Want to read it later?

Send the lesson to your inbox

Lesson 3 transcript

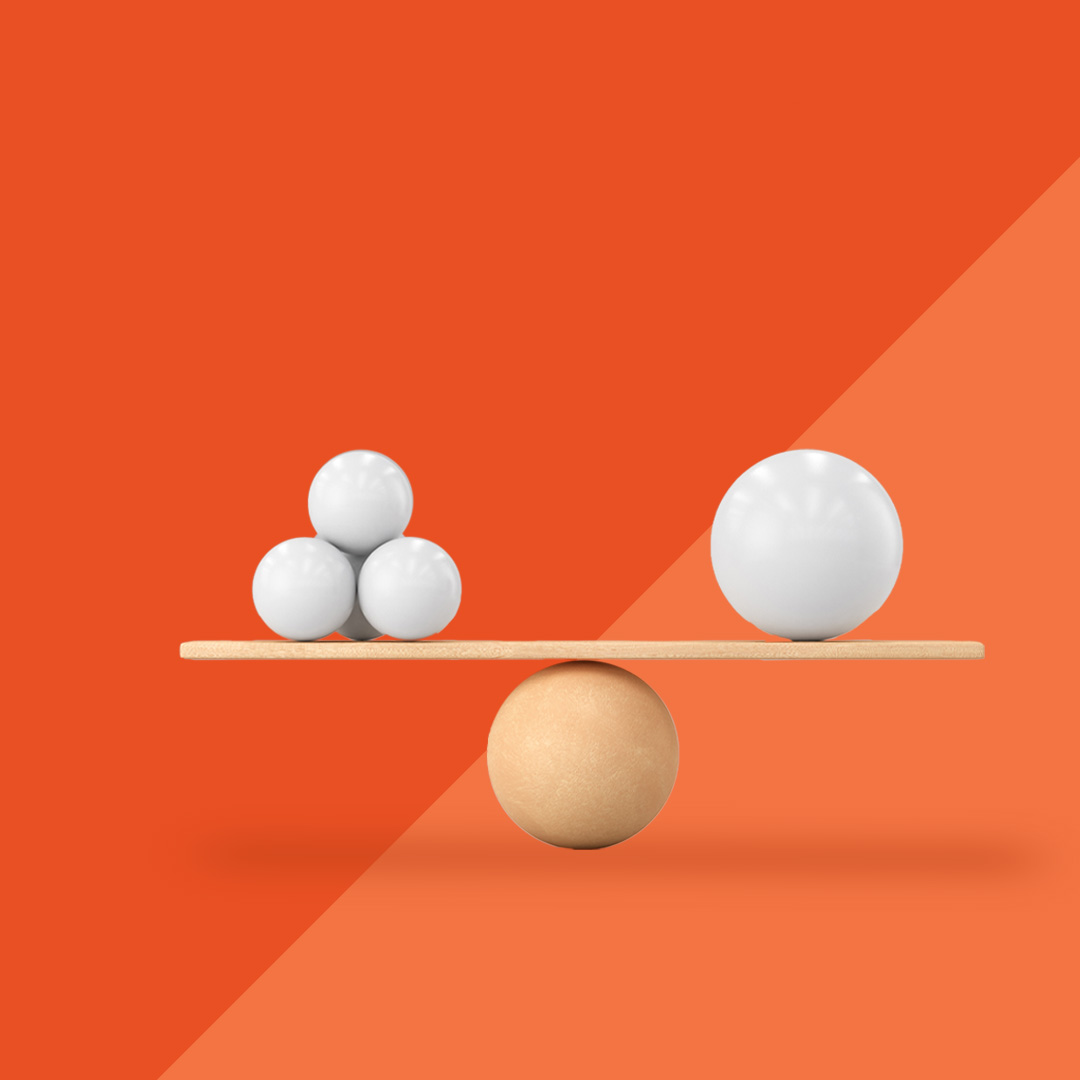

People sometimes use the words ‘investing’ and ‘trading’ interchangeably, but while they both refer to making money in the sharemarket, traders and investors generally pursue that goal in different ways.

Investing

- Someone who buys shares in a company with the goal to grow their investment over time

- Focused on long-term gains

- Generally don’t spend all day monitoring their portfolio and market movements

- Generally less comfortable with risk

Trading

- Someone who buys and sells shares quickly to try and profit from small price changes

- Focused on short-term profits

- Dedicate daily attention to their portfolio and market movements

- Generally exposed to higher risk

Time in the market vs timing the market

Another way to look at these different approaches is time in the market vs timing the market.

A person who tries to ‘time the market’, typically is the opposite to taking a long-term buy and hold approach, whereby you may not be so fixated on price when first investing, and typically buy into the market with the intention of holding your investments for multiple years.

Example:

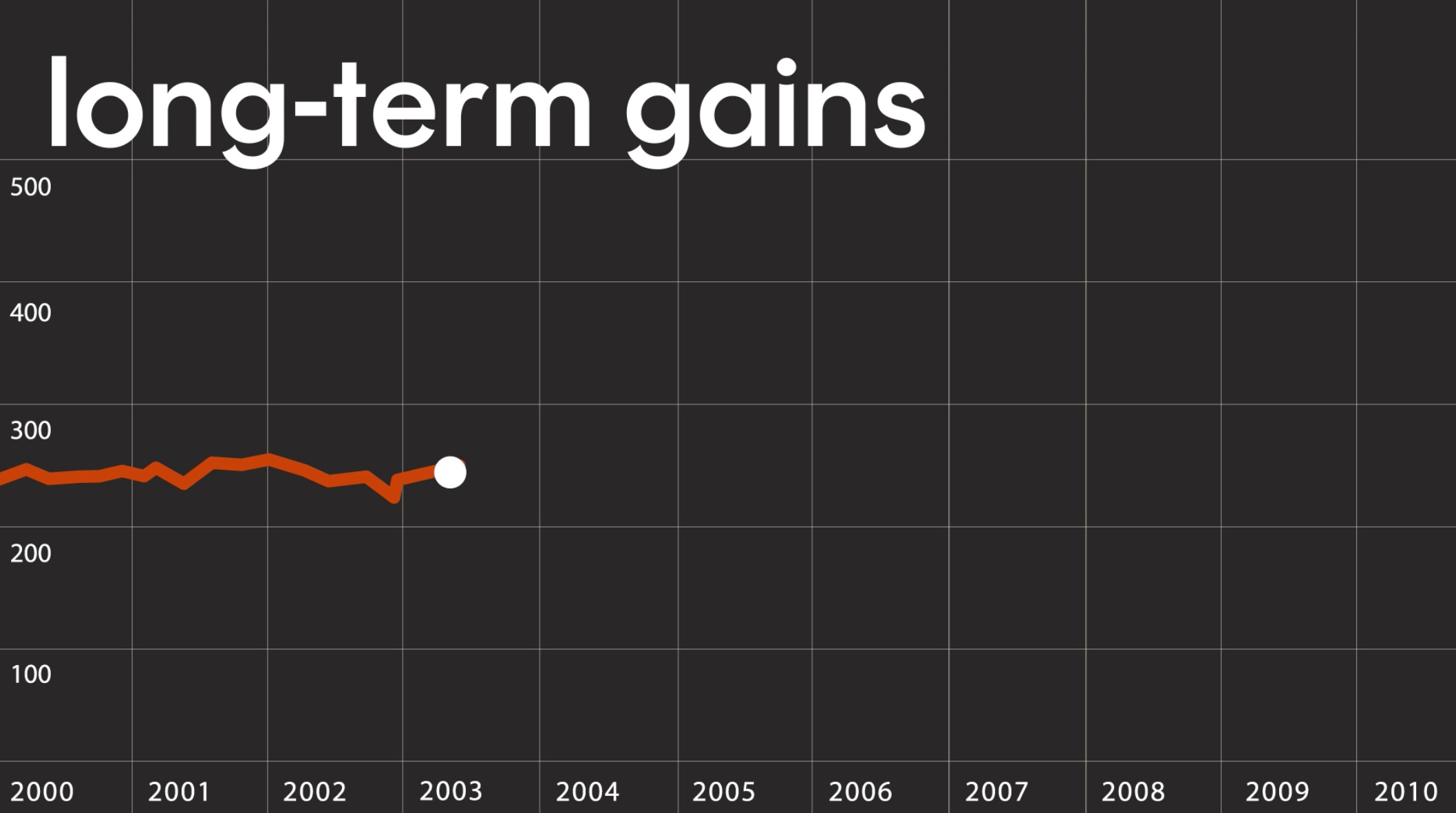

There are many studies, conducted over a range of timeframes and in sharemarkets around the world, showing the impact on investment returns of missing out on the best few days for the market in a given period.

These studies consistently show that not being invested on just a few of the big ‘up’ days for the market can have a dramatic impact on your portfolio.

One study [1] looked at the US sharemarket over a period of nearly 40 years, and calculated the impact of missing the best 5, 10, 30 and 50 days in that period.

An investor who hypothetically invested $10,000 into the US sharemarket (known as the S&P 500 Index) on 1 January 1980 and stayed fully invested would have seen their money grow to almost $660,000 by 31 December 2018.

Missing out on just the five best days during that period would have reduced their returns by 35%, while missing out on the 10 best days would have cut returns by more than half.

[1] Fidelity

So how to decide on the approach that is right for you?

There can be a place in your portfolio for both approaches – it simply comes down to how much money and time you might want to devote towards each approach.

Some people prefer to take more of a ‘set and forget’, long-term approach, where they’re happy to leave their investments to grow over many years – even decades – and comfortable with the fact that markets tend to rise and fall in the short term.

Other people may want to dedicate more time and focus to investing, and so may have a portion of their portfolio devoted to trading to achieve short-term profits.

Some people will use elements from both disciplines at different times, depending on their financial goals or different stages of life.

Understanding your mindset and recognising that there are different ways to approach investing in the sharemarket, can help you become a better investor.

Four questions to ask yourself:

- Are you looking for long-term growth or a short-term win?

- How much time do you have to manage your investments?

- How much risk are you comfortable with?

- Are you more comfortable trying to understand the long-term prospects of a company, or are you more interested in whether a share price will move in the short term?