Want to read it later?

Send this lesson to your inbox

Lesson 4 transcript

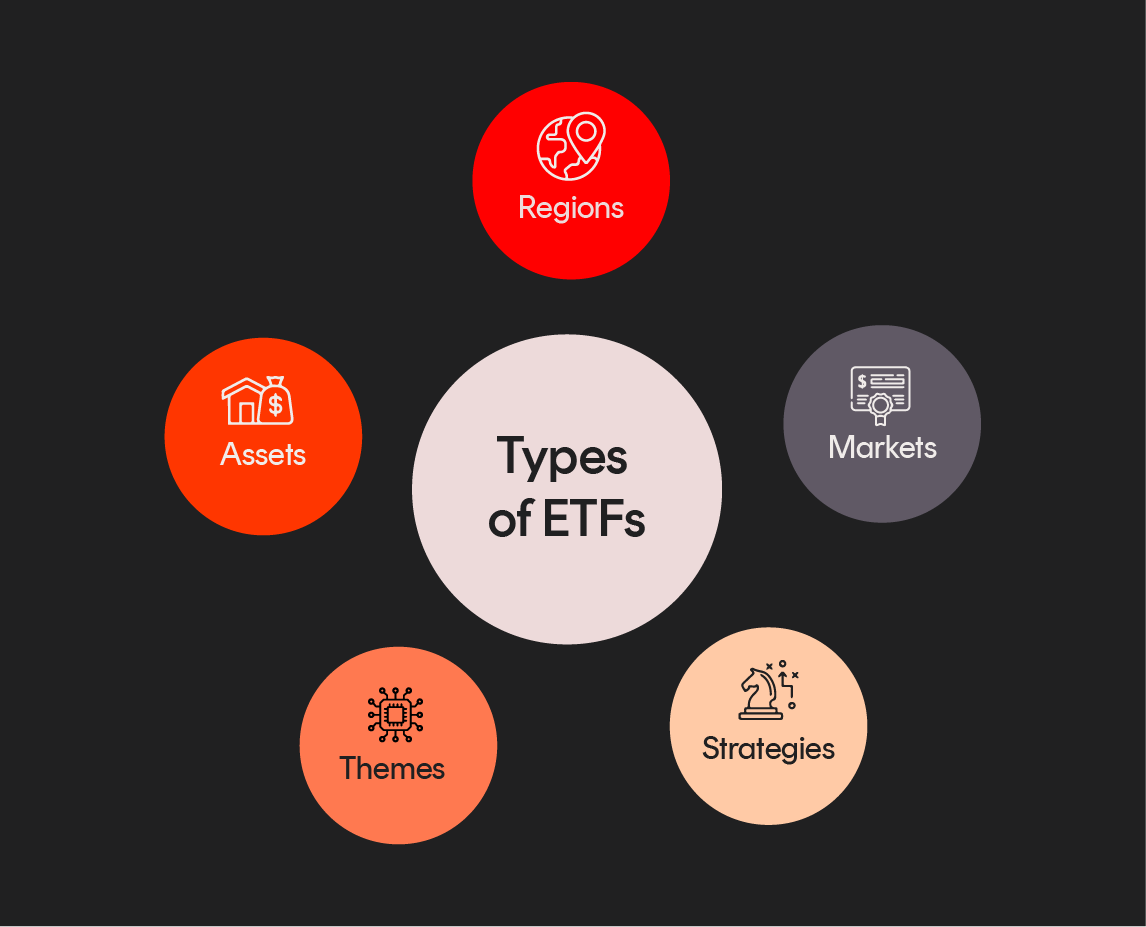

There are literally thousands of ETFs available globally today. All offering different shares, assets, markets and investment strategies. Let’s take a closer look at the types of ETFs on offer.

Equities

Among the most popular ETFs are those offering exposure to shares – also known as equities.

These ETFs invest in a collection of stocks (or companies) like those covered by a broad-based market index –

Such as the ASX 200, which tracks the performance of the largest 200 stocks listed in Australia, or the S&P 500, which tracks the performance of the largest 500 stocks listed in the United States.

Sector

You can further segment the share market by investing in companies in particular sectors or industries – from technology and energy to healthcare and financials.

Country/Regional

ETFs can be categorised by continent, country or group of countries – for instance, Europe or Asia Pacific. In fact, just about every developed nation – and some developing nations too – has a market in which to invest.

Thematic

ETFs can also be thematic, enabling you to invest in long-term structural changes such as climate change, cybersecurity, or artificial intelligence. A thematic ETF invests in a collection of companies that stand to benefit if the particular theme plays out.

Fixed income

Another popular asset class is fixed income. There are ETFs that invest in a collection of fixed income assets, such as Australian government bonds, US Treasuries, or corporate bonds.

Ethical

Another type of investment strategy is ethical investing, which has become increasingly popular with investors. Ethical ETFs include companies that do, and exclude companies that don’t, meet certain ethical, sustainability, social or governance criteria.

Diversified

If you’re not sure about where or what to invest in, diversified ETFs are an all-in-one solution designed to take care of asset allocation decisions for you. They offer a pre-set mix of investments aligned to a range of risk appetites, such as conservative, balanced or high growth.

Currencies

You can also use ETFs to invest in foreign currency – gaining exposure to the movements and performance of individual currencies, such as the Australian dollar vs the US dollar.

Alternatively, if you’re looking for exposure to international shares or bonds but are concerned about the effect of currency movements on your investment, you may consider investing in a currency hedged ETF which uses currency hedging to try to minimise the impact of exchange rate fluctuations.

Commodities

Another type of ETF is commodity ETFs, which invest in commodities, such as oil and gold-related assets.

Which ETFs are right for you?

The ETFs you choose will depend on why you’re investing and what you’re hoping to achieve.

It can help to reflect on your goals, investment timeframe and the level of investment risk you’re willing – and able – to accept to achieve the financial returns you’re after.

We cover this in greater detail in the next lesson.