Whether you’re an investor seeking to build a robust income portfolio or are eager to explore the potential cash flow from listed investments, there is one fundamental metric that holds the key to success: the ‘dividend yield’, or ‘distribution yield’.

Understanding the distribution yield is paramount, as it plays a pivotal role in evaluating the income potential of various investment opportunities including exchange-traded funds (ETF) and other exchange-traded products (ETP) that invest in equities (shares).

What is dividend yield?

At its core, the distribution yield, represents the income generated by an equity ETF based on the dividends paid by the underlying holdings, which are passed through to unitholders in the form of distributions. Those distributions may comprise one or more of the following:

- Dividends from Australian and international equities

- Capital gains from the sale of investments within a fund

- Interest payments from cash

The amalgamation of those various sources of income that is paid to equity ETF investors is referred to as a distribution, which is used to calculate the distribution yield or just the ‘yield’ for the ETF.

How is the dividend yield calculated? Dividend yield formula

Just like the dividend yield of a share, the distribution yield for an ETF is expressed as a percentage of the ETF’s market price, providing investors with a useful measure of the income that the fund has been paying over a specified period (usually 12 months).

For instance, INCM Global Income Leaders ETF had a net asset value (or ‘NAV’) of $16.01 per unit on 1 July 2024 and paid distributions of 80 cents per unit over the preceding 12 months. Its dividend yield (or distribution yield) for that 12-month period would be calculated as follows:

- Distribution amount per unit / NAV per unit x 100%

- $0.80 / $16.01 x 100% = 4.9%

In this example, the ETF’s dividend yield is 4.9%, meaning an investor received a 4.9% return on their investment from distributions, based on the NAV per unit of $16.01.

It’s important to note dividend yields are always retrospective. Past dividend yield metrics and performance are not an indicator or guarantee of future distribution or dividend payments or performance.

Creating a sustainable dividend yield with ETFs

Many Australian investors have a love affair with income investing, given the popularity of shares that historically have paid relatively high dividend yields such as Commonwealth Bank, National Australia Bank, Wesfarmers, Telstra, BHP and Rio Tinto held in portfolios and self-managed superannuation funds (SMSF).

However, the landscape of income investing is evolving, with a number of key trends reshaping how investors approach building portfolios for a sustainable dividend yield:

- Growing choice of income ETFs: Purpose-built dividend and income ETFs on the ASX have grown over the last decade, simplifying investing in a diversified basket of income-paying assets with a single trade, saving time and costs from having to analyse and manage a large number of individual securities. Furthermore, many ETFs also offer distribution reinvestment plans (DRP), allowing investors to compound and grow their cash flows.

- Options beyond Australian equities: ETFs now offer a broader range of income opportunities, encompassing asset classes including fixed income, REITs, infrastructure securities, international shares, as well as thematic and strategy-based funds, providing other income solutions that were harder to access before the 2010s.

- Importance of income diversification: Past events and cycles, including the global financial crisis, the COVID-19 market crash, and the prolonged low-interest rate environment for much of the last 15 years, have underscored the importance of diversification in income investing. Relying on one asset class, such as Australian equities, could lead to increased cash flow volatility if distributions are cut.

Factors for assessing ETFs’ dividend yield sustainability

When integrating dividend ETFs into your investment strategy, keep these crucial factors in mind when assessing different products:

- Fees: Compare management fees to keep costs in check, however, it’s also critical to ensure any products under consideration align with your objectives and goals.

- Asset class: Understand which asset class(es) the ETF invests in. Equities may have the potential to offer growing but more volatile income streams, while bonds can provide more stable cash flows.

- Sector and regional exposures: Analyse the ETF’s sectors and regions of investment. For example, while a focus on the financial sector may have the potential to provide higher income, it could also bring heightened risk of reduced dividends during economic challenges.

- Holdings: Review at least the top underlying companies or securities the ETF invests in, and the track record these have in paying and increasing distributions over time.

- Strategy: Assess the ETF’s underlying index or strategy and how it selects securities for income potential and sustainability. Be mindful that certain ETFs employ options strategies, which may not suit all investors’ preferences or risk profiles.

Ideas for an attractive and sustainable dividend yield

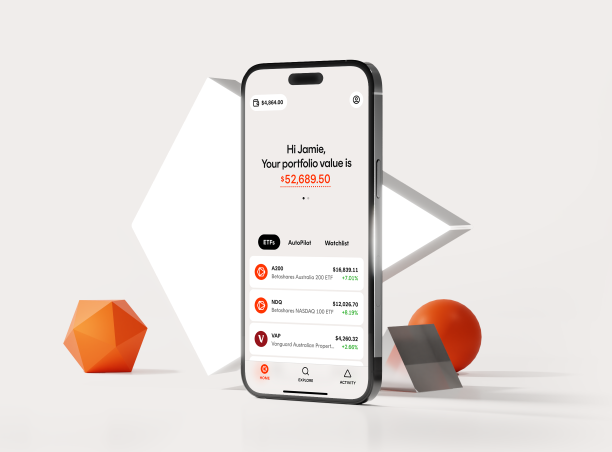

Betashares offers a number of solutions designed for investors seeking to create a sustainable dividend yield.

YMAX aims to generate attractive quarterly income and reduce the volatility of portfolio returns by implementing an equity income investment strategy over a portfolio of the 20 largest blue-chip shares listed on the ASX.

UMAX aims to generate attractive quarterly income and reduce the volatility of portfolio returns by implementing an equity income investment strategy over a portfolio of stocks comprising the S&P 500 Index.

QMAX aims to provide regular income along with exposure to a portfolio of the top 100 companies listed on the Nasdaq stock market. In addition, the Fund aims to provide lower overall volatility than the underlying Nasdaq-100 Index.

HVST aims to provide franked income surpassing the net income yield of the broad Australian share market on an annual basis by actively managing a portfolio of 40-60 domestic stocks.

INCM aims to generate attractive income from a diversified portfolio of 100 international shares that have been screened for their potential to generate regular and sustainable dividends, including 3M, IBM, Western Union and BMW.

Diversification remains a key tenet in navigating the complexities of the financial markets, especially after witnessing past events that underscore the importance of spreading income sources across various asset classes to protect cash flow.

The increasing popularity of ETFs offers investors a diverse range of solutions in the income toolbox. This opens up the possibility of crafting portfolios with a stronger and more resilient dividend yield that aligns better with your risk appetite and needs.

Investing involves risk. The value of an investment and income distributions can go down as well as up. An investment in a Betashares Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. Before making an investment decision you should consider the relevant Product Disclosure Statement and Target Market Determination (available at www.betashares.com.au) and your particular circumstances, and obtain financial advice.