Why ‘timing the market’ is a fool's errand

Originally published on September 1, 2022. Last updated on August 6th, 2024.

Markets don’t go up in a straight line (wouldn’t that be nice!).

In reality, and as investors are experiencing in the current environment, volatility goes hand-in-hand with investing and periods of negative returns are not uncommon. However, over the longer term, sharemarkets have tended to trend upwards.

Historical returns of the Australian sharemarket: S&P/ASX 200 Total Return Index

Source: Morningstar Direct, Betashares. Returns from 02/04/2001 to 06/08/2024 . Past performance is not indicative of future performance.

There are a multitude of factors that can cause periods of negative returns, whether this be a collapse in the financial system (the Global Financial Crisis), a global pandemic (COVID), or the prices of goods and services rising faster than anticipated (inflation), causing central banks to raise interest rates.

What to do during market volatility

Questions to ask yourself

When investors see the value of their portfolio declining, it is not unnatural for them to panic.

The key is to try to remain rational and maintain a disciplined investment approach. The opening phrase of Rudyard Kipling’s If comes to mind – “If you can keep your head when all about you are losing theirs …”.

To help you maintain a sense of level-headedness, you can begin by asking yourself two questions:

- Is this pullback ‘normal’ like many we have seen throughout history?

- Do my financial objectives remain the same?

If the answers to both these questions are ’Yes’, the pullback shouldn’t warrant wholesale changes in your investment approach. Sticking to smaller adjustments, if any, may be more appropriate.

Consider your options

When considering what to do with your portfolio, there are three main options:

- Sell and aim to avoid further losses

- Buy the dips, seeing an opportunity to buy at a lower price

- Do nothing and ride the wave

Without hindsight, there is no certainty as to which of these is best, however the first two do require you to time the market, which requires either skill or luck, and is almost impossible to do consistently. While everyone’s goals and circumstances are different, history suggests that taking a longer-term view may be the best course of action.

Tips for investing for the long-term

Diversification is your best form of risk management

Markets typically recover, individual stocks may not. As such, investors need to appropriately diversify their portfolios.

While a single ETF can provide access to hundreds of securities in one trade, it is also important to hold a blend of asset classes, regions and sectors as different exposures can benefit or suffer in different environments.

Know your risk tolerance and timeframe

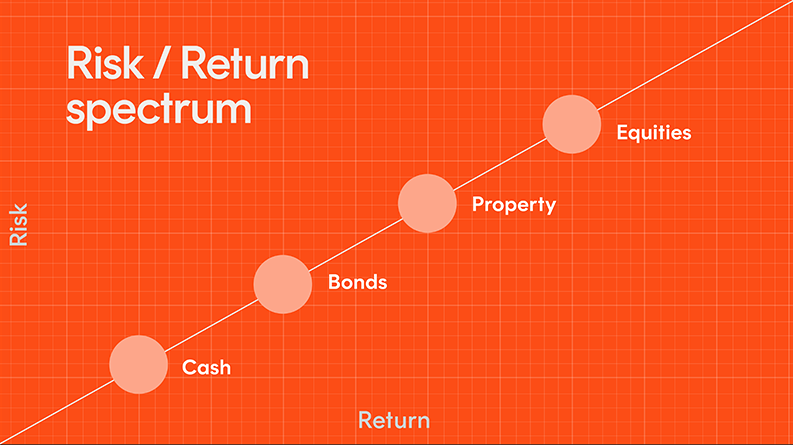

There is generally a trade-off between risk and return. Typically, the lower your risk, the less you should expect in return.

Risk/return profiles of different asset classes

Source: Betashares. Provided for illustrative purposes only. Not a recommendation to make any investment or adopt any investment strategy.

Knowing your risk tolerance is key to constructing your portfolio and should determine your mix of asset classes. Typically, the longer your time horizon, the more risk you can take as you have more time to weather periods of negative returns as illustrated above.

Contribute periodically

While it is extremely difficult to time markets, contributing on a regular, periodic basis (dollar cost averaging) can have great benefits. By sticking to a schedule, you will buy dips as well as buying at highs, assisting in reducing your overall volatility. It will also help enhance the compounding effect.

Conclusion

Market corrections are normal, however understandably can raise internal questions for investors. But keeping in perspective that markets can be volatile and maintaining a long-term plan with your financial goals firmly in mind can help you to make rational investment decisions.

A well-diversified portfolio should also allow you to weather the storm and come out the other side.

This article contains general information only and does not take into account any person’s objectives, financial situation or needs. Investors should consider the appropriateness of the information taking into account such factors and seek financial advice. It is provided for information purposes only and is not a recommendation to make any investment or adopt any investment strategy. Before making an investment decision in relation to a fund, you should consider the relevant product disclosure statement (“PDS”), your circumstances and obtain financial advice. PDSs and Target Market Determinations (TMDs) for Betashares funds are available on the Betashares website (www.betashares.com.au).