Government bonds are low-risk debt securities that provide a fixed income. The government repays the bond’s principal to the investor when the bond matures and makes regular interest payments.

Key takeaways:

- Government bonds are loans to the government. In return, the government pays regular interest.

- When a bond matures, the government repays the face value of the bond.

- The government uses the money to repay sovereign debt and to finance spending.

- Government bonds are low-risk investments.

What are government bonds?

Government bonds are the largest single pool of bonds on the Australian market, offering various investment opportunities. Essentially, a government bond involves lending money to the government for a set period, and the government pays interest on this. Then, when the bond matures, the government repays the face value of the bond.

The ability to receive regular interest payments and principal repayment are two advantages of owning government bonds. Bonds can assist in diversifying risk and improving a portfolio’s overall performance.

Because of the low risk and consistent earnings associated with government bonds, most default superannuation plans will invest a portion of their members’ money in them.

Why do governments issue bonds?

Governments raise money in several ways, for example, through taxes or by issuing bonds. To pay down government debt or fund day-to-day government spending, they issue bonds. Because a bond yields a stable, steady income, it can be attractive to investors.

The government might increase bond issuance when planning large projects or in times of financial need.

What are the different types of government bonds?

The Australian government issues different types of bonds. The two main types are Treasury Bonds and Treasury Indexed Bonds, also known as Treasury inflation-protected securities (TIPS).

- Treasury Bond: A treasury bond is a medium to long-term treasury security. It typically has a fixed interest rate paid every six months as a percentage of the bond’s face value. The government repays the face value at maturity.

- Treasury Indexed Bond: With inflation-indexed bonds, the government adjusts the coupon payments for Consumer Price Index (CPI) movements. The government pays interest quarterly. At maturity, it repays the face value of the bond, adjusted for movements in the Consumer Price Index.

How do government bonds work?

Bonds are fixed-income assets, where investors essentially lend money to the government at a fixed interest rate. In exchange, investors will receive regular interest payments. If investors hold on to the bond until it matures, they will receive the face value of the bond.

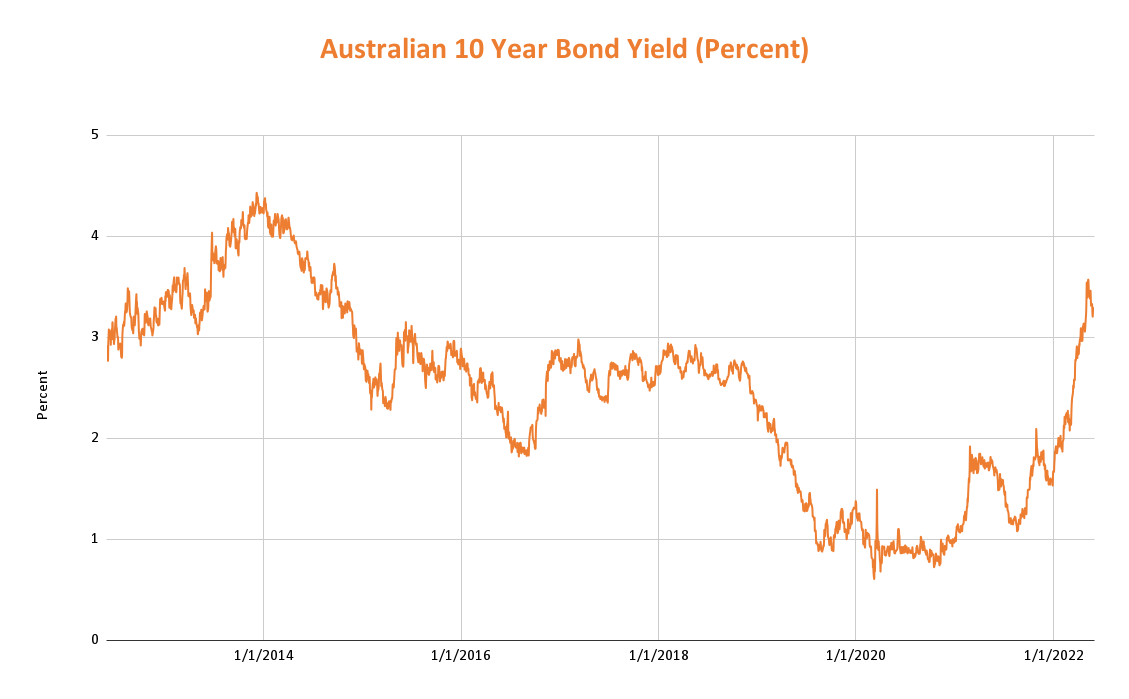

Treasury bonds have a range of maturities. You can see (on the chart below) the yield on the Australian government’s 10-year bonds over the last decade:

Source: Bloomberg

Source: Bloomberg

Government bond example

An investor buys A$10,000 face value worth of ten-year bonds with a 5% coupon. The investor receives 5% of the face value price, or A$500 each year, in two half-yearly payments of A$250 each. After ten years, the investor gets the A$10,000 back. Overall, they earned A$5,000 of coupon interest.

You can sell the bonds before the maturity date, with the amount received depending on how yields have changed since purchase.

Benefits & risks of government bond

Whether you’re eager for financial stability or want added security for retirement planning, bond investments are worth considering. Coupon payments provide a fixed, steady income stream.

The yield on a bond is generally higher than a savings account.

Not only do investors receive a regular income, but bonds are also predictable and make it easier to budget. You know exactly how much you’ll receive each quarter or year with a fixed coupon rate.

Government bonds are highly liquid. This means that if you want access to your funds, it’s easy to sell even large amounts very quickly without causing the price to fall. This works in both directions too. So, if you want to purchase a large amount of bonds, you can do so without causing the price to rise.

Government securities generally carry a very low risk as the Australian federal government is unlikely to default on interest payments.

Bonds are an excellent way to diversify an investment portfolio. Government bonds generally have a low or negative correlation with equities, which often make up the bulk of investors’ portfolios. If the share market falls significantly, government bonds are likely to perform well. This helps to ‘smooth out’ returns, meaning that at least part of a diversified portfolio is likely to be performing positively at any given time.

If you hold a bond to maturity, the government repays the face value. On the other hand, you can sell it to another investor at market value. If you sell the bond before it matures, the price received might be higher or lower than the face value. Market prices depend on supply and demand, interest rates, and the bond’s duration.

Currency risk is only applicable if your government bond is denominated in a foreign currency. If this is the case, as foreign exchange rates fluctuate, the value of your bond in AUD terms will change.

Inflation risk is the possibility that the real value of the bond will fall when Inflation-linked bonds help mitigate this risk by adjusting coupon payment rates to protect investors from inflation.

Interest rate risk refers to the possibility that the value of your bond may change due to rising or falling interest rates. The relationship is inverse, meaning the price of the bond will rise if interest rates fall, and vice versa. A bond is usually fixed-rate or floating-rate, though some include features of both. A fixed-rate bond’s coupon payment rate will stay the same until maturity.

A floating rate bond has interest coupons linked to a benchmark rate, with the coupons changing/resetting on a regular basis (typically quarterly) to reflect movements in the benchmark rate – this most neutralises the impact of interest rate changes on the price of the bond.

Why should you diversify your investments?

Where you choose to invest your money depends on your investment goals and risk tolerance. A diversified portfolio helps to mitigate risk. Diversification involves investing in high, medium, low-risk investments and different asset classes. The most important goal of diversification is to maximise the benefit of having different investments in your portfolio that do not move in lock-step.

Another factor to consider is that interest rates can affect bonds and shares differently. If you want to balance your portfolio, you might consider investing in bonds to balance the risk of your equities.

How to get started?

When the government issues bonds, they typically do so through auctions that large banks and other financial institutions invest in. You can also buy and sell exchange-traded government bonds on the Australian Securities Exchange (ASX) or gain exposure to a portfolio of government bonds through ETFs.

Choose an investment vehicle:

- Exchange-traded Treasury Bonds (eTBs).

- Exchange-traded Treasury Indexed Bonds (eTIBs).

- Government bond exchange-traded funds (ETFs).

BetaShares government bond ETFs

Through Betashares Government Bond ETFs, investors can diversify their portfolios and receive regular monthly income from a portfolio of high-quality government bonds.

AGVT Australian Government Bond ETF : Invests in bonds with a duration of 7-12 years. This ETF provides exposure to a portfolio of high-quality bonds issued by Australian federal and state governments, with a component issued by supranational banks and sovereign agencies.

GGOV U.S. Treasury Bond 20+ Year ETF – Currency Hedged : This ETF provides exposure to high-quality, long-dated, income-producing US Treasury bonds. Currency risks are hedged in this portfolio. This minimises the impact of currency fluctuations on the returns of the portfolio.

| For more information on risks and other features of these funds, please see the Product Disclosure Statement and Target Market Determination available on this website. |

Conclusion

Investing in Australian government bonds secures a steady, low-risk income. Government bond ETFs are low-risk, long-term investments with superior credit quality. To learn more about ETFs and how they could help you achieve your investment goals, visit our Betashares Education Centre.

IMPORTANT INFORMATION

This information has been prepared by Betashares Capital Limited (ABN 78 139 566 868, AFSL 341181) (“Betashares”). This information is general only, is not personal financial advice, and is not a recommendation to buy, hold or sell any investment or adopt any particular investment strategy. It does not take into account any person’s financial objectives, situation or needs. Before making a decision to invest in any Betashares Fund you should obtain and read a copy of the relevant PDS available from www.betashares.com.au or by calling 1300 487 577 and obtain financial advice in light of your individual circumstances. You may also wish to consider the relevant Target Market Determination (TMD) which sets out the class of consumers that comprise the target market for the Betashares Fund and is available at www.betashares.com.au/target-market-determinations. To the extent permitted by law BetaShares accepts no liability for any loss from reliance on this information.