Benefits of Betashares Dynamic Managed Accounts

Dynamic Asset Allocation (DAA)

The portfolios are rebalanced quarterly, providing the flexibility to make adjustments to asset allocation positions based upon Betashares’ modelling of asset class mis-valuations, risk objectives and economic considerations.

Best of breed ETF selection

ETF selection is based on merit, with ETFs from both Betashares and other leading ETF managers used to ensure portfolios are constructed in the most cost-effective and appropriate way.

Mix of market cap and smart beta methodologies

Betashares Dynamic Managed Accounts utilise both traditional low-cost market cap-weighted ETFs, and smart beta methodologies that have demonstrated outperformance, at a typically lower fee level than active managers.

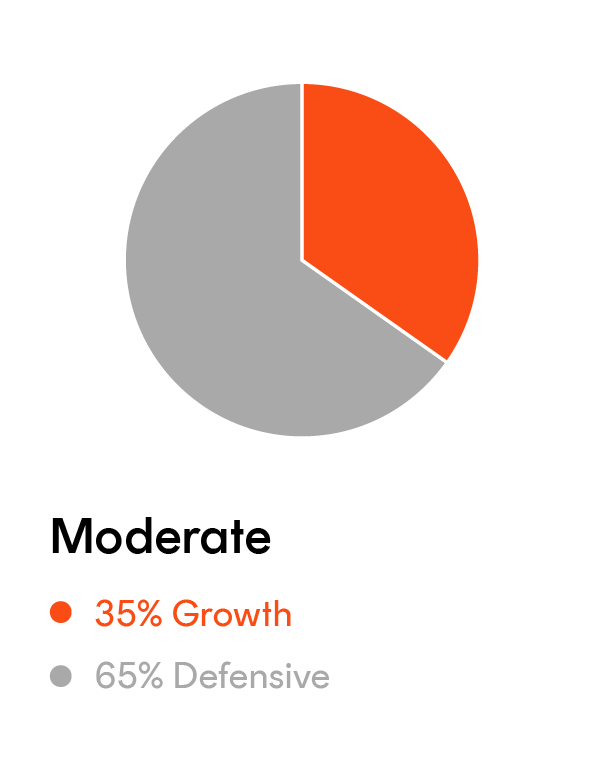

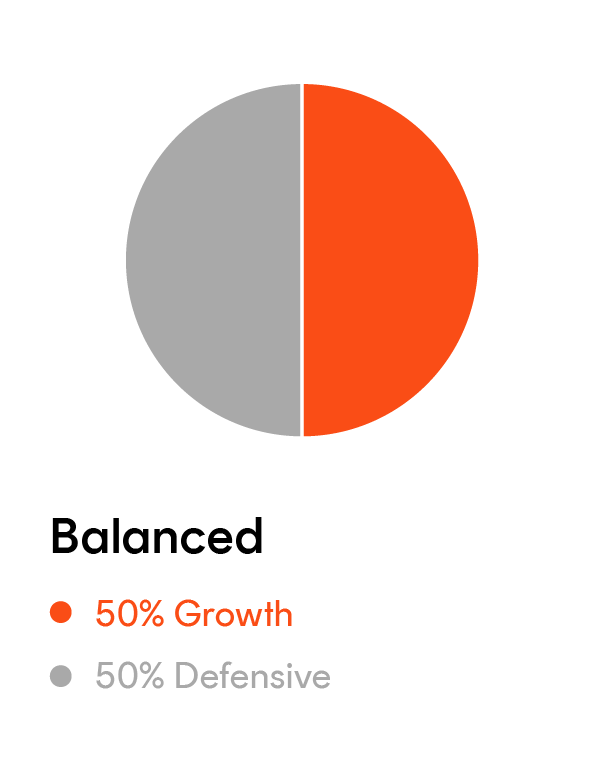

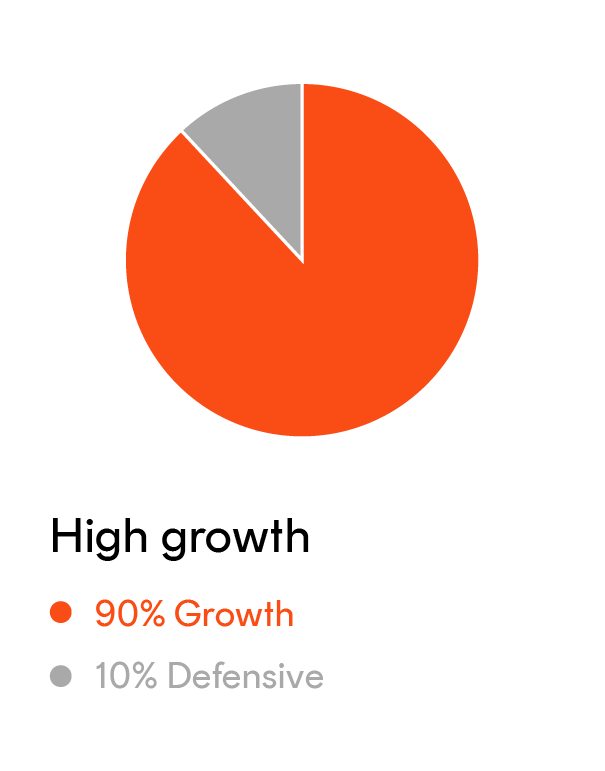

Risk profiles

Platform availability

Betashares Dynamic Managed Accounts are also available on OneVue, Mason Stevens and HarbourWrap.