9 minutes reading time

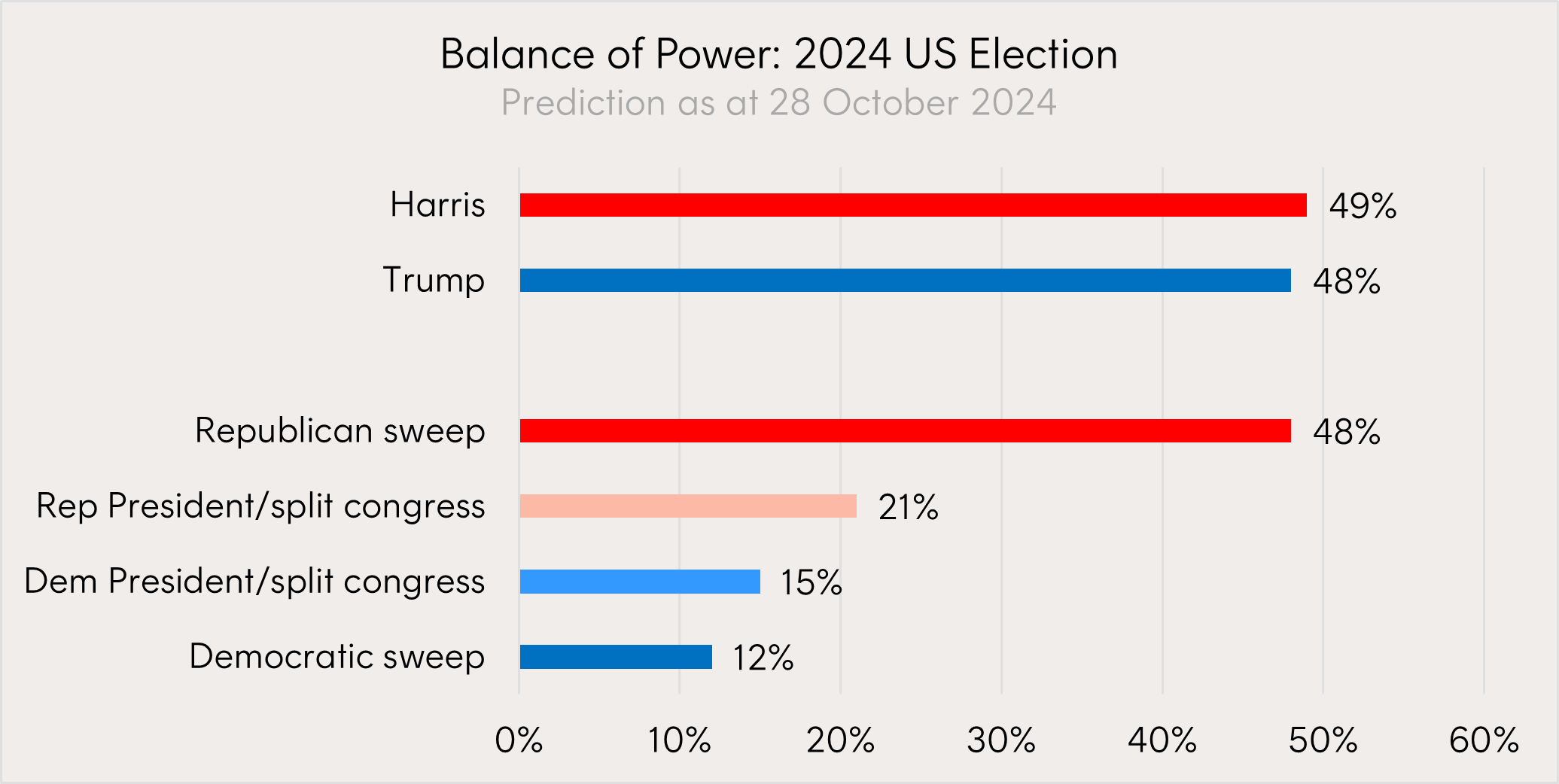

The 2024 US Presidential election between Vice President Kamala Harris and former President Donald Trump remains a tight race between two candidates with vastly different worldviews. As we head into the final stretch of the election season, betting markets have started to lean toward a Trump victory, though margins remain narrow.

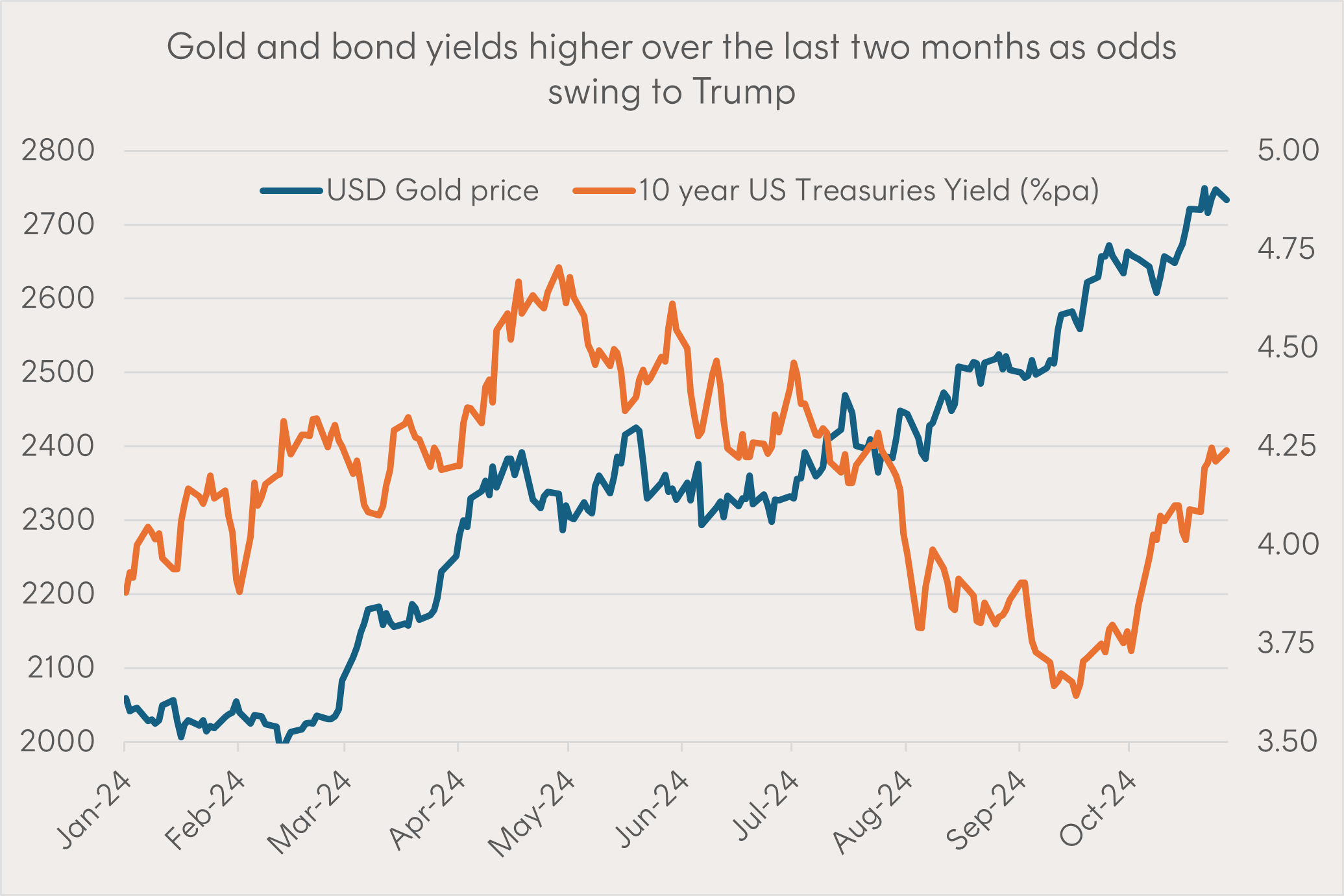

In recent weeks, bond yields and the gold price have both surged, in a sign that markets are pricing in a greater likelihood of inflation and larger US budget deficits with the Trump policy platform.

Source: Bloomberg, as at 25 October 2024. Past performance is not indicative of future performance.

This article will explore how each candidate’s policies could impact the global economy and markets, which depends not just on who wins the Presidency but whether their party is able to gain control of Congress.

The key policies that matter

Taxes and Spending

Harris

- Raise corporate tax rate from 21% to 28%

- Increase taxes on buybacks and companies’ foreign income

- Extend 2017 personal tax cuts for households earning under $400,000

- New taxes for billionaires and very high income earners

- Fiscal assistance for small businesses, housing, healthcare and parents

- Maintain US aid to Ukraine.

Trump

- Cut corporate tax rate from 21% to 15%

- Increase taxes on buybacks and companies’ foreign income

- Extend 2017 personal tax cuts for all

- Eliminate US tax on Americans living abroad

- Tax deductions on auto loans

- Repeal green tax incentives in Inflation Reduction Act (IRA)

- End US aid to Ukraine.

Both platforms are likely to result in an increase in the US budget deficit, with the Committee for a Responsible Federal Budget estimating the cost of Harris’ plan to be $3.5 trillion over 2026-2035, and Trump’s more than double that at $7.5 trillion. The great fear is that investors call into question the US’s ability to service that debt, blowing out Treasury yields. This fear has been spoken about many times in the past and has yet to materialise, despite US public debt being on track to hit 100% of GDP this year.

The ability of either candidate to implement their tax and fiscal policy is dependent on the balance of power in Congress. A Republican “sweep” (where they win the presidency, the house and senate) would make extending the 2017 tax cuts a near certainty. In any case, extending some of these cuts for middle-class households has bipartisan support.

Trump’s corporate tax cuts are expected to provide a short-term sugar hit to equity markets, much like we saw during his first presidency. However, a split President/Congress would make the corporate tax rate changes and tax credits/deductions proposed by either potential leader very difficult to implement in full.

Without a sweep for either party, the impacts on the budget and markets may be much more muted than expected.

Trade and Tariffs

Harris

- Continue Biden era support for US semiconductor and clean energy manufacturing

- Continue Biden era approach to strategic use of tariffs and trade embargos.

Trump

- Impose universal (10-20%) tariff on all imports

- 60% tariff for all Chinese imports and revoke China’s ‘Most Favored Nation’ status

- Further tariffs on certain auto imports.

Harris’ trade policies represent a continuation of the current Biden administration approach. The full effect of Trump’s tariff proposals could dramatically impact global trade. Unlike fiscal policy, Trump may be able to unilaterally implement tariffs by Executive Order without the consent of Congress.

The Peterson Institute estimates the potential revenue from Trump’s tariffs at $225 billion a year (before factoring in blowback from retaliatory actions from other countries) and will not come close to funding his tax cuts. The other danger in Trump’s tariff plan is the risk that it feeds into inflation and results in a stronger USD that removes the effectiveness of the tariffs in the first place. While the tariff threat to China must be taken seriously, some believe Trump’s proposed universal 10-20% tariff is merely a negotiating tactic to improve trading terms with other nations, including removing levies imposed on goods imported from the US.

Immigration, Energy and the Fed

Harris

- An increased focus on border control, with a conditional increase in new immigrant visas

- Prioritisation of clean energy industry investment and support

- Maintain Fed independence.

Trump

- Deport unauthorised immigrants, strengthen border controls and reduce immigration

- Repeal the IRA green subsidies

- Boost oil and gas development, LNG exports and power plant construction

- Potentially allow input from the President on Fed policy.

Trump’s immigrant policies do threaten economic growth, as a smaller workforce means lower GDP growth. While fewer workers could increase labour market tightness that feeds into higher inflation, the reverse is also possible – fewer consumers may reduce inflationary pressures, allowing the Fed to cut by more to support the economy.

Energy is a key part of Trump’s promise to keep inflation down. He favours opening up new land for drilling, offering tax relief for energy companies, and speeding up the approval of permits and pipelines in order to boost oil and gas production to keep energy costs down. A Harris government is likely to incentivise critical mineral producers to support US clean energy manufacturing.

Any perception of interference with Fed policy could stoke investor nervousness with regard to US government bonds and the USD.

Which candidate do markets prefer?

Ultimately, markets prefer policy stability and less regulatory pressure. Equity markets tend to respond well to tax cuts whereas bond markets favour a more balanced budget.

One big positive is that both candidates are known entities. Harris broadly represents a continuation of the Biden doctrine, albeit with incrementally larger deficits. Trump’s policies appear set to upend global trade and erode the tax base, but passing legislation is never easy, and he may face a Democrat-controlled House or Senate within Congress that could stifle some of his more radical policy proposals in any case.

Source: New York Times, Polymarket, as at 28 October 2024.

History demonstrates that staying invested—regardless of which party is in power—generally has been one of the most reliable strategies for achieving long-term returns.

In 1957 Republican President Dwight D. Eisenhower’s was in power and the S&P 500 Index was created. Since then, the S&P500 has shown no clear preference for either political party. Although the mean compounded annual growth rate (CAGR) has been slightly higher under Democratic presidents, median performance has been stronger under Republican presidents.

Comparing Historical Index Returns: Democrat vs. Republican Presidents

| Party | Mean S&P 500 CAGR | Median S&P 500 CAGR |

| Democrat | 9.6% | 8.3% |

| Republican | 6.2% | 10.2% |

Source: Yahoo Finance. The time series begins in March 1957 and extends to 13 August 2024. CAGR for each presidential term is calculated from inauguration day (e.g., President Donald Trump’s term from 20 January 2017 to 20 January 2021).Past performance is not indicative of future performance. Provided for illustrative purposes only. You cannot invest directly in an index.

The S&P 500 has experienced good and bad years under both parties, but it’s difficult to attribute market returns over any extended period to the office of the President when major market events, like the GFC, the Covid pandemic and breakthroughs in AI, are often outside of their control.

What if you want to take a position

Please note the below information is provided as general information only and is not a recommendation to invest or adopt any investment strategy. It doesn’t take into account any investor’s financial objectives, situation or needs. Investors should consider its appropriateness taking into account such factors. Investing involves risk.

Possible Trump trade ideas

- ‘America First’

- QUS S&P 500 Equal Weight ETF

- Domestically focused US companies have more to gain and less to lose from a possible trade war and protectionism. This could favour the S&P 500 Equal Weight Index (which QUS seeks to track, before fees and expenses) relative to the market cap weighted S&P 500 Index that is currently dominated by large global tech companies.

- Increased US energy production

- FUEL Betashares Global Energy Companies Currency Hedged ETF

- Under Trump’s plan to ramp up energy production, oil and gas companies could grow revenue even if oil prices go lower, as well as enjoying lower exploration and production costs and lower taxes.

- Greater currency volatility

- Conventional wisdom is that Trump’s policies will lead to a higher USD, however, he has explicitly stated he will bring the USD down. It is possible that greater currency volatility may result.

- Betashares has a range of currency hedged global and US equity exposures that seek to minimise the effect of currency fluctuations on returns

- Another option for investors seeking exposure to the performance of gold when currencies are volatile could be QAU Gold Bullion ETF – Currency Hedged

Possible Harris trade ideas

- Potential relief rally for emerging market Asia

- ASIA Asia Technology Tigers ETF

- East Asia is one of the most trade exposed regions in the world, and is home to some of the world’s leading high tech manufacturing and semiconductor supply chain companies, including Samsung and TSMC, which are both currently held in ASIA1.

- Supplying the US’s green transition

- XMET Energy Transition Metals ETF

- Harris has promised to establish of a national reserve of critical minerals such as cobalt, lithium, and nickel to advance the US’s aspirations in clean energy, EVs and battery tech.

- Defence spending

- ARMR Global Defence ETF

- Harris promises continued support for Ukraine and more multilateralism, while still maintaining a hard line against China. Global defence contractors may also receive a boost if Trump forces European NATO countries to increase their defence spending.

Investors should be mindful that with much market focus on “Trump trade” and “Harris trade” ideas, much of the potential upside may actually occur in the lead up to the election or may be limited to a short post-election bump.

In the longer term, markets are more beholden to macro-economic fundamentals than politics. Take for example the performance of “old energy” versus “clean energy” during the Trump and Biden era. Under Trump oil and gas companies had poor returns and clean energy and EV makers did well, and the reverse was true under Biden. These outcomes were the opposite to what was expected based on the respective Presidents’ policy agendas. In both cases, economic conditions and interest rates generally had a bigger impact in determining the ‘winners’ and ‘losers’, not the preferences of who was in the White House at the time.

Investing involves risk. The value of an investment and income distributions can go down as well as up. An investment in each Betashares Fund should only be considered as part of a broader portfolio, taking into account an investor’s particular circumstances, including their tolerance for risk. For more information on the risks and other features of each Betashares Fund, please see the relevant Product Disclosure Statement and Target Market Determination, available at www.betashares.com.au.

Reference:

1. No assurance is given these companies will remain in ASIA’s portfolio or be profitable investments. ↑