A Bitcoin ETF combines two prevalent forms of investment, ETFs and cryptocurrencies, into one package. A Bitcoin ETF aims to track the Bitcoin price, exposing investors to the digital asset without themselves directly holding the physical asset.

What is a Bitcoin ETF?

When investors refer to a ‘Bitcoin ETF,’ they are usually referring to a ‘spot Bitcoin ETF’.

A Bitcoin exchange-traded fund is an investment vehicle that seeks to track the price of Bitcoin. Bitcoin ETFs are traded on traditional regulated securities exchanges and are not available on cryptocurrency exchanges.

Any Bitcoin ETF offered in Australia is regulated by the Australian Securities and Investment Commission (ASIC). Investors can gain exposure to the digital asset without the hassle of having to sign up to a cryptocurrency exchange and creating a crypto wallet.

How does a Bitcoin ETF work?

Investors can gain access to Bitcoin directly or indirectly through two different methods: spot Bitcoin ETFs and Bitcoin futures ETFs. Here is how each product works.

A spot Bitcoin ETF is backed by physical Bitcoins that underpin the value of the ETF. If the value of the digital coins backing the ETF rises, the value of your investment can generally be expected to increase. In simple terms, if the price of Bitcoin increases, the investment should too.

A physically-backed Bitcoin ETF is the most direct way of investing in Bitcoin without buying Bitcoin on a crypto exchange and holding the coins. In this case, the fund holds them.

There are some negatives though. For example, investors are limited to trading an ETF within traditional market hours for regulated securities exchanges, unlike crypto markets which trade 24/7.

A Bitcoin futures ETF does not hold any Bitcoin as the underlying assets; instead, the fund holds futures contracts over Bitcoin instead of the actual coin.

A futures contract potentially allows investors to profit from rising prices through an agreement that sets a fixed price and a future date for delivery of an asset, or the cash equivalent value.

As a futures-based Bitcoin ETF does not hold Bitcoin, it is not directly exposed to the risks associated with storing the cryptocurrency.

Investing in Bitcoin futures can result in Bitcoin futures trading at a premium[1] or discount compared to the spot price, largely due to the process of “rolling” futures contracts at regular intervals in order to maintain investment exposure, which can result in gains or losses to the investor.

Bitcoin ETF approvals in the U.S. and Australia

Approvals in the U.S.

In 2017, the Securities and Exchange Commission (SEC) turned down[2] the first petition to launch a Bitcoin spot ETF. Later attempts with a futures-based fund had more success. The ProShares Bitcoin Strategy ETF, known as BITO, began trading[3] in October 2021.

BITO aims to track the price of Bitcoin futures contracts traded at the Chicago Mercantile Exchange (CME). According to news reports[4], BITO grew at ‘record speed’ following the launch, quickly reaching US$1 billion in assets.

In June of 2023, BlackRock’s iShares field paperwork for Spot Bitcoin ETF[5]. To date, the SEC has not approved a Bitcoin spot ETF. However, there is currently plenty of optimism that a BlackRock spot Bitcoin ETF will see approvals in late 2023.

In January of 2024, the SEC approves spot Bitcoin ETFs from financial institutions such as BlackRock, Ark Investments, 21Shares, Fidelity and Invesco, among others.

Approvals in Australia

Shortly after the launch of BITO, ASIC issued guidelines for the launch of ETFs that seek to track the price of digital assets such as Bitcoin and Ethereum. These guidelines addressed issues around market security, transparency, and pricing to better protect Australian investors.

On May 12, 2022, Australia’s first Bitcoin spot ETFs were launched, representing a significant milestone for Australian crypto investors.

It is noted that an Australian ETF providing exposure to companies supporting the crypto economy has been available to investors since November 2021. Betashares’ crypto equities ETF, ASX: CRYP, broke records for flows on launch day, reaching net inflows of A$39.7 million.

The advantages and disadvantages of a Bitcoin ETF

Spot Bitcoin ETF Advantages

- Investors can gain direct exposure to Bitcoin without having to sign up to a crypto exchange or create a wallet.

- Portfolio diversification.

- Investor protection regulation. Rather than investing in an unregulated off-market crypto exchange, investors in a spot Bitcoin ETF benefit from investing in a regulated product issued by a licensed issuer.

Spot Bitcoin ETF Disadvantages

- There are restrictions on trading hours with traditional exchanges, unlike crypto exchanges that operate 24/7.

- ETF management fees.

Futures Bitcoin ETF Advantages

- May have lower management fees due to ease of setting-up and lack of fees on custody and other requirements for spot ETFs

Futures Bitcoin ETF Disadvantages

- Potential for decay and divergence. See definitions for these terms at the end of this article.[6]

- The ETF does not hold physically-backed Bitcoin.

- There are restrictions on trading hours with traditional exchanges, unlike crypto exchanges that operate 24/7.

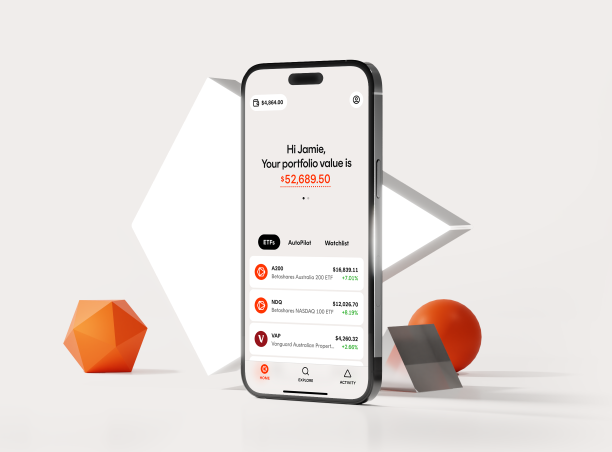

Betashares Bitcoin ETF (QBTC: ASX)

QBTC Bitcoin ETF offers a simple and regulated way to invest in the dynamic growth potential of the largest cryptocurrency, Bitcoin.

You can invest like any other ETF. No passwords to forget. No private keys to lose. Unlike cryptocurrency trading platforms, which can be subject to varying levels of regulation, QBTC is regulated in the same way as all ASX-traded ETFs.

The underlying holdings of Bitcoin are primarily held offline in cold storage by a leading global digital asset custodian. QBTC obtains exposure to cryptocurrency by investing in a NYSE-listed Bitcoin ETF run by the largest crypto index fund manager in the US, Bitwise.

How to invest in Bitcoin ETFs?

The Betashares Bitcoin ETF (QBTC) is traded on the ASX and is available through most online brokerage accounts.

You can invest with zero brokerage on Betashares Direct or find more information, such as the fund objective, key facts, holdings, performance, distributions, announcements, and resources, by visiting the fund page.

Invest in QBTC with zero brokerage

Final thoughts

A spot Bitcoin ETF provides institutional and retail investors with a mechanism to invest in Bitcoin without storing the keys for a Bitcoin wallet, signing up to a crypto exchange or worrying about the security of a crypto exchange.

The launch of Australia’s first spot Bitcoin ETFs is a milestone for Australian investors and the Bitcoin community. It provides investors with regulatory clarity, but it also opens the door[7] for superannuation funds wanting to invest in the sector.

Bitcoin remains a very volatile asset to invest in. To learn more about ETFs and how they could help you achieve your investment goals, visit our Betashares Education centre and subscribe to our new weekly crypto newsletter, Off the chain.

Betashares Crypto Equities ETF

Betashares also offers CRYP Crypto Innovators ETF , a crypto equities ETF which provides investors with focused exposure to the crypto economy, including companies building crypto mining equipment, crypto trading venues, and other key services that allow the crypto economy to thrive. You can invest in companies like Coinbase, RIOT Blockchain, MicroStrategy, Galaxy Digital in one single trade.

Glossary

Decay – this results in losses attributed to the underlying asset such as futures roll which may not be apparent in an underlying spot exposure.

Divergence – when the price of an asset is moving contrary to the underlying asset.

[1] https://www.investopedia.com/articles/investing/012215/how-invest-bitcoin-exchange-futures.asp

[2] https://www.cnbc.com/2017/05/25/bitcoin-flying-as-etf-gets-second-shot.html

[3] https://www.bloomberg.com/news/articles/2021-10-19/proshares-bitcoin-futures-etf-starts-trading-in-watershed-moment

[4] https://time.com/nextadvisor/investing/cryptocurrency/bitcoin-etf-approved/

[5] https://www.coindesk.com/markets/2023/06/16/first-mover-americas-blackrock-files-for-a-spot-bitcoin-etf/

[6] https://www.coindesk.com/policy/2021/10/28/4-reasons-not-to-invest-in-bitcoin-futures-etfs/

[7] https://www.smh.com.au/business/companies/win-win-situation-super-funds-are-opening-the-door-to-crypto-investments-20211219-p59irw.html

Investing in crypto assets or companies servicing crypto asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto asset markets.

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment.

Any investment in crypto assets or crypto-focused companies should only be considered as a very small component of an investor’s overall portfolio.

For more information on risks and other features of CRYP, please see the Target Market Determination (TMD) and Product Disclosure Statement, available at www.betashares.com.au. CRYP will not invest in crypto assets directly, and will not track price movements of any crypto assets.

IMPORTANT INFORMATION

Betashares Capital Limited (ABN 78 139 566 868, AFSL 341181) (“Betashares”) is the issuer of this information. This information is general only, is not personal financial advice, and is not a recommendation to buy, hold or sell any investment or adopt any particular investment strategy. It does not take into account any person’s financial objectives, situation or needs. Before making a decision to invest in any Betashares Fund you should obtain and read a copy of the relevant PDS available from www.betashares.com or by calling 1300 487 577 and obtain financial advice in light of your individual circumstances. You may also wish to consider the relevant Target Market Determination (TMD) which sets out the class of consumers that comprise the target market for the Betashares Fund and is available at www.betashares.com/target-market-determinations. To the extent permitted by law Betashares accepts no liability for any loss from reliance on this information.

Future results are impossible to predict and involve risks and uncertainties outside the control of Betashares. This information may include views, opinions, estimates and projections (“forward looking statements”) which are, by their very nature, subject to various risks and uncertainties. Actual events or results may differ materially, positively or negatively, from those reflected or contemplated in such statements. Readers must not place undue reliance on such statements. Betashares does not undertake any obligation to update forward looking statements to reflect events or circumstances after the date such statements are made or to reflect the occurrence of unanticipated events.