. The indices that these ETFs aim to track select companies based on ‘quality’ metrics such as high return on equity, low leverage, and earnings stability.

5. Betashares Australian Quality ETF (ASX code: AQLT) aims to track an index (before fees and expenses) that comprises 40 high-quality Australian companies. AQLT launched recently, in April 2022, and has returned -6.71% since its inception.

6. Betashares Global Quality Leaders ETF (ASX code: QLTY) aims to track an index (before fees and expenses) that comprises 150 global companies (ex-Australia) ranked by highest quality score. Since its inception in November 2018 to 31 December 2022, QLTY has returned 10.06% p.a.

A time for careful investing

2023 will no doubt throw up many fresh challenges for investors. Some, such as a potential US-led global recession, are already obvious and firmly in the sights of investors. Others could catch investors off guard, remaining obscured until the very last moment. For those positioned appropriately though, the impact might not be quite so severe.

Investing involves risk. The value of an investment and income distributions can go down as well as up. Before making an investment decision you should consider the relevant PDS and Target Market Determination (available at www.betashares.com.au) and your particular circumstances, including your tolerance for risk, and obtain financial advice.

Risks include: interest rate and credit risk with bond and cash investments, and market risk with share investments.

References:

1. https://www.bloomberg.com/news/articles/2022-12-20/economists-place-70-chance-for-us-recession-in-2023

2. 25 January 2023

3. Yield to maturity of 3.85%p.a. as at 25 January 2023. Yield will vary and may be lower at time of investment.

4. As at 30 January 2023. Average interest rate on the fund’s deposit accounts is variable and may be lower at time of investment.

5. https://www.oecd.org/health/health-data.htm