The number of unique entities that were active either as a sender or receiver. (e.g. clustering bitcoin addresses into entities such as balances < 1000 bitcoin or balances > 1000 bitcoin).

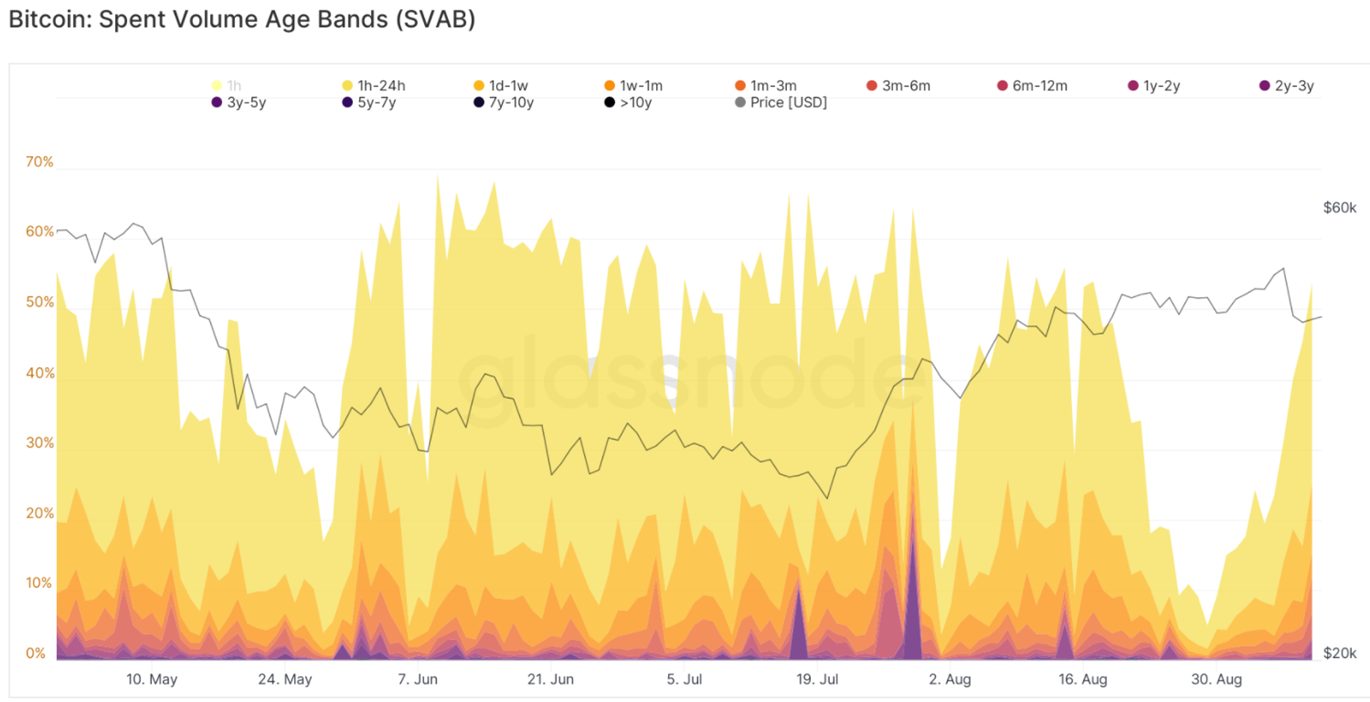

Shows the percentage of spent volume from each age bracket of coins measured from the last time it was spent or changed hands.

Source: Glassnode. Illustration only.

Investing in crypto assets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto asset markets.

Investing in crypto assets is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment.

Any investment in crypto assets should only be considered as a very small component of an investor’s overall portfolio.

BetaShares Capital Limited (ABN 78 139 566 868, AFSL 341181) (“BetaShares”) is the issuer. This information is general only, is not personal financial advice, and is not a recommendation to make any investment or adopt any particular investment strategy. It does not take into account any person’s financial objectives, situation or needs. Investing involves risk.