Want to read it later?

Send this lesson to your inbox

Lesson 6 transcript

The diverse nature of ETFs can support investors working with a variety of strategies. But most ETFs are designed to be held long term and are ideally used as building blocks to create a diversified portfolio.

Here are two examples of long-term investing strategies that can be easily achieved with ETFs.

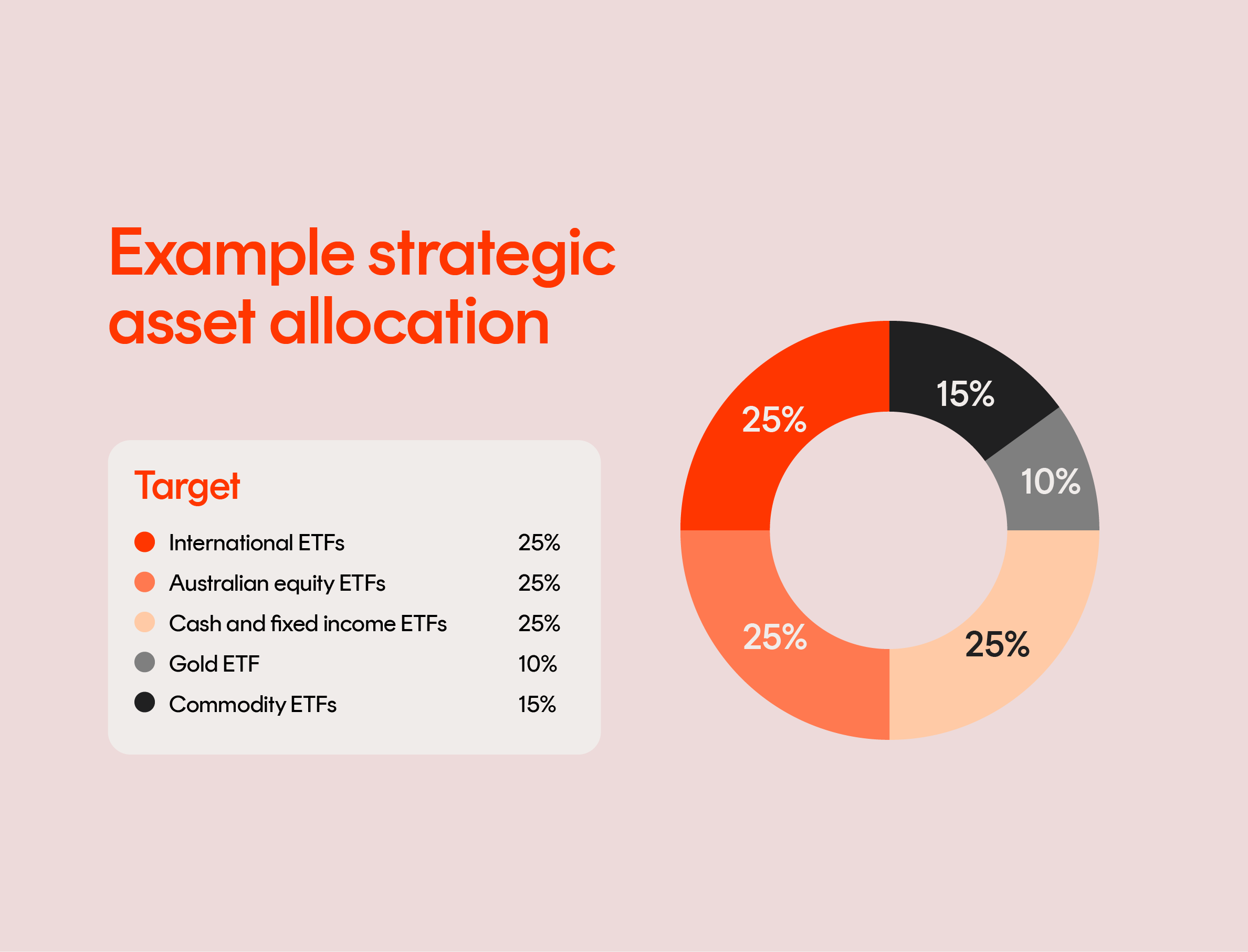

Strategic asset allocation

Strategic asset allocation involves setting targets for how much of your portfolio is allocated to different assets – then periodically rebalancing your portfolio back to those allocations when they change due to market movements.

Your risk tolerance, timeframe and goals will determine the percentage of your portfolio that you allocate to each type of investment – and these will all change over time.

Rebalancing may sound complicated. But the good news is that with ETFs, you’re buying and selling multiple investments in fewer trades – making it easy to review and rebalance your portfolio over time.

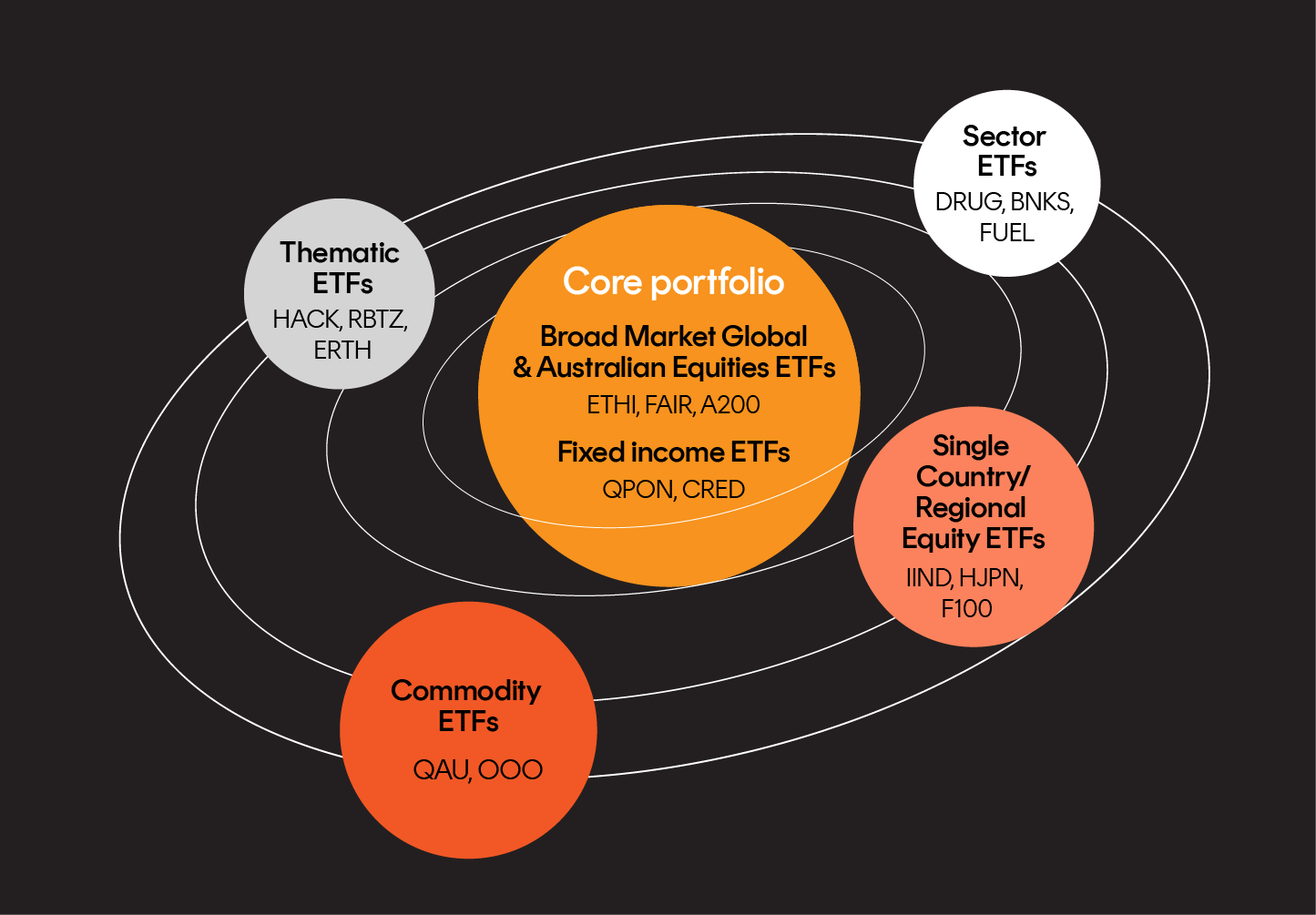

Core/satellite

This involves focusing on a core group of investments that are well-diversified, low cost and designed to be held for the long term. The idea is that you check in and review these investments regularly.

You then combine core investments with a smaller group of more tactical holdings known as satellites. These are designed as more focused investments, or areas of interest, that you add or subtract from your portfolio to capitalise on emerging trends and market movements.

If you haven’t already, check out our Investing course for a deeper understanding of the different asset classes and investment strategies for ETFs.