ESG investing, otherwise known as sustainable investing, stands for Environmental, Social and Governance.

Key takeaways

- ESG stands for environmental, social, and governance.

- ESG investment is increasing in popularity, with the younger generation leading responsible investment in Australia.

- An increasing number of fund managers offer ethical investment options. An increasing number of managed funds employ ESG criteria.

What is ESG investing?

ESG investing allows socially conscious investors to adopt a more ethical investment practice based on environmental, social and governance criteria.

- Environment refers to how a company performs regarding nature and climate.

- Social refers to the management of employees, suppliers, and customers.

- Governance refers to company leadership, audits and shareholders.

Sustainable investment opportunities are increasing in popularity. Younger generations of investors push the rise in ESGs. According to reports, retail assets invested in ESG investments increased by 66% from June 2020 to June 2021.

ESG investing examples

The move to clean energy and social responsibility falls into three categories. Let’s look at some examples of ESG issues.

- Climate change

- Greenhouse gas emissions

- Carbon emissions, reducing emissions

- Clean energy

- Resource depletion

- Waste and pollution

- Water and energy efficiency

- Sustainable supply chain

- Deforestation

- Biodiversity

- Energy efficiency (renewable energy stocks)

- Social equity

- Working conditions

- Equal opportunities

- Human rights

- Consumer protection

- Employee diversity

- Health and safety

- Child labour and slavery commitment

- Community engagement

- Business ethics

- Executive pay (executive compensation)

- Global supply chains

- Board diversity and structure

- Bribery and corruption

- Corporate finance

- Political lobbying and donations

- Tax avoidance

How to measure ESG rating?

The UN offers six principles for responsible investment.

Look for reporting that follows the ESG standards as outlined by the Global Reporting Initiative. Another way is to look at a third-party ESG rating agency. Some examples include:

- MSCI ESG Ratings.

- Sustainalytics ESG Ratings.

- Dow Jones Sustainability Index (DJSI).

Investors might also like to highlight the ESG score of other companies when doing research. Investors can use the sustainable index that best aligns with their priorities and properly evaluate companies’ ESG policies.

SRI vs ESG

Although many people interchange ESG investing with SRI — they are not the same. The difference between ESG and SRI lies in the how portfolios are constructed.

- SRI portfolios are typically constructed by applying negative screens to a universe of securities. The weight of stocks in the portfolio is usually determined by a simple measure such as market capitalisation or equally weighted.

- The weighting of stocks in an ESG investing portfolio is typically informed by the ESG performance of the company. Typically, companies with better ESG performance characteristics are given a higher weight in the portfolio. The negative screens employed in ESG investing are rarely as stringent as an SRI product.

Some products can contain elements of both ESG investing and SRI. The Betashares Australian Sustainability Leaders ETF is an example of a product that contains elements of both SRI and ESG investing.

Why is socially responsible investing important?

Responsible investing is a choice that investors make to invest in companies that support causes that are good for the environment as a whole — not just those that increase their bottom line.

Socially conscious investors care about LGBTQ rights, workplace diversity, fair wages, corporate transparency, and renewable energy. SRI investing is a way for investors to reap the rewards of investing in companies committed to making the world better.

The benefits of ESG investing

According to Barrons, ESG investing could grow from US$8 trillion today to US$30 trillion by 2030. Here are some benefits to becoming an ESG investor.

ESG investors can seek positive returns from investing in companies/industries that matter to them. For example, clean technology.

Investors that have a firm conviction in a company/sector’s long-term growth can invest in companies/sectors that benefit from these subsidies and programs.

For example, the Australian Government’s carbon credits, solar credits, and carbon and biodiversity pilot (C+B Pilot) programs.

The risks of ESG investing

Every investment carries risk. Let’s look at some of the risks associated with investing in ESG Funds.

Although the UN has standardised principles, there are no universal ESG methodologies, reporting, and ratings. In fact, around 600 ESG approaches are being used around the globe today, which makes it hard to determine what companies and funds are doing.

If you want to begin investing in funds with a social impact, check how they score with ESG rating agencies. For example, some ESG investment portfolios include tobacco stocks or invest in fossil fuels. That said, certain third parties do offer ESG metrics like:

- Moody’s: In 2020, Moody’s updated its methods for assessing ESG risks, followed by a revision in 2021 for ESG credit impact scores.

- Fitch Ratings: The pilot program introduced ESG Vulnerability Scores (ESG.VS) to assess the vulnerability of entities’ creditworthiness.

There is very little long-term data on the risks and opportunities of ESG investment in companies. While historical financial performance has been strong, there is no guarantee this will continue in the future.

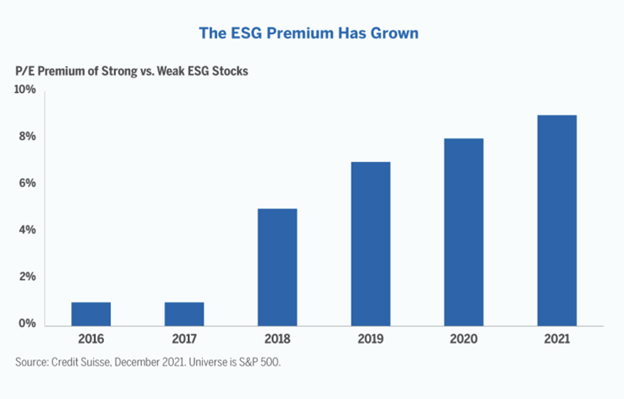

ESG premiums refer to the value placed on ESG companies — with many investors willing to pay more (a premium) for positive ESG records. From 2016 to 2021, the ESG premium grew substantially, with the price-to-earnings (P/E) ratio of strong ESG companies averaging 9% higher than the P/E ratio of weak ESG companies.

Image credit: Credit Suisse via Alger

The Australian Securities and Investments Commission (ASIC) is reviewing greenwashing. Greenwashing is when managed funds and superannuation funds incorrectly misrepresent or mislead investors and claim their products to be 100% green or ESG when they are only partially ESG.

Why is ESG investing growing in popularity?

The COVID-19 pandemic emphasised the importance of ESG issues by highlighting the need to think about how businesses can help solve a broader range of problems in society. The evolution of ESG investing indicates an improved understanding of corporate responsibility. The rise of shareholder activism implies that shareholders expect businesses to provide more than returns to their unitholders.

The Sixth Global and Institutional survey by Ernst and Young highlights that the world is racing towards a net-zero carbon economy. Since the pandemic, the survey found that 90% of investors attach greater importance to corporates’ ESG performance regarding their investment strategy and decision-making.

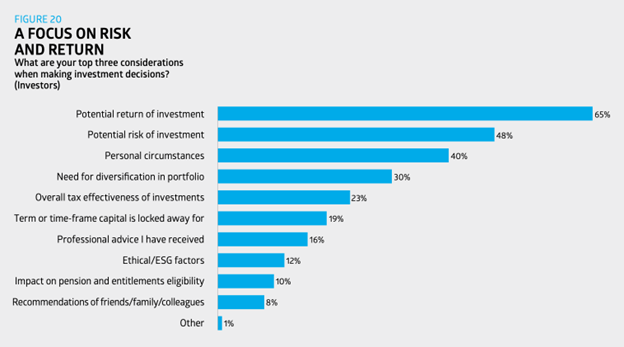

Australian investors are showing a greater appetite for ethical investments. The ASX Australian Investor Study in 2020 shows that 12% of participants surveyed say that ethical and ESG factors rank among their top three considerations for making investment decisions.

Source: ASX Australian Investor Study 2020 • Some figures may not total 100% due to rounding or multiple responses being allowed.

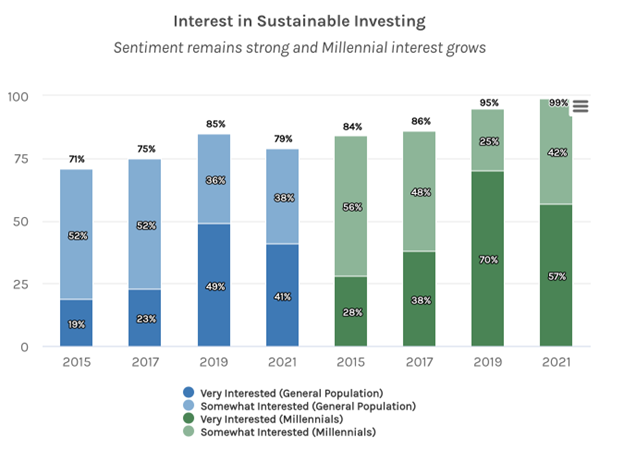

Gen Z-ers and millennials are enthusiastic about responsible investing and are committed to their values. According to Fortune Magazine, 95% of millennials are eager to use their financial capital for socially responsible investing.

Image credit: Morgan Stanley

Similarly, Morgan Stanley’s Institute for Sustainable Investing indicates that millennials’ sentiment and interest in sustainable investing is strong and continues to grow.

How to invest in ESG?

Building an ESG portfolio can be a complex process to understand each company’s global ESG policy and complete due diligence to assess the risk associated with each investment. Investors can also invest via an ethical ETF to ensure that the correct background work is done.

Some brokerage accounts have ESG screening tools. You can use negative screens to exclude companies that don’t match your values.

Seek advice from a registered financial adviser if you are unsure what stocks to buy. Alternatively, you could invest in an ETF consisting of ready-made diversified portfolios.

Choose an investment vehicle:

- Individual ESG stocks.

- ESG managed funds.

- Ethical ETFs.

ESG ETF List

Betashares’ wide range of ESG ETFs offers many green, environmentally sustainable, and ethical investment opportunities.

Final thoughts

ESG investing is an excellent way to gain returns and support companies whose values align with yours. The great thing about this is that investors have the potential to generate robust returns from ethical investing.

When institutional investors, consumers, and the government emphasise the importance of ESG, it forces companies to become better versions of themselves, making the world a better place. To learn more about ETFs and how they could help you achieve your investment goals, visit our Betashares Education Centre.

IMPORTANT INFORMATION

This information has been prepared by Betashares Capital Limited (ABN 78 139 566 868, AFSL 341181) (“Betashares”). This information is general only, is not personal financial advice, and is not a recommendation to buy, hold or sell any investment or adopt any particular investment strategy. It does not take into account any person’s financial objectives, situation or needs. Before making a decision to invest in any BetaShares Fund you should obtain and read a copy of the relevant PDS available from www.betashares.com.au or by calling 1300 487 577 and obtain financial advice in light of your individual circumstances. You may also wish to consider the relevant Target Market Determination (TMD) which sets out the class of consumers that comprise the target market for the Betashares Fund and is available at www.betashares.com.au/target-market-determinations. To the extent permitted by law Betashares accepts no liability for any loss from reliance on this information.