What is diversification?

Diversification is a key concept in the world of investing, and is often touted as one of the golden rules for building a robust portfolio and long-term wealth creation.

At its core, diversification is the strategy of spreading your investments across different assets to reduce risk. The idea is simple: by not putting all your eggs in one basket, this approach ensures that your overall portfolio is less susceptible to significant impact or volatility resulting from the decline of a single asset or asset class.

In this blog, we’ll delve into why diversification matters in investing, explore how exchange-traded funds (ETFs) play a pivotal role in achieving diversification, and provide investment ideas for building a diversified portfolio.

Top 3 benefits of diversification

Diversification isn’t just a catchy phrase; it’s a strategy vindicated by behavioural science and data. Let’s dive a little deeper and explore three tangible benefits it can provide to your portfolio and to you as an investor.

#1 – Diversification helps spread your investments

Why does a cricket captain strategically arrange their team across the field? Even if they are familiar with the batter’s tendencies, there’s always uncertainty about where the ball will ultimately land. Hence, fielders are strategically positioned to cover all potential outcomes.

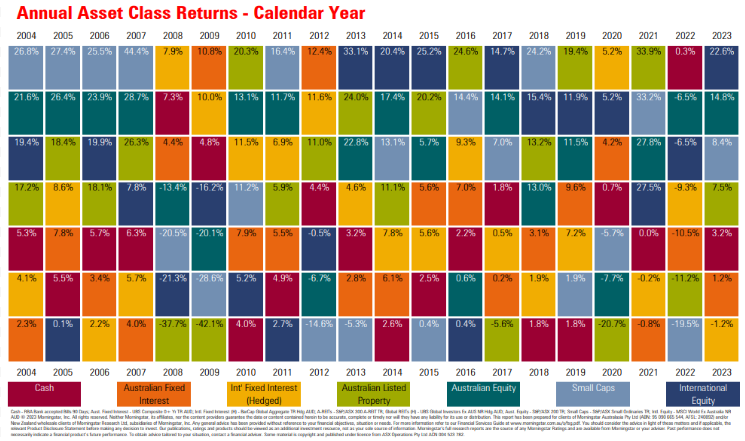

In the realm of investments, a similar principle applies. It’s impossible to predict with absolute certainty which asset class will excel in any given year, as illustrated by the annual asset class returns table below.

The data demonstrates that in certain years, growth assets like Australian small-caps and international equities knocked it out of the park, while in others, defensive investments like fixed interest and cash shone as equities got caught out amid market volatility.

This diversity in investment choices serves to balance risk and potential returns, ultimately helping to better fortify your investment strategy against unforeseeable fluctuations.

#2 – Diversification leads to increased opportunities

Australia only accounts for around 2% of the global equity market1. Hence, diversifying your portfolio to global markets can open up a world of investment opportunities. Furthermore, financial markets tend to follow cycles, with money flowing into specific areas, causing some assets, sectors or regions to outperform others.

These market cycles are evident in the yearly returns table above. For example, during the 2000s, Australian stocks thrived amid a commodities boom. Yet, in the 2010s, international stocks took the lead due to low interest rates benefiting tech and growth companies.

Now, think of an investor who exclusively holds Australian stocks. If international markets or bonds perform better in certain years, they might miss out on those returns. Diversifying your investments ensures your portfolio always has some exposure to sectors and markets with strong growth potential, while simultaneously avoiding home country bias, which could limit long term gains.

#3 – Diversification mitigates the emotional impact of investing

In the realm of behavioral science2, loss aversion is the tendency for humans to have a stronger aversion to losing money compared to their joy in gaining it. Imagine this: you might feel twice as bad about losing $10,000 as you feel good about gaining the same amount, as visualised below.

When one of your investments isn’t performing as well as expected, it can be a rather disconcerting experience. This discomfort might even tempt you into making impulsive decisions regarding that specific investment and your overall portfolio.

This is where diversification comes into play, acting as a ‘safety net’. Diversification can help to alleviate undue anxiety over a single underperforming asset because other investments in your portfolio may be able to help cushion those losses with better performance, providing more peace of mind and the potential to achieve better risk-adjusted returns over time.

Achieving diversification with ETFs

Having explored the concept and advantages of diversification, the next step is to understand how to put this strategy into action.

Building a diversified portfolio may seem daunting, but ETFs have simplified the process as they offer ‘pre-packaged’ assortments of investments or assets, making diversification more accessible, efficient and cost-effective.

For instance, consider a hypothetical investment portfolio whose equities allocation includes the Betashares Australia 200 ETF (A200) and Betashares Global Shares ETF (BGBL). These ETFs collectively grant exposure to indices comprising approximately 1,700 domestic and global companies, forming a strong core equity allocation.

Expanding into the defensive side of a portfolio, the inclusion of the Betashares Australian Composite Bond ETF (OZBD) introduces nearly 400 fixed-interest securities, while the Betashares High Interest Cash ETF (AAA) adds stability and income through bank deposit exposure.

However, the pivotal question remains: what is the optimal asset allocation within a diversified portfolio? The answer is unique for each individual investor, and may depend on factors including your age, objectives, and risk tolerance, and it may be appropriate to seek financial advice to help determine this.

With that in mind, Betashares’ diversified portfolios, easily accessible like any other Betashares ETF, can provide valuable insights into how professional investors navigate asset allocation for both growth-oriented and balanced portfolios.

Betashares Diversified All Growth ETF (DHHF)

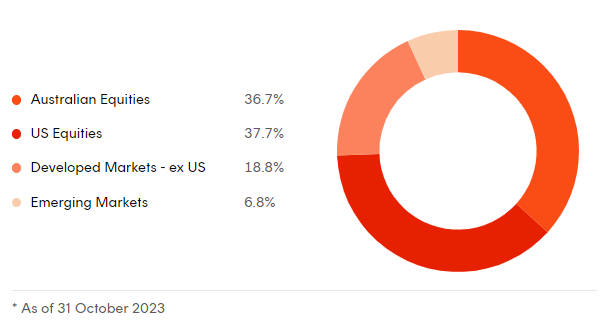

As shown in the graph below, DHHF’s portfolio is exclusively allocated to equities, encompassing large, mid, and small-cap stocks from Australia, global developed, and emerging markets. The ETF provides exposure to approximately 8,000 stocks listed on over 60 global exchanges, all wrapped up in a single ASX trade.

This ETF is designed to deliver cost-effective access to a diversified portfolio that may suit investors with a high risk tolerance and a penchant for the high growth potential of equities.

Betashares Ethical Diversified Balanced ETF (DBBF)

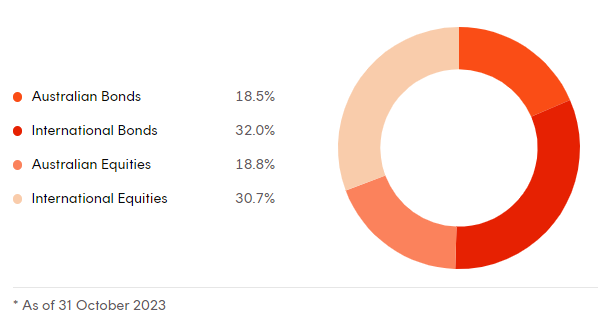

DBBF takes a balanced approach to managing risk, aiming for a 50% allocation to defensive assets, including Australian and international bonds, and a 50% allocation to growth assets, encompassing Australian and international shares, as shown in the graph below.

Additionally, DBBF is constructed using Betashares’ ethical ETFs, which combine positive climate leadership screens with a broad set of environmental, social and governance criteria. This approach may suit investors who prefer lower volatility, while still seeking growth potential, and aligning their investments with their ethical values.

Conclusion

In today’s ever-changing financial world, diversification remains a reliable strategy for building a strong portfolio and achieving long-term wealth.

ETFs have made diversification easier, offering accessible options for investors with varying risk preferences. However, creating a diversified portfolio is a personal journey, influenced by your specific financial goals and your comfort level with risk.

To ensure your investments align with your financial objectives, it’s crucial to understand your risk tolerance. Seeking quality financial advice can be a smart move to help you choose the right mix of assets.

Investing involves risk. The value of an investment and income distributions can go down as well as up. Before making an investment decision you should consider the relevant Product Disclosure Statement and Target Market Determination (available at www.betashares.com.au) and your particular circumstances, including your tolerance for risk, and obtain financial advice.