Want to read it later?

Send this lesson to your inbox

Lesson 1 transcript

Exchange traded funds (ETFs) are an easily accessible and low-cost way to build an investment portfolio, which can make them suitable for either beginners or experienced investors, and for an array of investing strategies.

ETFs are diversified managed investment funds which trade on a stock exchange, such as the ASX. For the investor just starting out, they make it possible to gain diversified exposure to a range of asset classes, including shares, fixed income and commodities, both in Australia and internationally, without having to commit a substantial amount of money.

Whether your investment strategy is time-based or goal-based, ETFs can be a good way to gain exposure to either growth, income or defensive investments, or for tactical exposure to a particular theme, region, country, currency and more.

How ETFs work

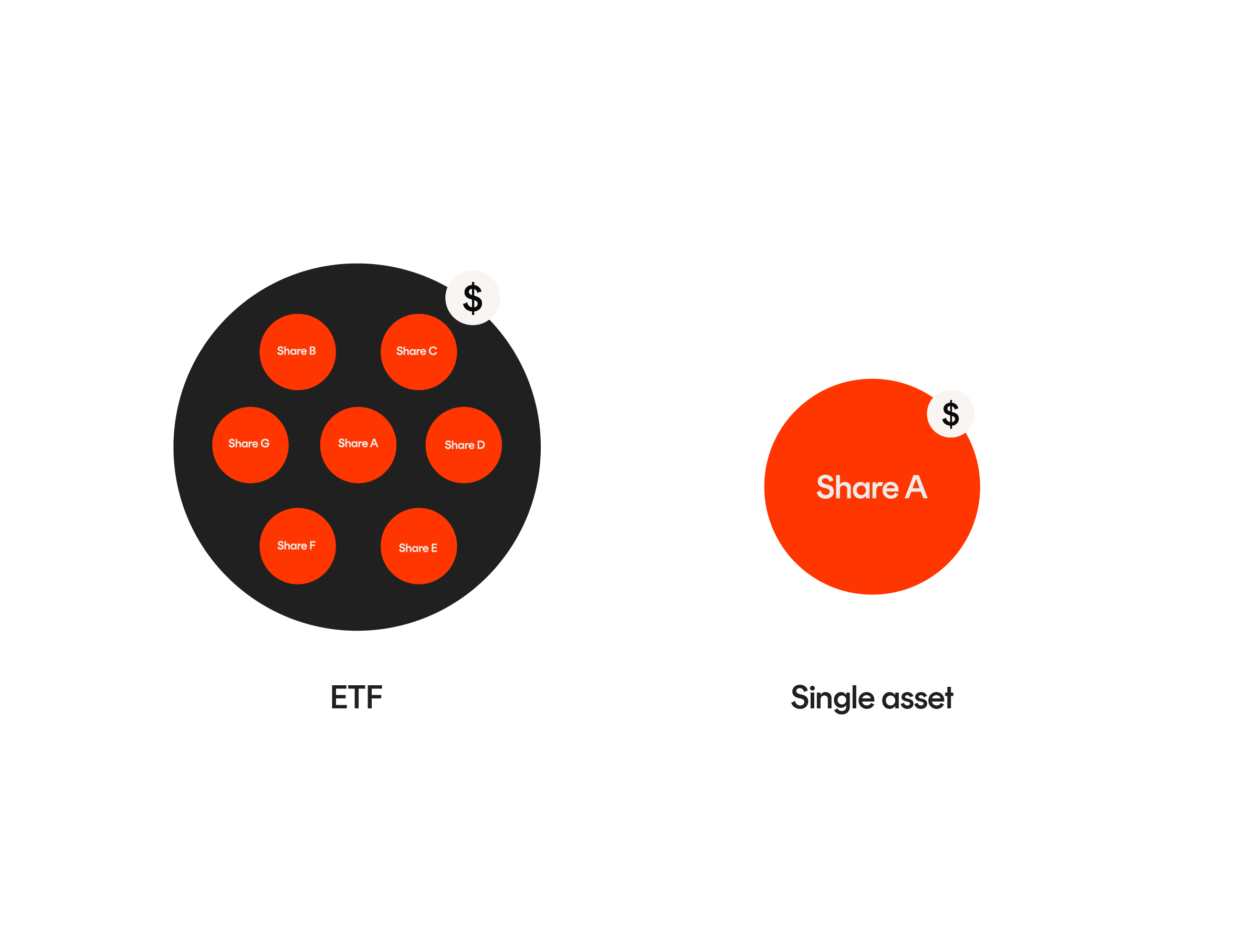

When you invest in an ETF, you gain exposure to a fund that holds a collection of investments in its portfolio.

Unlike buying a single asset, such as a stock, an ETF provides access to a portfolio of assets in one trade which helps to add instant diversification to a portfolio.

ETFs track market indexes

ETFs enable you to invest in a broad range of shares in one trade that generally aims to closely track the performance of a market index.

A market index typically tracks the performance of a group of shares, which represents either the overall market, or a specific sector or segment of the market, like technology or retail companies.

You’re likely to hear most about the S&P/ASX 200, the S&P 500, the Nasdaq-100, and the Dow Jones Industrial Average. These indices are generally used as proxies for the performance of the market overall, essentially providing a ‘pulse check’ on what the broader market is doing.

The value of the ETF goes up or down with the performance of the companies (or other assets) that make up the index.

The A200 Australia 200 ETF is an example of an ETF that tracks the performance of an overall sharemarket.

A200 aims to track the performance of an index consisting of the 200 largest companies by market capitalisation listed on the ASX (before fees and expenses).

Now, let’s look at an example of an ETF tracking a specific segment of the sharemarket.

The DRUG Global Healthcare Currency Hedged ETF provides exposure to a more specific sector by tracking an index consisting of world’s leading healthcare companies.

Here’s an example of an ETF that aims to track the performance of an index tracking a specific theme.

The DRIV Electric Vehicles and Future Mobility ETF offers exposure to an index comprising of 50 of the world’s leading automotive technology companies (before fees and expenses).