Cause to pause

5 minutes reading time

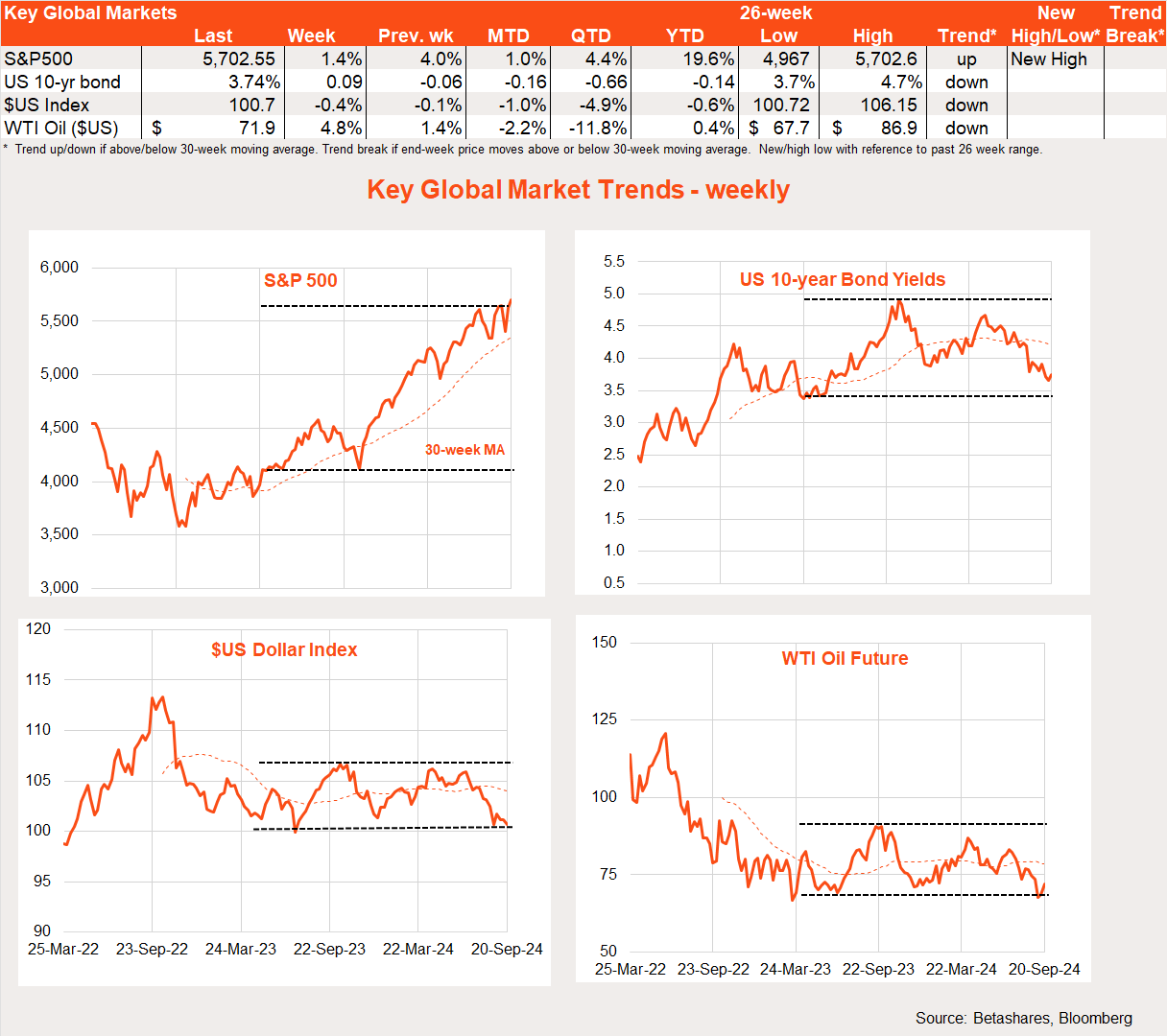

Global markets

Global equities rose further last week following a well-anticipated 0.5% rate cut by the US Federal Reserve. Reassuring US labour market data added to the optimism.

What was once considered an unlikely prospect – unless US recession risks were intensifying – the 0.5% Fed rate cut came to be largely expected by the market by the time of the announcement, as evident from post-event profit taking in both bond and equity markets.

What was impressive is that the Fed managed to cut rates by more than the usual 0.25% move without (as I feared) scaring the horses. The Fed effectively indicated it was so confident about the inflation outlook that it could take out added insurance against an undesired growth downturn. It was an ‘insurance’ cut rather than an emergency ‘fire hose’ to douse the the expanding flames of recession.

In terms of forecasts, the Fed nudged up and down its unemployment and inflation expectations respectively, though the outlook remains consistent with a soft landing. It expects the unemployment rate to lift from 4.2% to 4.4% by year-end (compared to a June expectation of 4.0%) and hold at that level till end-25. Core inflation is expected to hold steady at 2.6% by year-end (June expectation 2.8%), though ease further to 2.2% by end-25.

The Fed’s ‘dot plot’ suggests another 0.5% lowering in rates this year, 1% in 2025, and a further 0.5% in 2026.

Indeed, last week’s economic data provided further reassurance that recession risks remain contained. August retail spending remained firm, and weekly jobless claims held at impressively low levels. With still firm growth and low/falling inflation, this is as close to a goldilocks or ‘sweet spot’ US economic environment as you’re likely to see. This bodes well for many investment markets, including fixed-rate bonds, equities and gold.

In other key global news, the Bank of England left rates on hold – having cut rates only the previous month. This is consistent with the current ECB approach of re-normalising rates in a measured way, such as only moving every other meeting.

Although NZ Q2 GDP was a bit better than feared (declining by 0.2% rather than 0.4% as the market expected) – it was still weak enough to keep the RBNZ on a more aggressive rate cut path, with expected 0.25% rate cuts in both October and November.

Global week ahead

Markets may well consolidate a little in coming weeks given all the good news that has now been priced in. That said, two key highlights this week include Q2 US GDP on Thursday (US time) and the private consumption expenditure deflator (PCED) inflation measure on Friday. GDP is expected to be firm, with annualised growth of 3%, while core PCE inflation is expected to be flat in the month, though due to base effects would nudge up the annual rate from 2.6% to 2.7%. All this, should it pan out this way, would be non-threatening to markets.

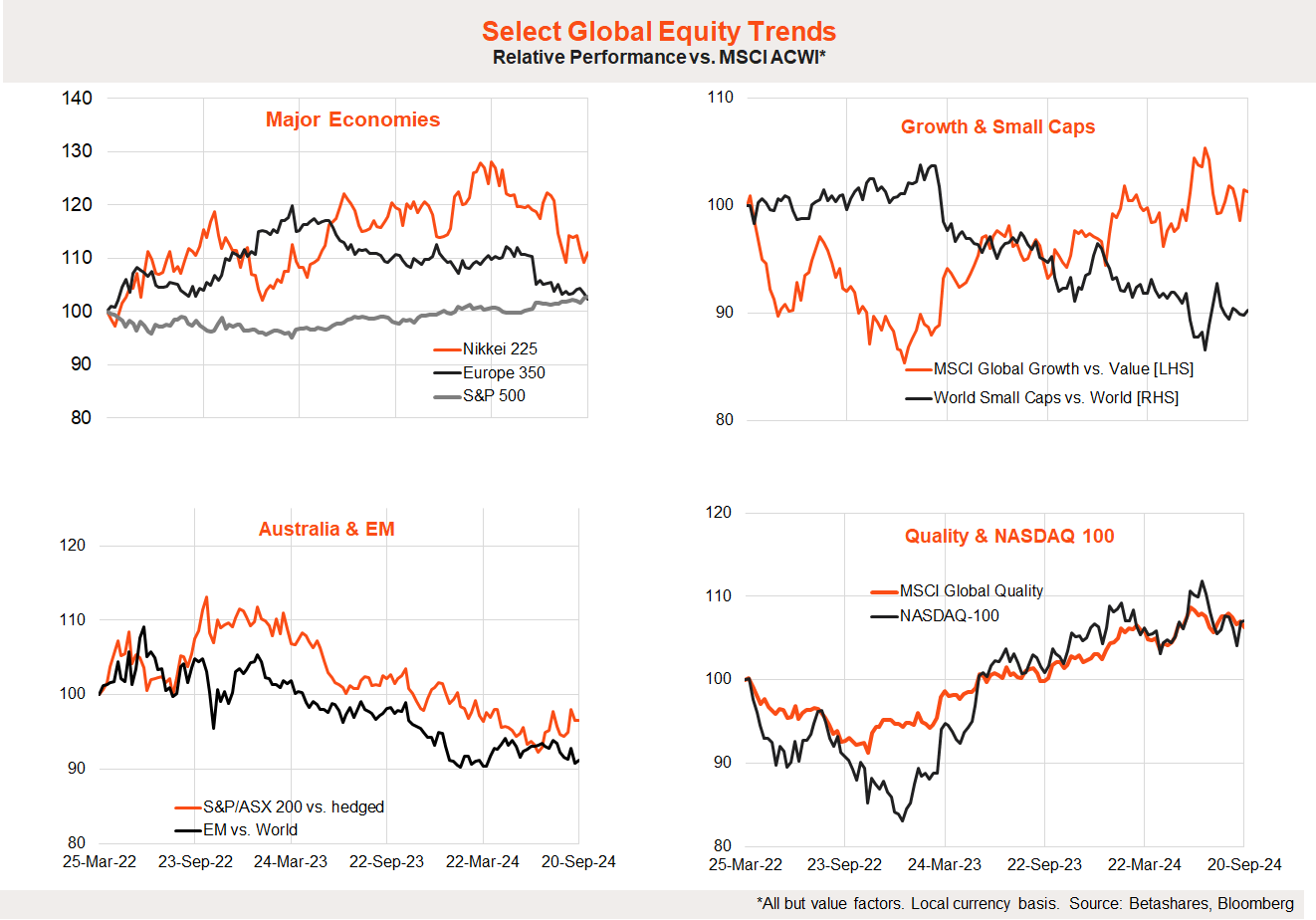

Market trends

In terms of equity trends, one interesting development of late is signs of Australian outperformance since early July, powered by the financial sector. Japan’s market also bounced nicely last week.

Otherwise, the tug of war between between growth/technology/US/large caps and cheaper alternative areas remains in a state of flux.

Can cheaper value stocks outperform as equity markets continue to trend up? I suspect they can, but the evidence to date remains patchy.

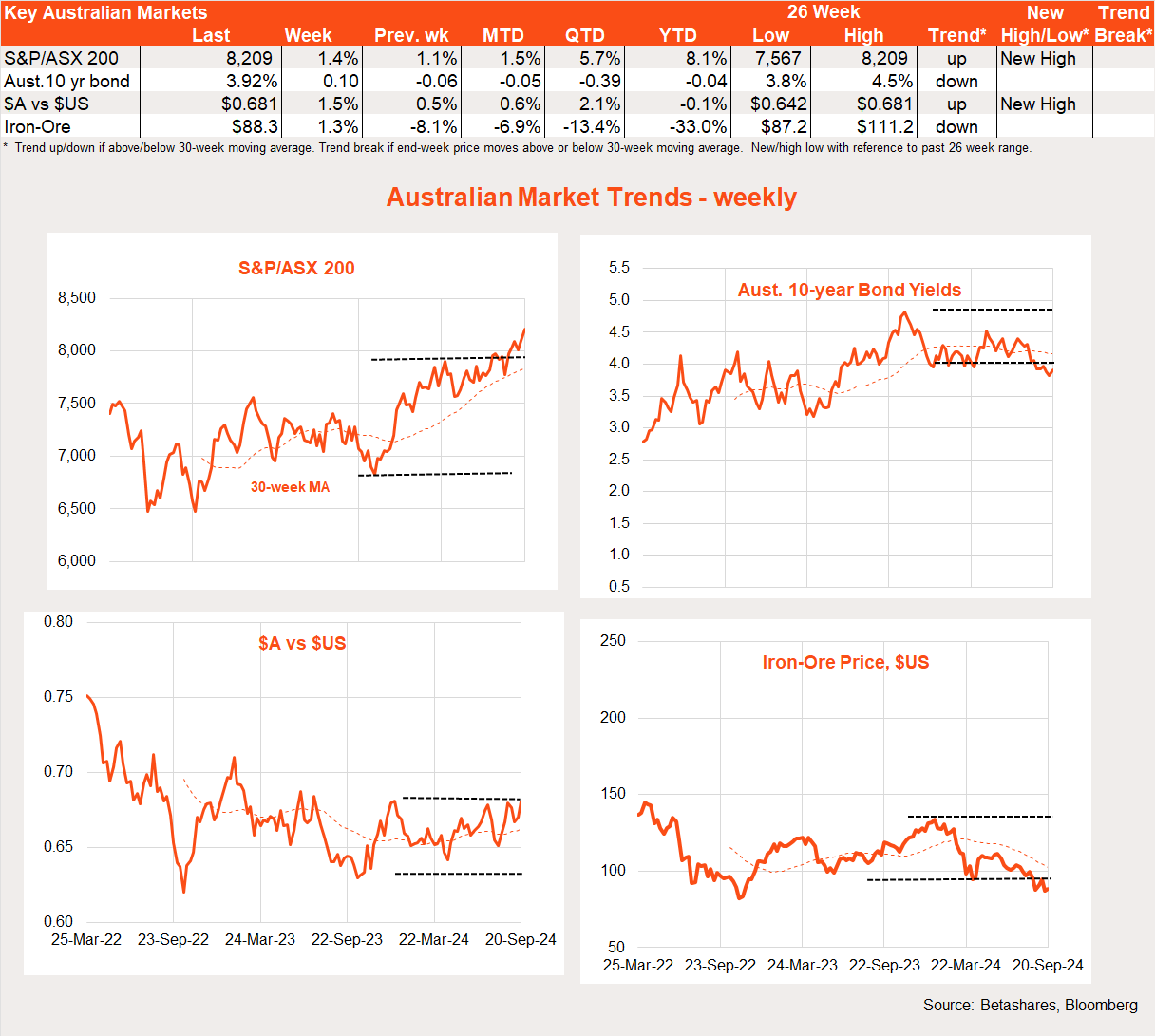

Australian market

The local S&P/ASX 200 index rose further last week, and now seems well though the 8,000 barrier and into record high territory. Bond yields are also breaking lower and the $A higher, even though the latter is not being helped by weakening iron-ore prices.

The local highlight last week was another solid labour market report, with 47k gain in employment during August and a steady unemployment rate of 4.2%. The economy retains an admirable ability to find jobs for our still strongly rising labour supply – thanks in part to the booming ‘care’ economy.

Against this background, I don’t expect much new from the RBA policy meeting on Tuesday – rates will remain firmly on hold amid concerns that inflation remains too high.

The RBA will likely look though the sharp decline in annual headline monthly CPI inflation in the August report on Wednesday – due to the impact of higher energy cost rebates. Instead, focus will be on underlying measures of inflation – such as the trimmed mean – which is likely to hopefully show a further modest easing in annual inflation from the current rate of 3.8%.

Have a great week!