Positioning client portfolios for 2024 and beyond

Following a period of aggressive interest rate increases both in Australia and overseas, inflation has been falling – but encouragingly, economic growth has remained resilient.

Can we achieve a ‘soft landing’? Or is a less appealing economic scenario likely to unfold?

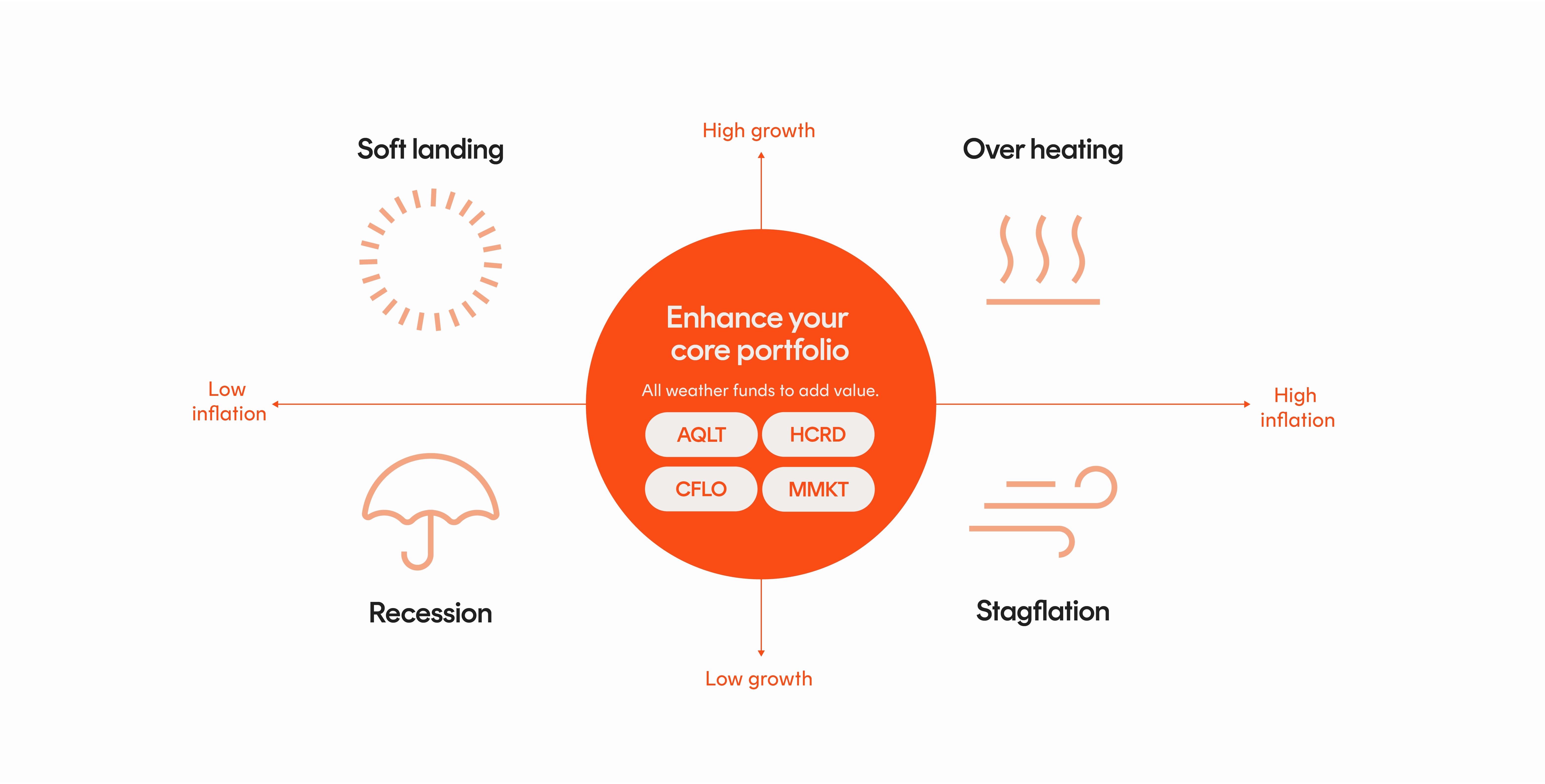

Whichever way economic growth and inflation goes, there are options to position client portfolios to respond.

The 'all weather' portfolio

An ‘all weather' portfolio consists primarily of funds that have the potential to perform well in a range of economic conditions. This approach lessens the need to take a view on how economic and market conditions will unfold.

The tactical approach

A tactical approach involves having a view on which economic scenario will eventuate, and taking positions specifically intended to benefit if that view turns out to be correct.

Betashares 'all weather' portfolio solutions

Many advisers focus on broad equity market beta at the lowest possible cost for their ‘all weather’ core. But beyond low-cost beta, how can you add value to a portfolio’s core?

Here are four funds you can add to core broad market exposures to achieve a resilient ‘all weather’ portfolio.

Australian Quality ETF

Australian shares

Higher quality and lower stock concentration, for a better-balanced allocation to Australian equities.

Global Cash Flow Kings ETF

International shares

An enhanced index approach to investing in companies that generate strong cash flows, to provide potential for long term outperformance compared to broad global equity benchmarks.

Int Rate Hedged Aust Investment Grade Corp Bond ETF

Cash and fixed income

A liquid, transparent, ‘all weather’ credit portfolio, providing a level of income and capital stability that might surprise you.

Australian Cash Plus Fund (managed fund)

Cash and fixed income

Make your cash work harder for you with access to an institutional grade cash solution.

Tactical positioning for particular market scenarios

The funds below have the potential to enhance performance outcomes in different economic scenarios.

Get the 2024 Outlook

With the high inflation and rising rates of 2023 apparently behind us, markets’ attention are now turning to potential rate cuts in 2024.

Can central bankers thread the policy needle? Will geopolitical concerns throw us off the path to recovery? And how can client portfolios be positioned for any outcome? Find out in the report below.