The ultimate guide to dividend ETFs

What is an ETF and how do they work?

An ETF is an open-ended investment fund, similar to a traditional managed fund, but which can be bought or sold like any share on the ASX. Most ETFs aim to closely track the performance of an index or underlying asset, and seek to provide the returns of that index or asset – less any fees and costs.

Unlike buying a single asset, such as a stock, an ETF provides access to a portfolio of assets in one trade which helps to add instant diversification to a portfolio.

Offering access to almost every corner of the market and every major asset class, Exchange Traded Funds are one of the fastest growing categories of investment products in the world.

How many Australian investors use ETFs?

The 2024 Betashares & Investment Trends ETF Report found there are now 2.2 million investors in Australia holding ETFs in their portfolio, up from 2 million last year. There was an estimated 273,000 unique individuals making their first ETF investment in the past year.

New investors state “diversification” being one of the top motivators for using ETFs. Other key motivators include “saving time compared to picking individual stocks”, “easy to buy and sell” and “provides a good portfolio core”.

Advantages of ETFs

Here’s why more and more Australian investors are turning to ETFs to help them achieve their financial objectives.

Diversification: ETFs help investors gain exposure to a range of investment strategies, geographic regions and asset classes.

Access: Investors can buy and sell ETFs on the ASX like any normal shares through online brokers and investment platforms. With platforms like Betashares direct, you can buy and ETFs with zero brokerage fees.

Liquidity: ETFs are traded on the Australian Securities Exchange (ASX) and can be bought and sold during the trading day.

Transparency: Information relating to ETFs, including underlying portfolio holdings and fees, can be accessed at any time via the fund manager’s website.

Cost-effective: Because ETFs either aim to simply track the performance of an index or asset class or rules-based methodology, there are no in-built ‘active management’ fees to worry about.

SMSF friendly: Just like shares, ETFs are eligible to be bought inside Self-Managed Super Funds (SMSFs), and the popularity of ETFs has been growing strongly with this client base. Create a SMSF investment strategy using ETFs.

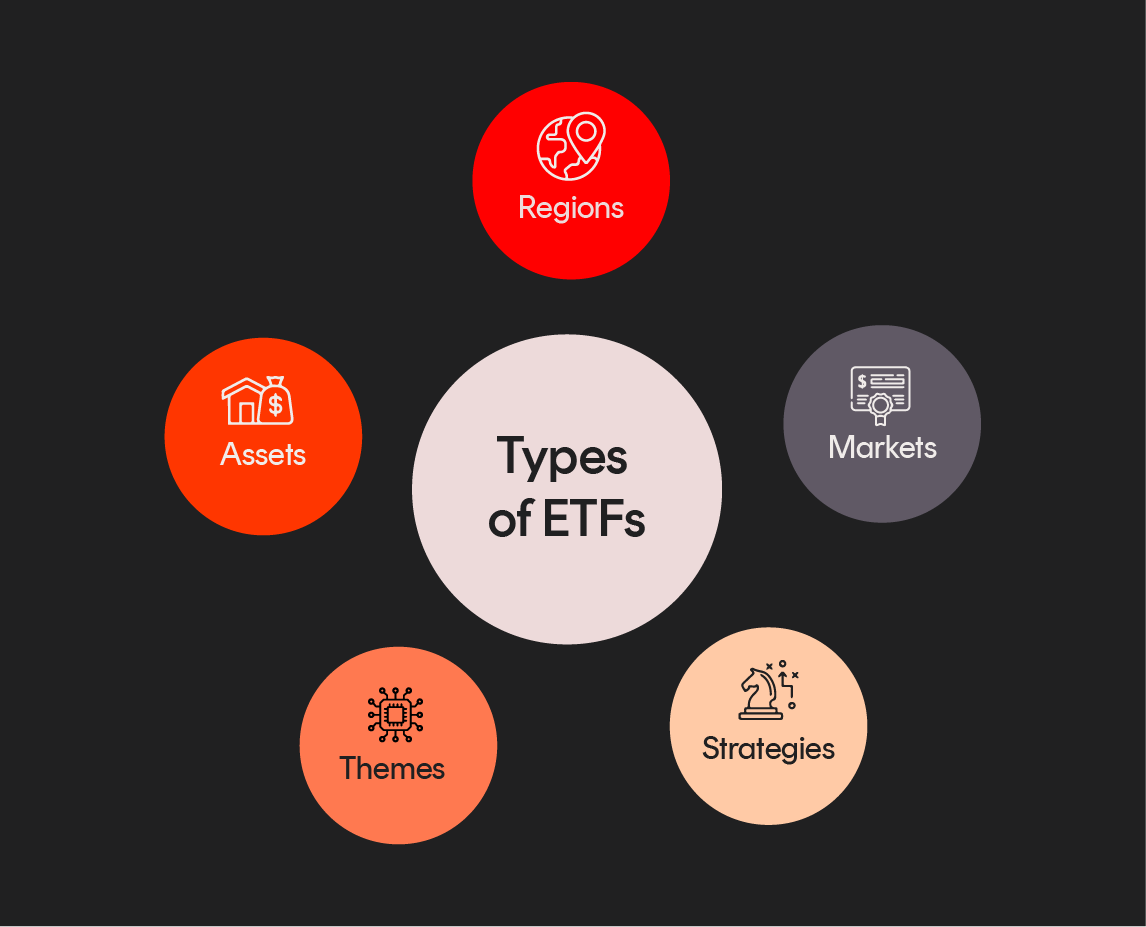

What can you invest in through ETFs?

With hundreds of ETFs available on the ASX, investors have a plethora of choice to build a diversified portfolio that suits their needs. Established and emerging categories of ETFs include:

Australian shares and sectors: Aussie large caps to financials, there is an abundance of Australian ETFs providing exposure to the broad Australian market, specific sectors and objectives such as generating a high level of income.

International shares and sectors: International ETFs which offer exposure to a range global equities are increasingly being recognized by investors for their growth potential and diversification benefits. There are funds offering exposure to the S&P 500 as well as global healthcare, technology and cybersecurity stocks, sectors which are under-represented on the Australian market.

Property securities: Investors seeking income and property diversification opportunities can find ETFs such as RINC Betashares Martin Currie Real Income Fund (managed fund) that invest in both Australian and global real estate investment trusts.

Fixed income: These ETFs wrap up bonds across a specific or range of different sectors including government debt (government bonds) and corporate securities (corporate bonds) for investors’ convenience while paying regular distributions.

Precious metals and commodities: For investors seeking exposure to gold, oil or resources stocks, commodities ETFs offer the ability to obtain targeted exposure for diversification.

Foreign currencies: Have a view on where the U.S. Dollar, Pound or Euro is going? Foreign currency ETFs can help investors bypass the inconvenience and complexity of trading in FX markets.

Digital assets: The crypto economy has been growing strongly led by the performance of Bitcoin and Ethereum. New digital assets ETFs, such as Betashares Crypto Innovators ETF, offer the opportunity to invest in companies building the crypto universe. When investors refer to a ‘Bitcoin ETF,’ they are usually referring to a ‘spot Bitcoin ETF’.

Diversified ETFs: With diversified ETFs, such as Betashares Diversified All Growth ETF, investors can gain exposure to several asset classes in one hit at a level of risk that suits their appetite. These products can save investors’ time as the asset allocation and investment selection is completed for them by the ETF provider.

Geared investment funds: Otherwise known as leveraged funds, offer a cost-effective way to leverage your exposure to the sharemarket. These are actually ‘managed funds’, and not ‘ETFs’. These geared funds offer opportunity to increase investment exposure but also carry more risk.

ETF investment strategies: how do investors use ETFs?

ETFs offer investors flexibility for a wide range of investment strategies. Some examples include:

Portfolio construction and asset allocation: When it comes to asset allocation, ETFs can be used as core holdings in a portfolio and as building blocks for portfolio construction. For example: A ‘sector’ ETF can be used by an investor in order to simply obtain exposure to a particular industry sector such as healthcare, energy or technology companies.

Core Satellite strategy: Core-satellite investing involves an allocation to diversified investments, whether broad domestic or global exposures, which are essentially bought and held for the long term – this is known as the ‘core’ component.

Along with this ‘core’, more tactical positions are added to the portfolio as the more ‘actively managed’ portion – these positions form the ‘satellite’ component and can be, for example, specific regional or sector exposures

Dollar cost averaging: Otherwise known as DCA, involves investing the same amount of money at regular intervals, for example monthly or quarterly – without regard to market movements. This strategy assists in mitigating market timing risk and can help you gradually accumulate wealth.

Betashares has a large selection of ETFs and other exchange tradeable funds that cater to different investor needs.

View all our funds

ETFs vs index funds and managed funds: What’s the difference?

There are distinct differences between how ETFs operate relative to unlisted index and managed funds, and these are important to consider in the context of building a portfolio. See more on ETFs vs Index Funds.

| Considerations | ETFs | Unlisted index and managed funds |

| Pricing | A key defining feature of ETFs is that they trade like stocks on the sharemarket and can be bought and sold during ASX trading hours. | Index and managed funds prices are updated once at the end of each trading day, meaning investors have less flexibility around purchasing and selling units at set prices. |

| Simplicity | Because ETFs trade on the stock exchange, an investor with a brokerage account is free to buy different funds, much like shopping for different items at a supermarket with just a few clicks. | Index and managed funds are generally bought and sold directly from the issuer. The process to “purchase” or “redeem” units in a fund can also be onerous and may require completing paper-based application forms. |

| Minimum trade size | Like ordinary shares, the minimum initial investment in an ETF begins at $500 for most brokers (however, platforms like Betashares Direct allow you to invest from as little as $10), making it affordable to start your investing journey. | Depending on the fund, a minimum investment requirement of $5,000 or more is typical across unlisted index and managed funds, with subsequent minimum incremental investments of $500 or more potentially applying. |

| Transaction costs | Brokerage commissions and bid-ask spreads apply on each trade. With Betashares Direct, there is zero brokerage on ETFs. | No brokerage fees apply, however, entry and exit costs do. |

Types of ETFs: Active vs passive ETFs

ETFs can either be passively or actively managed, though the former dominates in Australia in terms of popularity.

Passive ETFs: These products are designed purely to match a specific index’s performance before fees. Passive ETFs don’t use professional stock pickers and research specialists to build portfolios and time markets with a view to outperform the benchmark and thus have considerably lower running costs. They also publish all their holdings on a daily basis.

Active ETFs: Actively managed ETFs on the other hand aim to beat the index or achieve a specific return objective by utilizing a significantly higher level of human resources and trading activity. While they can potentially generate higher returns, they also generally charge higher fees for the privilege. Unlike passive ETFs, active funds don’t disclose holdings daily to keep their trades confidential.

See 21 years of data on active vs passive investments in the SPIVA report.

Investing in ETFs: how to buy and sell

There are three primary ways of buying and selling ETFs:

Via an online broker: Buying and selling an ETF is very straightforward. ETFs like ASX: NDQ, A200, ETHI and more trade exactly like shares, so if you are able to buy and sell shares than you are able to buy and sell ETFs! Like shares, ETFs can be bought and sold at any time during the ASX trading day through a stockbroker.

That means there is no need open a separate trading account beyond your existing share brokerage account. Once your brokerage account is established, the ASX ticker of the fund is used to make a purchase or sale, without the need for any additional paperwork. In addition, this also means there is no minimum investment requirement, beyond that stipulated by your broker.

If you don’t have an online brokerage account, simply follow the sign-up procedures and once your account is activated and funded, you can start trading! Invest with Betashares Direct today.

Via a traditional broker: A traditional or full-service broker generally costs more than an online broker but provides a broader array of services beyond just buying and selling ETFs and other securities. They can provide research, financial planning, estate, and superannuation services as well as access to initial public offerings.

Via a financial adviser: Many financial planning firms are increasingly adopting ETFs as part of their service offering. While using a professional adviser comes at a higher cost, they’ll be able to build a portfolio based on your goals and risk tolerance and manage your portfolio on your behalf.

A cheaper alternative to financial advice is to consider a robo-advisor, which are tech companies that provide automatic online investing advice. These services get you to answer questions about your financial objectives and create a customized portfolio of ETFs and other funds that you can invest in (for a fee). The robo-advisor provides regular updates about the performance of your strategy and rebalances your portfolio for you.

How do ETF fees work?

Like all managed funds, ETFs charge fees and incur costs. However, they tend to be a cost-effective managed investment option. Most ETFs are passive investments that do not charge the high active management fees charged by traditional managed funds. Learn more about ETF fees.

What are the risks of ETFs?

The primary risks of investing in ETFs come from the investment risk associated with investing in the asset class or strategy that the ETF provides access to.

For example, if you invest in an ETF which provides exposure to the broad Australian sharemarket, then movements up or down in the sharemarket will generally lead to positive or negative investment performance in the ETF. For more information on the risks of a particular ETF, please see the relevant Product Disclosure Statement (PDS).

ETF structure explained

Investors should also understand whether an ETF is physical or synthetic as this constitutes part of its risk profile. There are two main types of ETFs:

Physical ETFs: Physical ETFs own some or all of the underlying securities that make up a particular benchmark. For example, the Betashares Australia 200 ETF owns all of the underlying securities of the Solactive Australia 200 Index in order to accurately replicate its performance.

Synthetic ETFs: Synthetic ETFs on the other hand use derivatives to provide exposure to an asset class that is hard to access and own physically. For example, instead of owning barrels of crude oil, a synthetic ETF tracking oil would hold a series of futures contracts that reflect changes in the price of the commodity. As a result, they generally have a higher risk profile and will face different types of risks than their physical counterparts.

In Australia, synthetic products such as the Betashares Crude Oil Index ETF – Currency Hedged (synthetic) must have “synthetic” marked in parentheses to help investors easily identify their structure.

What to consider before buying an ETF

Not all ETFs are made equal. The following key factors should be considered when assessing which provider and fund you put your money in.

Reputation of the provider: It’s important to consider how long the provider has been around, their track record and assets under management. Betashares is now trusted by over 1 million Australian investors and their adviser with over $42 billion in funds under management.

Quality of exposure: What is the methodology of the index used by the ETF? Look for ETF issuers that work with reputable index providers. Some common and well known index providers are Standard & Poor’s, Nasdaq and Solactive.

Total cost of ownership: Compare the complete cost of buying and holding ETFs against similar products – including management fees and the transaction charges it typically incurs.

Tracking error: Take note of how well the ETF provider has done its job in replicating the performance of the index it’s meant to track. Due to fees, passive ETFs by their nature cannot beat the index, but their returns should be very close to it.

Domicile: The domicile, or location of the fund you are investing in is important. An Australian domiciled ETF can help you avoid administrative headaches like the W-8 BEN form that must be filled out when investing in United States domiciled funds.

Where are my assets held?

ETFs are regulated unit trusts whose units trade on the ASX much like shares. They have the same legal structure as traditional managed funds and are subject to the highest form of investor protection regulation available in Australia.

The assets underlying ETFs do not form part of the assets of the product issuer. Rather, they are held on trust for the benefit of unitholders. As an extra layer of separation, the assets are normally held by an independent third party custodian appointed by the ETF issuer. This essentially means ETF assets are not available to creditors of the issuer in the unlikely event of a default.

ETF liquidity

The open-ended structure of an ETF means that the liquidity of the ETF goes significantly beyond the ‘on-screen’ volume an investor may see on the trading screen. In fact, the liquidity of an ETF is generally at least as much as the liquidity of the underlying assets held by the ETF.

Examples of Betashares most popular ETFs

FAQs

ETF stands for Exchange-Traded Fund.

An ETF is a type of managed fund. Like traditional managed funds, ETFs can invest into many different underlying assets, offering potential diversification benefits for investment portfolios. Traditional managed funds are usually actively managed to try to outperform a benchmark index. ETFs are mostly passively managed, as they and typically aim to track a benchmark index. Traditional managed funds tend to have higher management fees to pay for their active management approach, while ETFs tend to have lower fees, due to their passive, index-tracking approach. Learn more about ETFs vs Managed Funds.

Net asset value (NAV) represents the value of the underlying assets or holdings of the ETF, after all fees, costs and other liabilities have been deducted. NAV is not the same as market price. The market price of an ETF is the price at which ETF units are bought and sold in the course of a day’s trade on the exchange. Learn more about NAV.

While Betashares cannot control or influence the execution of your ETF trade, we would like to highlight the following considerations, for you to keep in mind:

Before placing your ETF trade order, check with your broker (or look at “market depth” if using an online broker) to make sure you have accurate bid-offer information. If there is an iNAV associated with the Fund, you should check this against the price at which you are planning on buying or selling the ETF to make sure you are getting close to ‘fair value’.

It may be prudent to use limit orders rather than market orders to make sure you get the price you are expecting. Limit orders allow investors to specify a buy or sell price and will only get executed at the stipulated price.

Avoid trading in the first and last 10 minutes of the trading day – at this stage there is generally a lot more volatility in share prices which may lead to wider ‘buy-sell’ spreads.

For more information on trading ETFs, click here.

ETFs invest in securities and other assets, and seek to provide distributions based on those underlying securities or assets. Depending on the ETF, distributions may be paid on a monthly, quarterly, half-yearly or annual basis. Depending on the ETF’s investment strategy, the distribution could be made up of dividends, interest, and/or capital gains that are realised by the ETF on the sale of underlying assets. See our guide to dividend ETFs or Dividend/Distribution Reinvestment Plan (DRP).