Want to read it later?

Send the lesson to your inbox

Lesson 1 transcript

Many people consider saving and investing as alternatives. But it’s really the way you combine saving and investing which can have a powerful effect on your wealth.

Saving typically results in earning a lower return but with limited risk. In contrast, investing allows you the opportunity to earn a higher return, but you take on the risk of loss in order to do so.

While saving and investing both involve setting money aside to save for the future, there are some key differences to understand.

If you were to keep your money in a piggy bank and not invest, you’d never have more money than what you’ve stashed away yourself. And if you were to keep your money in a bank with low interest, it will generally only grow by a fairly low margin.

The goal of investing is to make more money than you originally put towards the investment.

Saving |

Investing |

| Short term

Typically for smaller, shorter-term goals like saving for a purchase or for emergencies |

Long-term

Investing may help you reach long-term goals, such as paying for a child’s education, starting a business or planning for retirement |

| Ready access to cash

A savings account gives you access to cash when you need it |

Longer wait to access invested funds

When you invest, it can take a few more days to access your money, in the process of selling your shares and receiving the cash – also known as ‘liquidating your assets’ – compared to a savings account |

| Involves minimal risk

Savings – in cash under your mattress or in a bank – are sometimes guaranteed, while investments are not |

Always involves risk

Investing doesn’t guarantee a return, and it is possible to lose some or all of the funds invested |

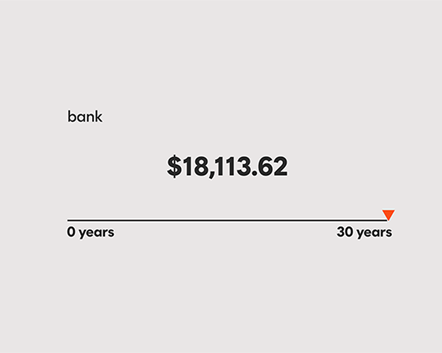

Saving vs investing - How do the numbers stack up?

The numbers are pretty stark when you compare saving with investing over many years.

$10,000 in savings over 30 years

If you had $10,000 saved in a bank account earning 2% interest per annum over 30 years, it would grow to $18,113.62 – that’s only $8,113.62 earned.

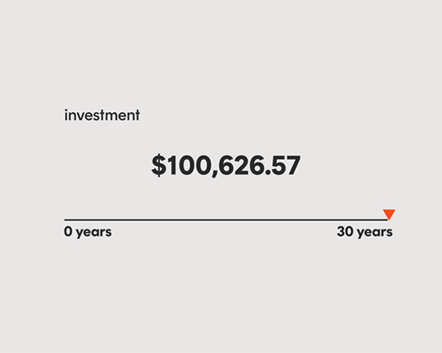

$10,000 invested over 30 years

A $10,000 investment that earns 8% per annum over 30 years will grow to $100,626.57 – multiplying more than five times over.

Hypothetical example provided for illustrative purposes only. Past performance is not indicative of future performance. Not a recommendation to make any investment or adopt any investment strategy.

Compound interest - the ‘Eighth Wonder of the World’

The main reason for the dramatic difference to the example above is the rate at which interest compounds. Compounding is one of the fundamental components of wealth creation and a phenomenon famously coined “the eighth wonder of the world”.

You can think of compound interest as a self-fulfilling cycle, where your investment earns interest, and then your interest earns interest, creating a snowball effect.

Compounding means that your wealth can grow faster over time, because you’re not only getting returns on your initial investment, you’re also getting returns on your returns.

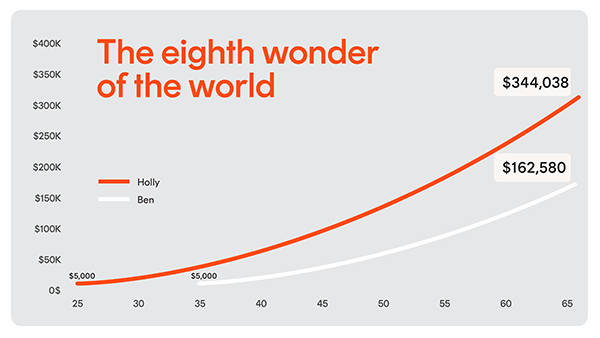

While any investor can take advantage of compounding, the greatest benefit goes to those who get started early. The best way to explain this is through a simple case study.

As you can see in the hypothetical on the right-hand side – delaying the start of your investment journey by 10 years could make quite the difference in the world of compounding.

Holly has only contributed $12,000 more to her investing ‘pot’ (10 years x 12 months x $100) – but ends up with more than double Ben’s final nest egg.

If you give your money enough time to compound and add to it along the way, it can grow into much greater wealth.

Source: Betashares. Hypothetical example provided for illustrative purposes only. Past performance is not indicative of future performance. Not a recommendation to make any investment or adopt any investment strategy.

So when to save and when to invest?

There is a time and place for both, so you should base your decision on your situation. A rule of thumb suggests your decision should come down to two things – time and risk.

If you think you need ready access to your money within a couple of years – like for a house deposit or your own business – it may make more sense to save. This is because if the sharemarket falls, an investment may not have enough time to recover before you need the funds.

But if you have a longer period of time before you might need to draw on your money – such as three or more years – then investing may make more sense.

Generally, the longer your timeline, the more important it is to consider investing vs saving.