Market order vs limit order: When to use each

From an investment perspective, the standout global sector of recent years has undoubtedly been technology.

Summary

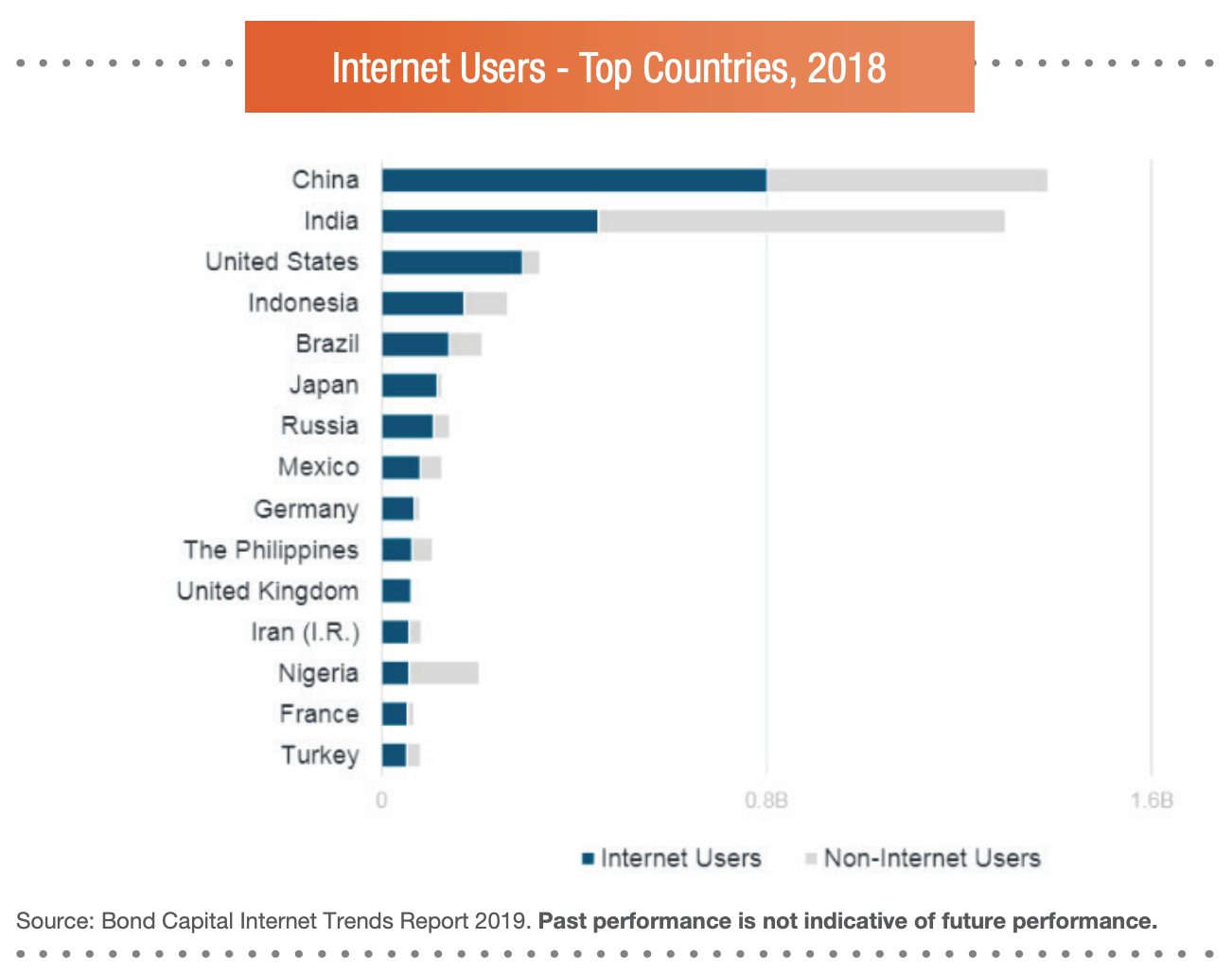

- Estimates suggest half the world’s population now has access to the internet, up from only one quarter a decade ago1

- With more economic activity taking place online, cloud storage of information, and rapid advances in robotic and artificial intelligence technologies, companies in this dynamic part of global equity markets have been enjoying strong growth in earnings and share price performance

- The advent of ETFs has meant it has never been easier or more cost effective for Australian investors to gain diversified exposure to a broad range of dynamic technology companies both at home and abroad

1 As at 2018 (compared to 2009). Bond Capital Investment Trends Report 2019.

Introduction

The technology sector’s strong performance has been a feature not just of recent years, but also during the COVID-19 pandemic.

In the six months following the market lows of March, technology indices rebounded strongly, hitting new highs in early September. The NASDAQ-100 Index, for example, rose 77% from lows on 23 March to 3 September, while locally, the S&P/ASX All Technology Index more than doubled over the same period2.

The move to online activity has only accelerated under the economic lockdowns and social distancing restrictions that have been put in place around the world to deal with the COVID-19 pandemic. It has been estimated that consumer and business digital adoption hurtled forward 5 years in a matter of 8 weeks during the start of the most severe restrictions.

This adoption may be seen by many as the digital revolution3. The closure of many shops and offices, for example, has seen a large increase in online shopping and remote work-from-home arrangements through video-conferencing.

Yet, while Australia has a thriving local tech sector that is poised for growth, technology’s share of the overall sharemarket remains low by global standards – which in turn has contributed to the underperformance of our bank-heavy market in recent years.

Also, knowing exactly which companies are likely to do best in this broad and dynamic global sector is a difficult task for experienced and well-resourced professional fund managers, let alone direct investors.

But if you feel like you’ve missed the technology boom so far: all is not lost.

2 Past performance is not indicative of future performance. You cannot invest directly in an index.

3 McKinsey – The COVID-19 recovery will be digital

What is an ETF?

An ETF is a managed investment fund, units in which can be bought and sold on the ASX, just like shares.

An equity ETF pools money from investors and uses the proceeds to buy a portfolio of individual company shares – helping to reduce single-company exposure and offering diversification across a whole market or a particular market sector (such as technology).

In the main, ETFs are passively managed ‘index’ funds, which aim to track the performance of the market or a relevant benchmark index. A key benefit of this approach is that the ETF provider is not looking to beat a benchmark, so does not employ a team of highly paid investment managers to pick stocks, which means investors are generally subject to lower management fees.

Historically, most active fund managers have had a hard time outperforming passive indexing approaches in any case. ETFs also offer transparency – anyone can see at any time what companies an ETF holds by going to the ETF provider’s website.

Last but not least, the process of regularly re-weighting stocks (e.g. according to their market capitalisation) helps to ensure that these indices (and the ETFs which seek to track them) remain exposed to the top technology companies over time.

Companies that tend to underperform – and lose market capitalisation – have their weightings reduced, and may eventually even be cut from these indices, to be replaced by newer, better-performing companies with rising market capitalisation.

1. The global technology giants

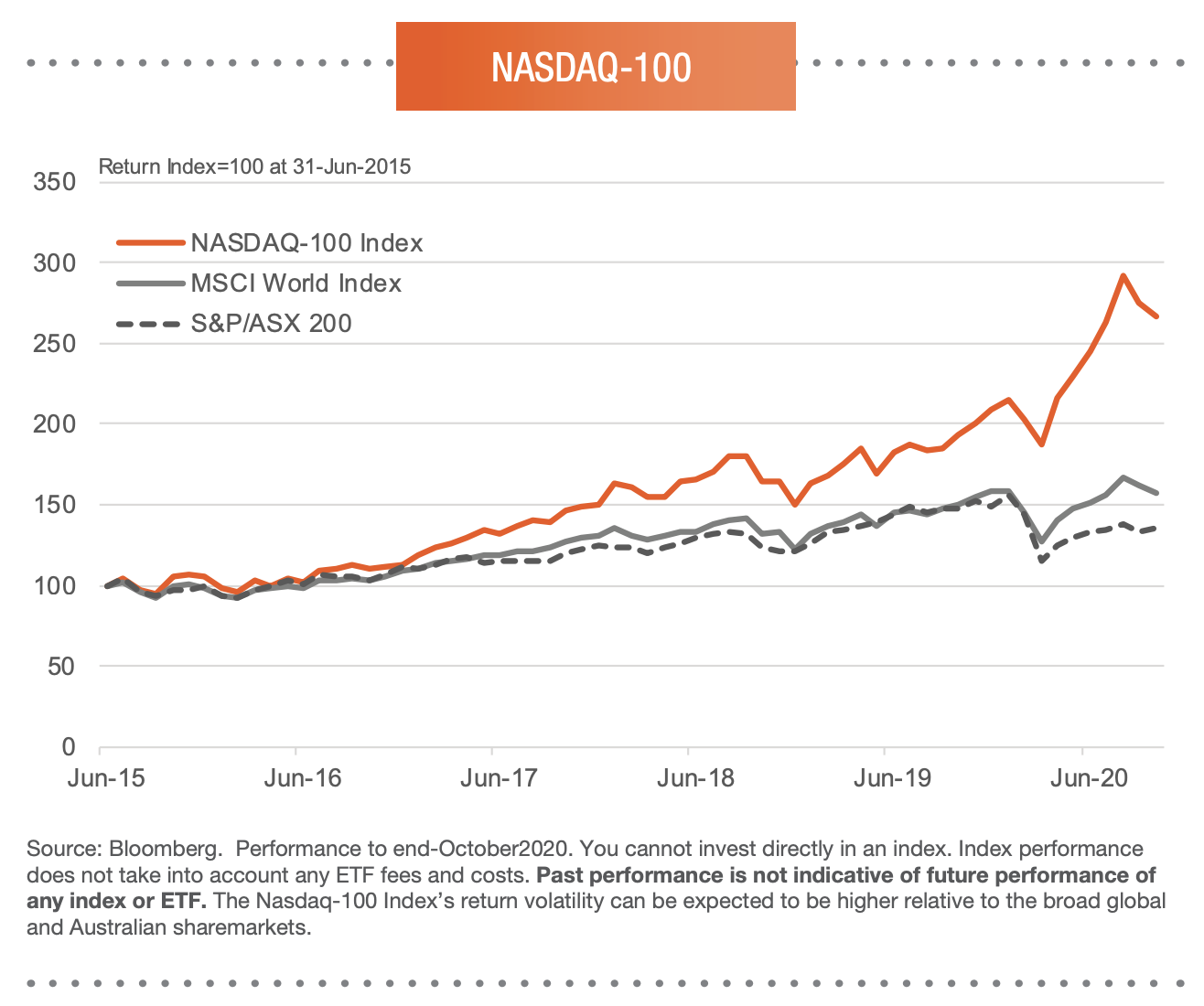

The NASDAQ-100 Index is one of the best-known equity indices in the world. Although not strictly a ‘technology’ index per se, it has become the world’s pre-eminent exchange for many of the world’s most innovative companies.

The NASDAQ-100 Index includes many of the leading technology, consumer and healthcare companies across the globe that are revolutionising our world, including Apple, Microsoft, Alphabet (formerly Google), Amazon, Tesla and Facebook. In their own way, each of these companies is contributing to major global trends favouring more online and digitised activity.

Indeed, the internet has become the world’s information highway, with around 3.5 billion searches performed daily on Google alone4. Traditional media has been disrupted by both online news sites and video streaming services.

We’re spending more of our leisure time on social media sites such as Facebook, and shopping less in ‘bricks and mortar’ stores and more on websites such as Amazon and eBay. We’re watching more video content on YouTube and Netflix rather than via traditional television. All this activity is spawning spill-over demand for cloud data storage services, a sector dominated by companies such as Amazon and Microsoft.

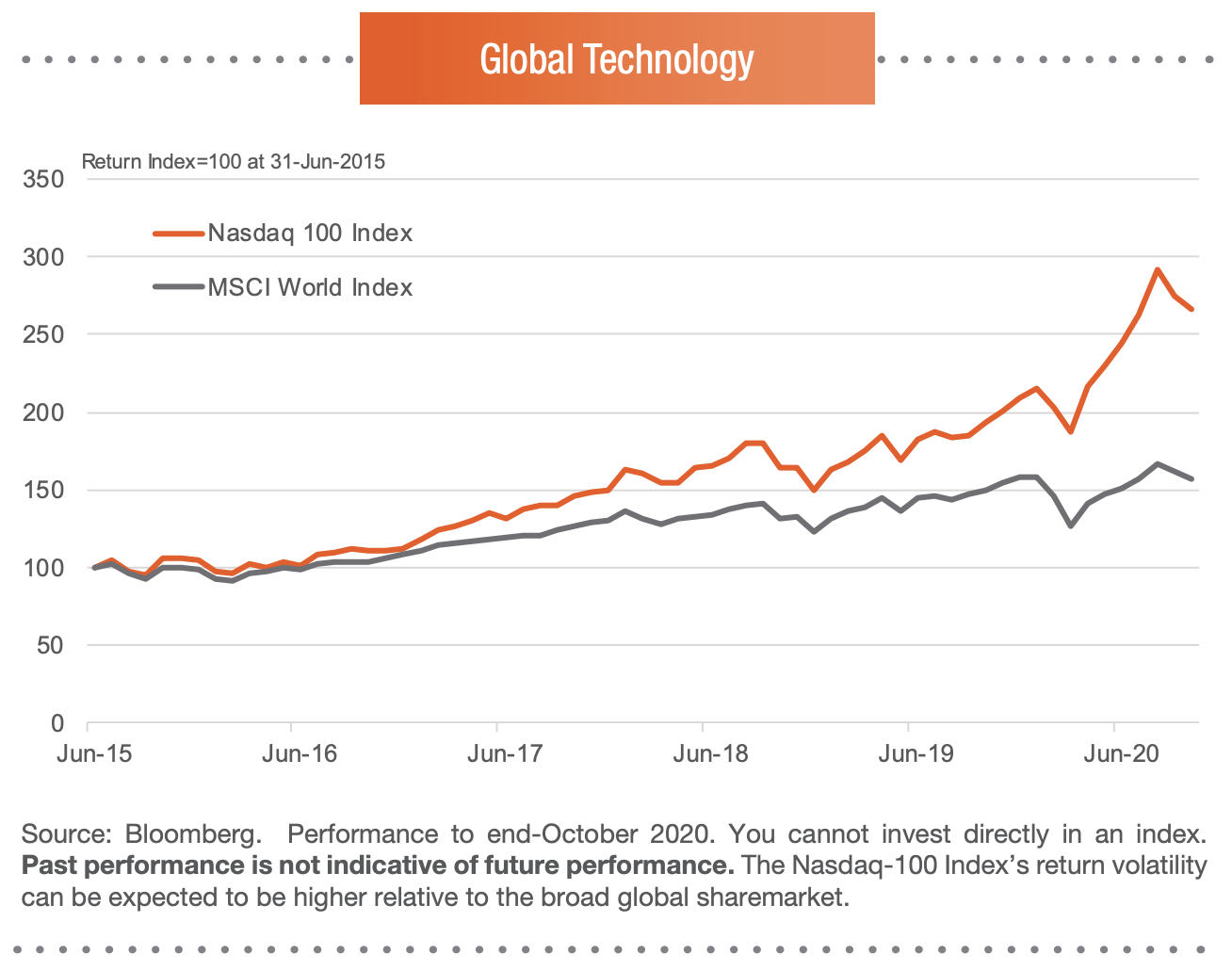

It’s no surprise therefore that since the financial crisis almost a decade ago, the NASDAQ-100 Index has strongly outperformed both the Australian and broader U.S. sharemarkets.

What’s more, much of this performance in recent years has been fundamentally driven by strong underlying earnings growth. BetaShares offers two ETFs that track the NASDAQ-100 Index, one currency hedged and the other unhedged.

Australian investors seeking exposure to companies within the NASDAQ-100 Index have a choice between NDQ Nasdaq 100 ETF and HNDQ Nasdaq 100 Currency Hedged ETF , which obtains its investment exposure indirectly by investing in NDQ.

Both funds provide investment exposure to 100 of the largest non-financial companies listed on the NASDAQ market, and include many companies that are at the forefront of the new economy.

4 InternetLiveStats.com, November 2020.

2. The dynamic Australian tech sector

While the technology sector today is an important segment of the global equity market, it is still a relatively small share of the Australian sharemarket – which remains top-heavy in arguably ‘old world’ bank and resource stocks.

It’s perhaps underappreciated that Australia has managed to develop its own thriving group of listed techrelated companies – businesses that are making their mark not just locally, but also on the world stage. As has been the case worldwide, several local internet upstarts such as carsales.com, Webjet and REA have successfully disrupted the established retailing and media industries to grow into dominant businesses in their own right.

Afterpay is a more recent addition in the consumer space, with its innovative ‘buy now, pay later’ transaction service. There is also a growing range of technology services for business, such as Xero online accounting and global logistics software supplier WiseTech Global.

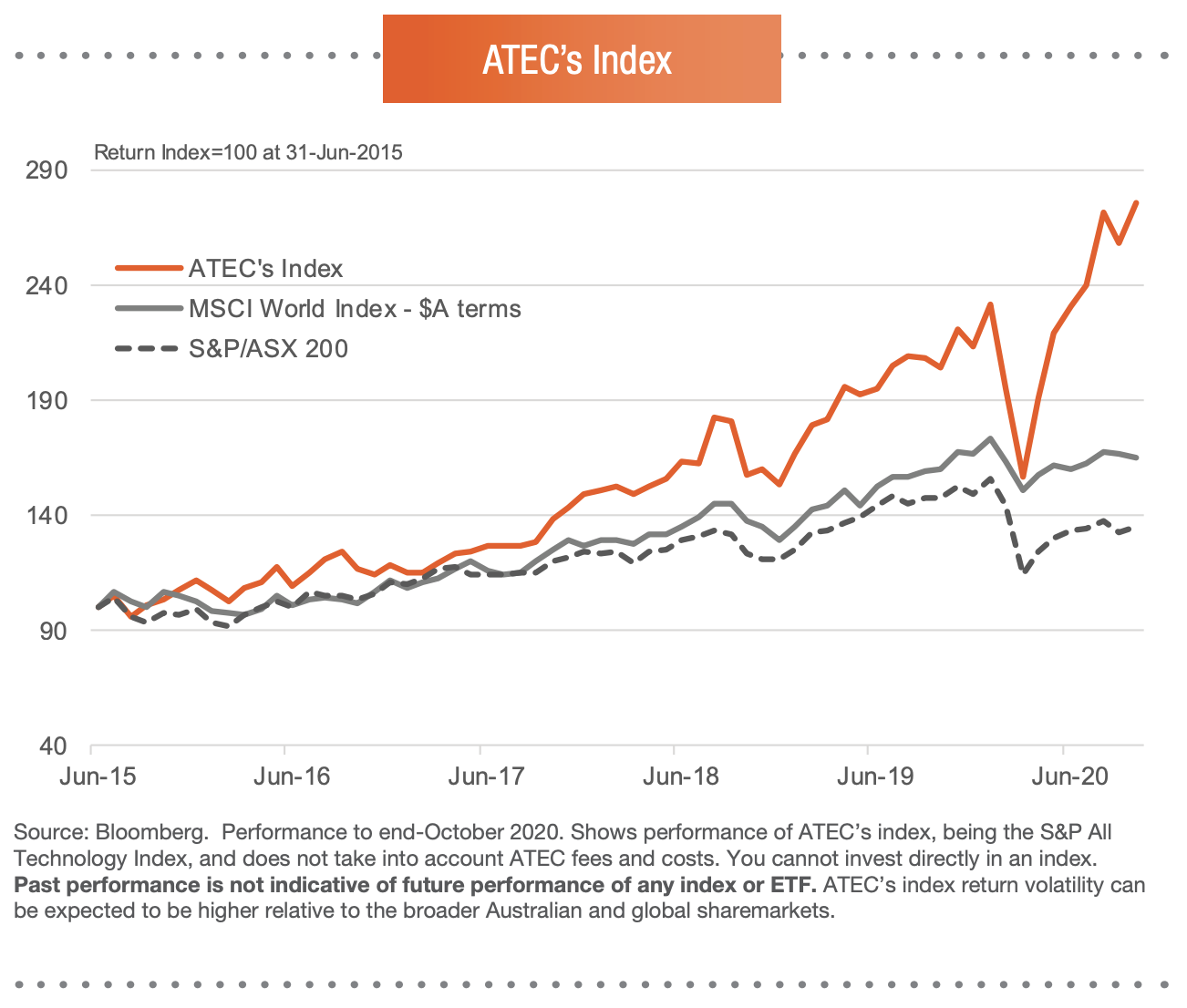

ATEC S&P/ASX Australian Technology ETF provides exposure to many of these companies by tracking the performance of the recently created S&P/ASX All Technology Index. The index includes ASX-listed companies within a diverse range of tech-related industry segments such as information technology, medical technology, consumer electronics, online retail, interactive media and internet marketing services.

Reflecting the dynamism in this area of the sharemarket, the number of companies within the S&P/ASX All Technology Index nearly doubled – from 24 to 46 – over the five years to 31 December 2019, with the total market capitalisation of these companies increasing more than fourfold from $A17 billion to nearly $A92 billion over the same period6.

The S&P/ASX All Technology Index has produced relatively strong returns in recent years compared to the broader Australian sharemarket, in line with the outperformance of the technology sector globally (albeit with greater volatility than the broader market, given its tech sector concentration).

Given the top-heavy nature of the Australian equity market, not only does ATEC potentially provide a good long-term domestic growth opportunity, it also offers a handy means of reducing exposure to the fortunes of the large and long-established financial and mining companies that dominate many investment portfolios.

6 S&P Dow Jones Indices LLC. Data based on the last day of each year from 2014 to 2019.

3. Asia’s technology tigers

If you are looking for exposure to the growing technology sector in one of the most economically dynamic regions, ASIA Asia Technology Tigers ETF provides double-barreled exposure to two of the world’s arguably strongest investment themes: technology and Asia.

Indeed, due to its younger, tech-savvy population and less developed traditional retail, media and communication industries, Asia has already leapfrogged the West in terms of online activity and technological advancements.

For example, despite having relatively low income per capita, China already had 772 million internet users as at end-2017, or more than twice as many as in the United States. And already, around 20% of Chinese retail spending takes place online – or around twice as much as in the U.S. Almost 40% of Chinese online payments occur on mobile phones, or almost three times the 15% share in the U.S.7

At the same time, Asia (exJapan) has been one of the boom economic regions within emerging markets, and its technology sector has been a significant performer amongst global sharemarkets.

According to one study by Google and Temasek Holdings, South East Asia’s internet transactions8 – covering online bookings, gaming and retail spending – are forecast to grow at a compound annual rate of 20% over the 10 years to 2025, reaching almost US$200 billion.

Online retail spending alone is expected to grow at an annual rate of 32%, reaching US$88 billion.

While the investment ideas discussed above provide exposure to technology companies specific to certain regions (Asia) or exchanges (NASDAQ and the ASX), the final two to be discussed in this report provide global exposure to companies within particular high-growth technology sub-sectors.

7 Google and Temasek report, 2019.

8 E-conomy: SEA 2019. Swipe up and to the right: Southeast Asia’s $A100billion internet economy.

4. Global cybersecurity

The demand for cybersecurity should be fairly evident to most internet users given the unfortunate but inevitable rise in cybercrime associated with our increasing reliance on the internet.

According to IBM9, for example, there were over 11.7 billion private records either leaked or stolen in the three years from 2016 to 2018, not including the likely many more breaches that were not publicly disclosed. Cybersecurity firm Symantec Corporation says it discovered 670 million new unique pieces of malware in 2017 and just over 245 million in 201810.

According to information cited in the Australian Cyber Security Growth Network’s Sector Competitiveness Plan 2019, as set out in the graph below, cybersecurity is already a huge market, with global spending reaching $US170 billion this year alone. By 2026, spending is expected to reach $US270 billion, representing 8% annualised growth over the next six years (or around twice the expected growth in global GDP).

With these challenges in mind, HACK Global Cybersecurity ETF was developed to provide investors with diversified exposure to leading global cybersecurity firms.

The index HACK aims to track covers the leading firms from a diverse range of countries such as the U.S., Britain, Israel, Japan and South Korea, and includes names like Cisco, Symantec, CyberArk and Itron. These companies are at the cutting edge in providing software and hardware to keep our data safe from hackers.

9 IBM Annual Cost of Data Breach Report, 2019.

10 Australian Cyber Security Growth Network, Sector Competitiveness Plan 2019.

5. Robotics and Artificial Intelligence

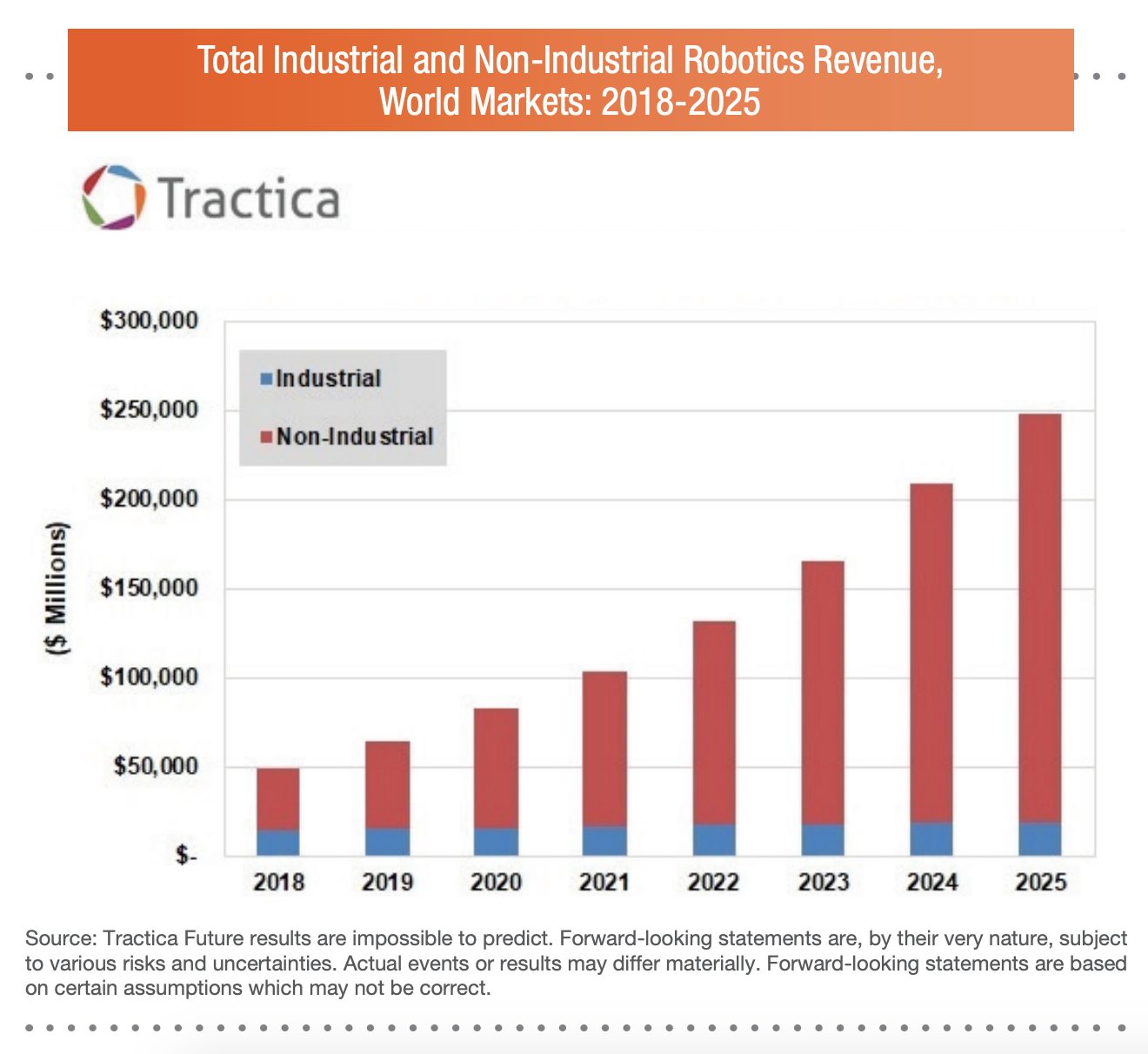

Reflecting both technological innovation and looming workforce shortages due to population ageing, another fast-growing segment of the global technology sector is robotics and artificial intelligence (A.I.).

In the manufacturing sector, for example, robots are increasingly capable of undertaking large-scale assembly work, often without human intervention and in factories that don’t require the expenses associated with light or air-conditioning.

According to The Boston Consulting Group, one quarter of U.S. manufacturing operations will be automated by 2025, compared with only around one tenth in 201511. But while the use of robots to replace the repetitive tasks of humans on the factory floors of the world is increasingly well understood, what’s perhaps less appreciated is how robotics and A.I. (effectively teaching robots to learn for themselves) is taking root in a vast array of other industries beyond traditional manufacturing.

In the defence industry, drones and wheeled robots are being increasingly used to undertake various roles that would have otherwise involved risk to human life. Robotic devices are allowing surgeons to undertake once-difficult operations – in areas such as heart and brain surgery – with greater precision and less patient risk than ever before.

Robots have also proven capable of diagnosing many diseases with much greater accuracy than human doctors. Meanwhile, A.I.-facilitated self-driving cars promise to revolutionise the transport industry, with some estimates suggesting 60% annual growth in the decade to 203012.

Robotic planting and harvesting machines are also anticipated to transform the agricultural sector. And robots are even starting to make inroads into personal services – such as aged care – through providing patients the medicines and care they require on a 24-hour basis.

According to Tractica Research, the global robotics industry had sales revenue around US$50 billion in 2018, and is expected to reach $US250 billion by 2025, implying compound growth of 25% p.a.13

Additionally, Tractica forecasts revenue from A.I. software will grow from US$10 billion in 2018 to US$126 billion by 2025, implying compound annual growth over this 9-year period of 44%.

RBTZ Global Robotics and Artificial Intelligence ETF aims to track the performance of an index that provides exposure to leading companies involved in the production or use of robotics and automation products and services.

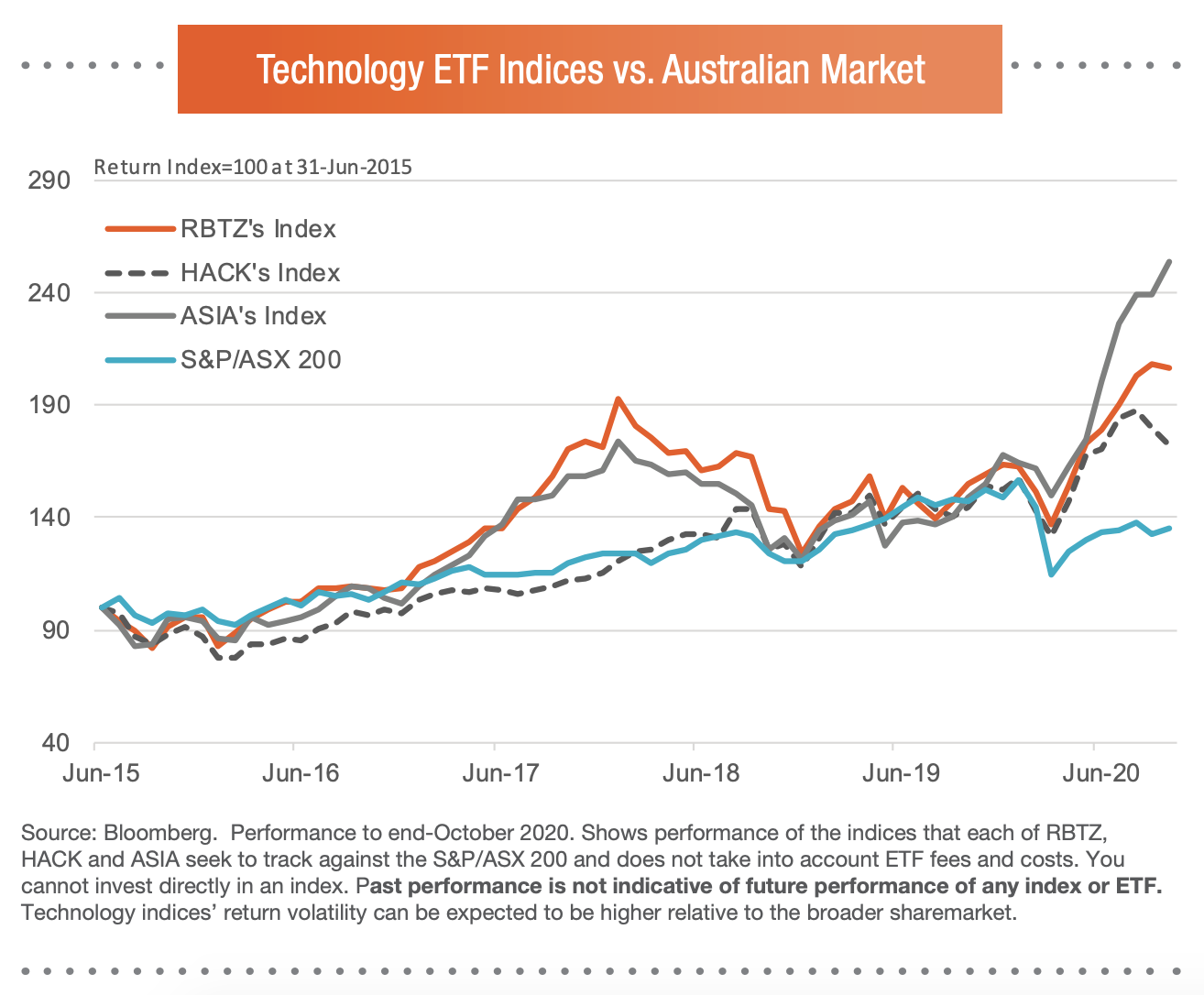

As seen in the chart here, the range of global technology exposures described above have performed relatively well in recent years – as might be expected given the strong growth in their underlying markets. Of course, it’s important to keep in mind that past performance is not indicative of future performance.

11 Boston Consulting Group Report, How Robots Will Redefine Competitiveness, 23 September 2015.

12 Grand View Research, Self-Driving Cars and Trucks Market Size, Share and Trends Analysis Report, June 2018.

13 Robotics Market Forecasts, June 2019.

Conclusion

Australia, along with the global economy more broadly, is going through a period of profound technological advancement.

It’s therefore no surprise that since the global financial crisis more than a decade ago, technology stocks – both at home and abroad – have performed relatively strongly. What’s more, the COVID-19 pandemic has only accelerated structural changes in the economy (such as more online shopping and working from home) that favour these innovative technology companies.

With these developments in mind, we think it’s important for local investors to have the ability to gain access to a range of both local and global technology opportunities – especially given the Australian market’s top-heavy exposure to banking and resource stocks.

The suite of BetaShares funds outlined in this report aim to provide an easily accessible, cost-effective, and transparent means of adding technology exposures to your investment portfolio. Periodic rebalancing, moreover, ensures these funds will continue to provide exposure to the leading companies in this dynamic part of the market over time.