What is an ETF? Explaining Exchange Traded Funds

Be careful when yield types change

While yields on an investment can change over time, the type of yield used to assess the investment should remain consistent. Investors should be wary if a product frequently changes the yield measure displayed.

This article explains common yield measures applied to fixed interest (FI) securities, gives examples of when certain yield measures may be inappropriate, and provides a summary of which yields are considered most suitable for various types of FI securities.

What is yield?

Yield is a measure of the internal rate of return (IRR), and is typically used to assess fixed income securities. It is usually quoted as a percentage per annum based on the market price of the security. Yield is forward looking and can usually be calculated for the life of the security. Depending on the measure used, yield calculations take into account some or all the following:

- the current price of the security

- the coupon paid by the security

- repayment of the security’s face value

- timing of the payments

Floating rate yields

While yields on fixed rate securities can be calculated with a good degree of certainty, the nature of floating rate securities means that other measures can be more useful.

Floating rate securities are securities with coupons that change over time as the interest rate of the floating rate securities’ reference benchmark changes. The typical floating rate securities issued in AUD will be referenced to the AUD bank bill swap (BBSW) rate, and the floating rate securities’ coupon will be the BBSW rate plus a margin, with the coupon rate typically resetting on a quarterly basis immediately after a coupon is paid.

Given that the coupons paid over the life of floating rate securities are not fixed, a yield in the form of an IRR cannot be calculated with precision. As such, professional traders use spread margin measures, such as ‘discount margin’, when assessing the value of floating rate securities. Given this article’s focus on yield measures, spread measures for floating rate securities will be discussed in a future article.

Common types of yield

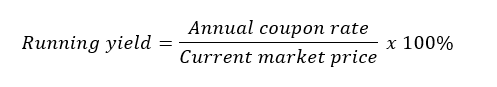

This is the income that an investor can expect to receive over the next 12 months based on the FI security’s coupon rate and expressed as a percentage of its current market price.

A running yield can be calculated on any security that pays a coupon. However, as it does not take into account capital gains/losses when the security is sold or matures, it is of limited use for securities with a pre-defined maturity date and redemption value.

Yield to maturity, and its variations (yield to call and yield to worst) are generally regarded as the most useful measures of return, as they take into account both regular income payments, and capital gains/losses. Capital gains/losses can arise even when a FI security is held to maturity; as the bond is purchased at a premium/discount to its face value, and over time the premium/discount is ‘pulled to its par or face value’ until at maturity the face value, which is lower/higher than the price paid, is returned to the investor.

YTM is the annualised total return an investor can lock in if they hold a bond to maturity and the bond does not default. YTM is generally considered the best and only sensible measure of yield for a vanilla bond with a fixed coupon, face value and maturity date.

Since it captures both income payments and the return of the bond’s face value at maturity, YTM enables you to compare securities with different coupons and different prices.

The formula for calculating YTC is identical to that used for YTM, with the only difference being the date of maturity.

YTC applies when a fixed coupon bond with a set face value has a call right attached, where the issuer of the bond can choose to buy back the bond at face value on the call date (an earlier date than maturity date), effectively resulting in early maturity of the bond. It is also possible for a bond to have multiple call dates, in which case YTC typically refers to the yield to first/earliest call date.

YTW is the lower of YTM or YTC, making this the most conservative measure of yield.

YTW is also the preferred yield measure used by professional fixed income investors when assessing the value of fixed coupon bonds with call rights. As alluded to above, it’s possible for bonds to have multiple call rights, in which case YTW refers to the return to whichever call date or maturity date produces the lowest yield.

Yields can also be expressed in real terms, where the impact of inflation is removed from the calculations by adjusting for CPI. When comparing inflation linked bonds (ILBs), real yields should always be used.

How is yield measured?

The below table summarises yield measures generally considered most appropriate based on security characteristics.

| Coupon/dividend | Maturity | Redemption value | Best yield measure | Example security |

|---|---|---|---|---|

| Fixed | Fixed | Fixed | Yield to maturity | Nominal government bond |

| Fixed | Callable | Fixed | Yield to worst | Fixed rate corporate bond |

| Linked to inflation | Fixed | Fixed | Real yield | Inflation linked government bond |

| Floating | Fixed | Fixed | Spread margin over reference benchmark | Floating rate notes |

| Floating | Callable/Perpetual | Uncertain | Spread margin over reference benchmark | Hybrid securities |

When a yield is more flattering

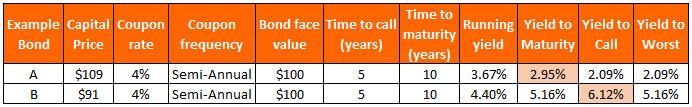

Investors should be alert to the inappropriate use of yield measures. Using callable bonds by way of example, the table below demonstrates when YTM or YTC looks higher and appears more flattering:

Bond A is trading at a premium (capital price above face value), hence YTM appears more attractive than YTC. YTM is higher as coupons above the yield can be received for longer with a later maturity. However, given that a price premium strongly increases the likelihood of the bond being called as it is cheaper for the issuer to call a bond at the par value of $100 rather than to buy back the bond on market at a premium over par, the most accurate yield measure is indicated by YTC.

Bond B is trading at a discount (capital price below face value), hence YTC looks more attractive. YTC is higher since the bond is redeemable by the issuer at the par value of $100, which is higher than the expected capital price at the time of the call. However, given that an issuer can always choose to buy-back their bonds on market at the cheaper capital price without exercising the call right, the price discount implies that YTM/YTW is the most relevant measure in this case.

In the case of Bond A, YTW is the same as YTC. In the case of Bond B, YTW is the same as YTM.

Bond indices

Measures of return can be applied not just to individual bonds, but also to bond indices and funds that aim to track those indices.

Taking a real-life example of the AusBond Composite Index, which is the main bond index in Australia – at the time of writing (January 21, 2022) this index had a YTW of 1.64% versus a running yield of 2.73%, due to the index including many high coupon government bonds issued a long time ago, when interest rates were much higher than now. Remember that YTW takes into account any expected capital gains or losses, while running yield does not.

This index includes an Australian government bond maturing on 15/07/2022 with a coupon of 5.75%, which has a running yield of 5.602% and a yield to maturity of 0.170% (as of January 21, 2022).

While the running yield might be 5.602%, it is practically impossible for this bond to achieve a total return of 5.602% over the next year. As each of the semi-annual coupons is paid in the time between now and maturity, the capital value of the bond can be expected to fall by approximately the amount of the coupon, and so what the investor receives in income, they will (approximately) lose in capital value. In this instance, the running yield is not at all reflective of expected return.

Similarly, the most reasonable measure of expected return for the index will be the YTW – not the running yield.

Conclusion

When looking at fixed income securities or funds, yield measures are useful tools to help investors’ evaluations. However, it is important that investors are familiar with the different types of yield measures and the situations when each of these yield measures best applies.

Investors should be wary of an apparently attractive, high yield number, if this yield measure is not appropriate and disguises a lower but more representative yield.

Finally, investors should understand that just looking at yields does not give you a good picture of total return!

Yields should be considered in conjunction with other key factors, such as credit rating/quality, the seniority or rank of securities, shape of the yield curve and potential for roll-down return. This is even more so the case for floating rate securities, as an exact yield cannot be calculated. We will discuss these and other important factors relevant to fixed income returns in future articles as part of our Fixed Income series.