Fed meeting recap: hawkish quarter point rate cut

7 minutes reading time

Australians are known for their love of travel and passion for discovering hidden gems and iconic landmarks around the world.

Just as discovering new places can provide different perspectives, investing in different countries can offer exposure to themes, industries and companies that may not be available on the local sharemarket. However, many investors in Australia tend to have a ‘home bias’, preferring domestic assets over foreign ones.

According to the ASX Australian Investor Study1, only 15% of investors held international shares directly, while 58% held direct Australian shares. Despite Australia’s strong long-term equity returns and attractive tax incentives (franking credits), investors may be limiting their potential for growth and diversification.

In this article, we will explore four ETFs that can help Australian investors reduce their home bias and diversify their portfolios.

Travel is a joy for many Australians, but a strong US dollar can dampen the experience from a financial perspective.

One solution, for investors who have a view that the US dollar will strengthen against the Australian dollar, is to consider an investment in the

USD

U.S. Dollar ETF

. USD also has the potential to generate attractive income from its US dollar bank deposits (currently 4.13% p.a. 2), for investors comfortable with foreign exchange fluctuations.

Why the US dollar, why now?

The US Federal Reserve is taking an aggressive stance on inflation and may be willing to risk a recession to tame it. During times of economic uncertainty, investors traditionally view the US dollar as a ‘safe haven’ currency.

Currently, US interest rates exceed those on offer in Australia3, offering investors a yield premium and the opportunity for capital appreciation if the US dollar continues to strengthen against the Australian dollar.

The US is famous for landmarks such as the Statue of Liberty, Golden Gate Bridge, Grand Canyon, and Mount Rushmore, but it’s American technological innovations that continue to revolutionise our everyday lives.

The NDQ Nasdaq 100 ETF includes companies such as Apple, Amazon, Facebook, Google, and Tesla, which have helped drive the modern economy through innovative products, services, and business models. The US tech industry benefits from a strong ecosystem of research and development, a vibrant entrepreneurial culture, and relatively easy access to capital.

Why US technology, why now?

Despite concerns about higher interest rates affecting the sector, technology adoption remains a long-term growth theme with continued potential. The pandemic has accelerated the adoption of remote work and digital solutions, leading to an increased demand for productivity tools, cloud computing, automation and AI.

By providing exposure to sectors underrepresented in the Australian sharemarket, such as technology, NDQ offers Australian investors the opportunity to diversify their portfolios beyond financials and mining.

3. HEUR Europe Currency Hedged ETF

When Australians dream of traveling to Europe, they often picture strolling along the charming cobblestone streets of Paris, taking in the breathtaking views from the Eiffel Tower, enjoying the lively atmosphere of Oktoberfest in Munich, and admiring the ancient architecture of Rome.

But Europe is not just a destination for wanderlust; it also offers exciting investment opportunities. The region is home to some of the world’s most iconic brands and exporters, such as Moet Hennessy Louis Vuitton, L’Oréal, Allianz, Airbus, BMW, Adidas, and Heineken, all companies which are in the portfolio of HEUR Europe Currency Hedged ETF 4.

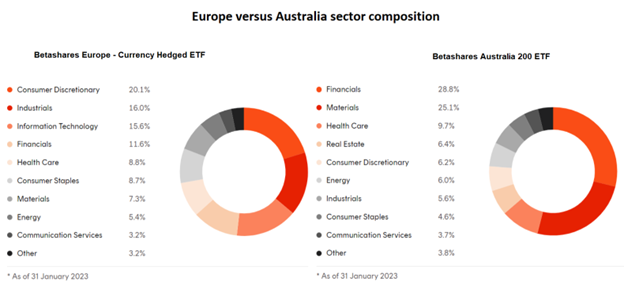

Investing in HEUR can provide a valuable complement to an Australian-centric portfolio, as it offers exposure to consumer discretionary, industrial, and IT stocks that are underrepresented in the local share market (see below).

Source:Betashares

Additionally, the companies covered by the index HEUR aims to track are export-focused, which means they generate revenue from a diverse range of sources, including the US and China. By investing in HEUR, Australian investors can broaden their investment horizons and potentially benefit from the growth and performance of some of Europe’s most successful and internationally recognised companies.

Why Europe, why now?

Europe’s current price/earnings ratio (P/E)5 of 13.3 may present an attractive opportunity compared to the valuations of 14.4x for Australia3 and 18.1x for the US3 Additionally, the region’s exporters could potentially benefit from various factors such as the Chinese re-opening, a mild European winter, a possible pause in US rate rises, and a weaker US dollar, which is usually associated with an improvement in global growth.

4. ASIA Asia Technology Tigers ETF

Asia’s allure as a travel destination is undeniable, from the hot springs of Taiwan to the Great Wall of China and the bustling cities of South Korea. However, the region is more than just a source of adventure and cultural experiences. Asia is also home to a booming technology sector, driven by its young and tech-savvy population, which presents a massive investment opportunity.

The Southeast Asian e-commerce market alone is projected to triple by 2026, reaching about US$340 billion in sales, with a compound growth rate of 22% 6. The Chinese e-commerce market, which is more developed, is expected to hit nearly US$5 trillion in sales by 2025, growing annually by 11.6%7. (Actual outcomes may differ materially from forecasts.)

Investors looking to capitalise on this potential growth can consider an investment in the ASIA Asia Technology Tigers ETF , which provides access to a diversified portfolio of Asia’s largest tech companies (excluding Japan), including Alibaba, Tencent, and Baidu8. The ETF offers exposure to a broad range of sectors, such as e-commerce, online gaming, semiconductors, and digital payments, which are not widely represented in the Australian market.

Why Asian technology, why now?

Despite challenges from China’s strict Covid lockdowns and tech crackdowns, there are indications of positive sentiment. For example, Didi’s ride-sharing restrictions have been lifted9, and up to 900 video games may be approved in 2023,10 potentially benefiting gaming giants including Tencent and NetEase.

Furthermore, ASIA is currently trading at pre-Covid levels with a P/E ratio almost half of what it was before, making it appealing to investors who recognise the sector’s long-term growth prospects (see chart below) while keeping in mind the associated risks.

ASIA P/E and unit price on select dates over 31/12/2019 to 28/02/2023

There are risks associated with an investment in the Funds, including market risk, sector risk, country risk, risk and currency risk. In the case ASIA there is also concentration risk and emerging market risk. In the case of USD there is also interest rate risk. Investment value can go up and down. An investment in the Funds should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. ASIA’s returns can be expected to be more volatile (ie vary up and down) than a broad shares exposure, given its more concentrated exposure. For more information on risks and other features of the Funds, please see the Product Disclosure Statement and Target Market Determination for the relevant Funds, both available on this website.

References:

1. Source: ASX Australian Investor Study 2020 (Page 49)

2. As at 16 March 2023.

3. As at 16 March 2023.

4. As the date of this article. No assurance is given that these companies will remain in HEUR’s portfolio or will be profitable investments.

5. Source: Bloomberg, Betashares. As at 28 February 2023. Europe represented by S&P Eurozone Exporters (Hedged AUD) Index. Australia represented by Solactive Australia 200 Index. US represented by S&P 500 Index. You cannot invest directly in an index. Historical data is not indicative of future outcomes.

6. Source: E-commerce is entering a new phase in Southeast Asia. Are logistics players prepared?

7. Source: Chinese e-commerce market to reach US$3.3 trillion in 2025, says GlobalData

8. As at the date of this article. No assurance is given that these companies will remain in ASIA’s portfolio or will be profitable investments.

9. Source: China lifts 18-month ban on new Didi users as tech crackdown wanes

10. Source: China’s video game makers come in from the cold as crackdown eases