In the space of a few short years the ETF industry has grown exponentially, and now holds a significant place in the investment landscape.

Funds have continued to flow out of managed funds and into ETFs, and there is no sign of this changing, as a new generation of investors comes to understand the benefits ETFs offer.

However, there is still some confusion around exactly how ETFs differ from traditional, unlisted, actively-managed funds.

Summary

- ETFs and managed funds are both made up of many different assets, offering diversification for investment portfolios

- Managed funds are usually actively managed to try to outperform a benchmark index

- ETFs are mostly passively managed, as they typically aim to track a benchmark index

- Managed funds tend to have higher management fees to pay for the skill and experience of the fund manager vs a traditional passive ETF which aims to track the benchmark index only

| ETFs | Managed Funds | |

| Diversification | Varies depending on the fund, but generally high, typically with exposure to an entire index | Varies depending on the fund |

| Expenses and Fees | Brokerage costs; lower management fees; bid/offer spreads | Buy/sell spreads, higher management fees, performance fees may also be charged |

| Pricing | Real time, intra-day | Varies from end of day to weekly or even monthly |

| Liquidity | Generally high, intra-day | Varies significantly from high (daily) to limited liquidity in closed end structures |

| Accessibility | Buy or sell units like any share on a stock exchange such as the Australian Securities Exchange (ASX) | Usually need to apply through an adviser for the fund manager – higher administrative burden |

| Transparency of underlying portfolio | Portfolio constituents visible daily | Rarely available daily – can be opaque |

Key differences explained

Diversification

A key benefit of many ETFs is the diversification benefits they can provide. Broad market or sector ETFs typically aim to track an index that serves as a benchmark for an entire sharemarket, or a market sector.

For example, A200 Australia 200 ETF provides exposure to the top 200 companies on the Australian sharemarket by market capitalisation, in a single trade. This diversification means that the risk when investing in an ETF is significantly lower than when investing in a single stock.

In the case of actively-managed funds, the fund manager selects which stocks to invest in. While the manager typically will invest in a portfolio of stocks, in many cases a managed fund will have more concentrated exposure compared to a broad market or sector ETF, potentially increasing the risk position from an investor’s perspective.

Expenses and fees

The cost differential between managed funds and ETFs is arguably one of the primary reasons for the growing popularity of ETFs. Managed funds typically charge significantly higher fees than ETFs offering similar exposure.

In addition, some managed funds charge investors ‘performance fees’ when their performance exceeds a specified benchmark. By comparison, most ETFs charge a simple management fee and no performance fees.

The management fees for Betashares’ broad market Australian shares ETF (A200), for example, are only 0.07% p.a.1 – whereas managed funds providing similar exposure to Australian shares can charge fees of between 1-2% p.a.

The primary reason for this dramatic cost differential is that most ETFs are passive funds, aiming to track the performance of an index, and so do not incur the costs of active management.

The impact of fees on your returns can be significant.

Example:

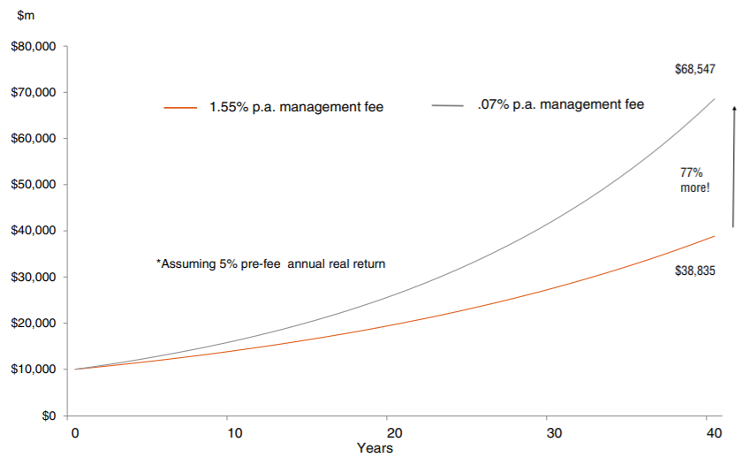

This chart compares the investment return of a low-fee passive ETF (A200) with that of an actively managed fund with a similar investment strategy (Australian shares), assuming:

- pre-fee returns of 5% p.a.

- a starting balance of $10,000

- A200’s management fee of 0.07% p.a.

- a typical active management fee of 1.55% p.a.[1] Morningstar

Over a 40-year period, the lower-fee ETF investment would grow to be worth $68,547, compared to the higher-fee managed fund investment’s closing value of $38,835. The low-fee option would be worth around $30,000, or 77%, more than the high-fee option at the end of this period. Seemingly small differences in management fees may not, at face value, appear to matter all that much, but they can have a significant effect on after-fee returns over time.

Investment Portfolio Value Over Time

Illustrative only. Assumed performance is not indicative of actual performance. Actual performance of A200 and the Australian sharemarket may differ.

Pricing

Another benefit of ETFs is their pricing transparency. Because they are traded on the ASX, you can see the price of your investment at any time during each trading day.

By comparison, pricing for managed funds is typically provided far less regularly, on a daily, weekly or even a monthly basis. Due to the intra-day pricing of ETFs, you should in most circumstances be able to readily determine your investment position.

Also, because they trade like shares, there is no minimum investment size for ETFs (aside from any minimum your broker may require), unlike many managed funds that have minimum investment amounts that can be quite sizeable.

Liquidity

As ETFs are traded on a stock exchange, you can normally buy or sell at any time during the trading day at prevailing market prices.

Also, ETFs are required to have at least one dedicated ‘market maker’, which seeks to ensure there will be sufficient liquidity to allow you to buy and sell your units, and also that the difference between the bid and offer is generally kept low.

Most managed funds do not provide intra-day liquidity. Investors will usually only be able to dispose of their investment at the end of each day or less frequently.

Accessibility

ETFs are traded like shares, so you can buy units through your broker or financial adviser. Once you have a brokerage account, no additional paperwork is required to trade ETFs. In comparison, managed funds are typically purchased off-market. Application forms are usually required, which can be time-consuming and complicated to fill out.

Transparency

One of the most oft-cited benefits of ETFs is the transparency of their underlying portfolios. For example, the Betashares website provides information on each of the portfolios held by Betashares ETFs, updated daily, so you can check what each fund holds at any time.

By comparison, many managed funds provide relatively little information about the holdings of the fund. Often you are given information only about the largest holdings, and even then, on a relatively infrequent basis, making it harder to understand exactly what underlying assets you are investing into.

ETF vs managed fund performance

Investors are increasingly comparing the performance of actively managed funds against passive options and are becoming increasingly aware of the impact on performance of the typically higher fees charged by active fund managers, relative to lower cost alternatives such as ETFs.

Active fund managers historically have not shown a great track record against their performance benchmarks.

Learn more

As more and more products are launched onto the Australian marketplace, you can diversify further into new investment strategies, new asset classes and new geographic regions – all as simply as buying a share.

To continue learning about ETFs, portfolio construction and investment strategies, visit the Education Centre.