Chamath De Silva

Betashares - Head of Fixed Income Chamath is responsible for the portfolio management function and fixed income product development at Betashares. Previously, Chamath was a fixed income trader at the Reserve Bank of Australia, working in their international reserves section in Sydney and London, where he managed the RBA’s Japanese and European government bond portfolios. Chamath holds a Bachelor of Commerce degree (First Class Honours in Finance) from the University of Melbourne, is a CFA® charter holder and has sat on the Bloomberg AusBond Index Advisory Council.

5 minutes reading time

Alpha – the elixir of life for active managers and the holy grail for investors that select them. Defined as the excess returns above an appropriate benchmark or the ability to improve a portfolio’s risk profile over passive options, it captures the returns attributable to a manager’s skill. Given such skill is a scarce resource, managers that truly deliver alpha should be compensated accordingly. However, before blindly handing over what is often a 1 per cent (or greater) base fee and potential performance fees, ask yourself if you are truly getting alpha on an after-tax basis.

A brief history of alpha

Developments in finance theory and portfolio management have seen benchmarks, and therefore the hurdle for active managers, evolve over time. The capital asset pricing model (CAPM) introduced the idea of beta or a common market factor in the 1960s, implying true outperformance does not stem from absolute returns or returns over cash, but returns over what’s explained by exposure to the broad market. Outperformance continued through the 70s and 80s, with many managers employing so-called “style biases”, such as structural overweight exposures to small cap stocks or stocks with low price-book ratios that were able to offer a return premium beyond just the broad market. It was not until the early 90s that these factors were documented and like beta before it, size and value became commoditised, further raising the bar for alpha.

Over the past 20 years, we’ve had a proliferation of additional factors (including quality, momentum and low vol) that can be packaged into transparent, rules-based indices, making it harder than ever for stock pickers to beat certain benchmarks. Combined with the growth of ETFs and the dizzying array of indices they track, both traditional cap-weighted and smart beta (which may include factor-based indices or fundamental-weighted indices like the QOZ FTSE RAFI Australia 200 ETF , most investors could potentially satisfy their investment objectives from purely passive products. As a result, alpha should now not be considered just excess returns or returns over “beta”, but rather excess returns over factors and rules-based exposures, bringing the concept of alpha ever closer to the true measure of manager skill that cannot be indexed or automated.

In addition, as many retail investors and advisors have moved away from stock picking towards using index-linked products as portfolio building blocks, it has left institutional investors increasingly fighting with each other for an ever-shrinking pool of opportunities. Combined with technological developments like machine learning, the ability to analyse vast amounts of data is progressively becoming democratised, reducing previous informational advantages further. Being a skilled manager today is not enough when the competition is more skilled than ever before and equipped with the latest technology.

Beating the market after fees and transaction costs is hard. Doing it consistently is even harder.

In a recent post, I discussed the impact of fees at length, however, broadly speaking, fees act as a permanent drag on returns and compound over time. This feature already places active funds (which tend to charge much higher fees than indexed products) at a disadvantage when trying to deliver outperformance after fees. Transaction costs are another area where ETFs have a big advantage. As ETF providers don’t need to pay for expensive research to track an index (research costs tend to be bundled into brokerage and execution charges), ETF providers face negligible commissions for trading, usually between zero and low single digit basis points. Active funds will also tend to exhibit much higher turnover by nature, adding to the return obstacles to overcome.

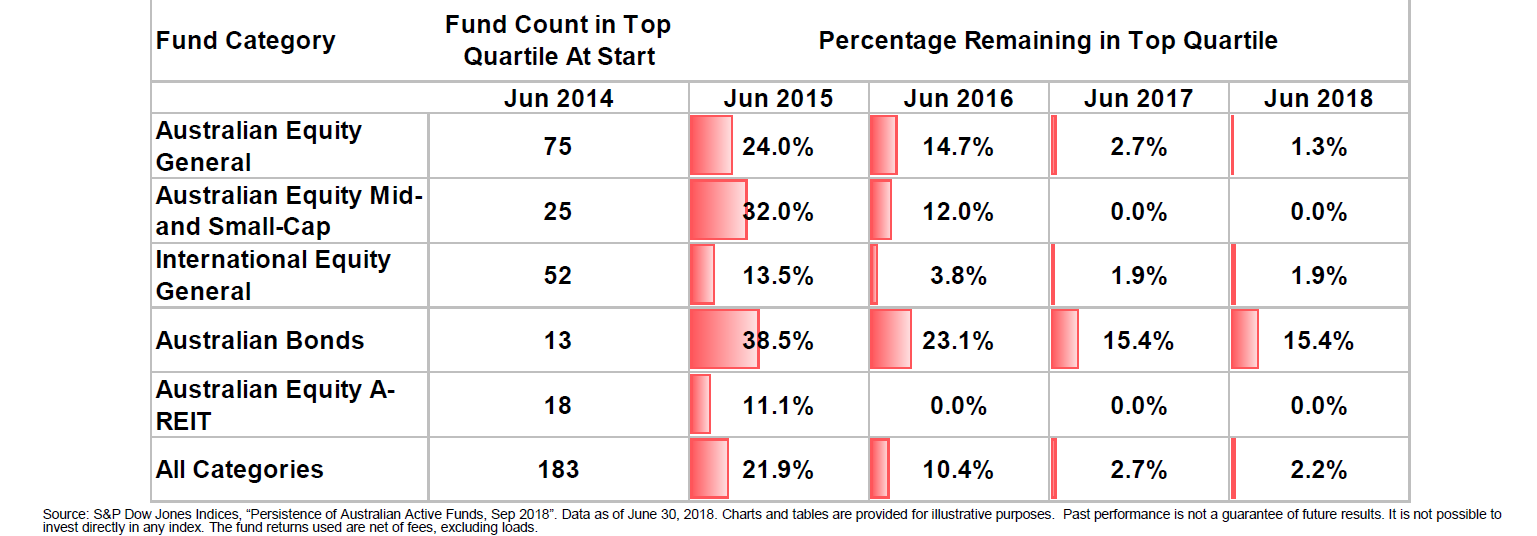

If the hurdles of fees and transaction costs aren’t enough, another challenge to consistent outperformance over time is there is often a winner’s curse, where the best performing managers during one period underperform in subsequent periods. This could be due to changes in the investment team, changes in the investment process or just an inability for the alpha generation to scale with larger amounts of assets under management. For example, successful small cap managers may outgrow their preferred markets (or face higher transaction and market impact costs) and be forced into larger, more liquid and more competitive arenas. The below table from S&P DJ Indices dramatically illustrates this point: Out of the 183 top-quartile Australian active funds in the 12-month period ending June 2014, only 4 of them remained in the same quartile in the next four consecutive 12-month periods.

Is your alpha truly alpha after taxes?

ETFs are often referred to as “tax efficient”, primarily due to the fact that ETFs generally have lower turnover (i.e. the buying and selling of underlying positions) than active management. Indexing, particularly traditional market-cap weighting, tends to have much lower turnover by design. Even smart beta exposures will generally have much lower turnover than similar actively managed funds. Turnover within a fund tends to have the effect of not only increasing trading costs, but also crystallising capital gains, which is not desirable for long-term investors. Remember, taxes are imposed on income and capital gains, not returns, and depending on your tax situation, what was pre-tax alpha could be negative alpha after taxes.

Summary

The hurdles to successful long-term active management are numerous:

1. It’s hard beating the market on a risk-adjusted basis or providing better diversification than a cheaper, rules-based option

2. It’s harder beating an appropriate risk-adjusted benchmark (which is never reported on) capturing known sources of excess returns that can be indexed

3. It’s even harder doing this after fees and transaction costs

4. It’s very hard doing this consistently over long periods of time amid greater competition among managers

5. A great investment team and process may not always scale to increased assets under management or new markets

6. It’s incredibly hard doing all this while keeping fund turnover low and keeping capital gains realisation to a minimum.

Increasing competition between managers and for informational advantages, a finite pool of excess return opportunities, tougher passive benchmarks and tax-implications from high turnover mean only a very small proportion of active managers can deliver consistent alpha after taxes for their investors. That said, if an active manager can overcome all these hurdles and still deliver after-tax alpha through skill, they are worth paying for.

-

QOZ

FTSE RAFI Australia 200 ETF

There are risks associated with an investment in QOZ, including market risk, security specific risk and sector concentration risk. Investment value can go up and down. An investment in the Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

Written by

Chamath De Silva

Head of Fixed Income

Chamath is the Head of Fixed Income at Betashares and is a voting member of the firm’s Investment Committee. He is responsible for managing the fixed income ETFs and leading the fixed income product development. In addition, he shares responsibility for the strategic and dynamic asset allocation decisions for the Betashares model portfolios. Previously, Chamath was a fixed income trader at the Reserve Bank of Australia, working in their FX reserves management function in Sydney and London. There, he managed the RBA’s Japanese and European government bond portfolios across a range of market conditions. Chamath holds a Bachelor of Commerce degree (First Class Honours in Finance) from the University of Melbourne. He is a CFA® charter holder and has sat on the Bloomberg AusBond Index Advisory Council.

Read more from Chamath.